Evaluating The Risk: Is Now The Time To Buy Cheap Tech Stocks?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating the Risk: Is Now the Time to Buy Cheap Tech Stocks?

The tech sector has taken a beating lately. After years of meteoric growth, valuations have plummeted, leaving many investors wondering: is this the dip to buy? While seemingly attractive, "cheap" tech stocks present a complex risk-reward scenario demanding careful consideration before investing. This article will delve into the factors influencing this volatile market, helping you determine if now is the right time to jump in.

The Allure of Discounted Tech:

The current market offers a compelling proposition: access to previously expensive tech giants and promising startups at significantly reduced prices. This discount is primarily due to a confluence of factors, including:

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes have increased borrowing costs, impacting the growth-oriented tech sector disproportionately. Companies reliant on future earnings are hit harder as discounted future cash flows become less valuable.

- Inflationary Pressures: Soaring inflation has eroded consumer spending, impacting demand for discretionary tech products and services. This reduced demand directly affects revenue projections for many tech companies.

- Geopolitical Uncertainty: Global instability, including the ongoing war in Ukraine and escalating trade tensions, adds to the overall market uncertainty, influencing investor sentiment towards riskier assets like tech stocks.

Identifying Potential Bargains:

While the overall picture is challenging, discerning investors can find opportunities. Focusing on companies with:

- Strong Fundamentals: Look beyond the current market price and examine key metrics like revenue growth, profitability (or a clear path to profitability), and strong balance sheets. Companies with a history of consistent performance are better positioned to weather market downturns.

- Innovative Products/Services: Companies offering genuinely innovative products or services with significant market potential can outperform even in a challenging environment. Consider the long-term prospects and disruptive potential.

- Resilient Business Models: Analyze the business model's resilience to economic headwinds. Subscription-based models, for instance, often demonstrate greater stability compared to those reliant on one-time purchases.

Navigating the Risks:

Despite the potential for bargains, investing in cheap tech stocks involves significant risks:

- Further Market Corrections: The tech sector could experience further declines before a sustained recovery. Be prepared for potential losses.

- Company-Specific Risks: Individual companies face unique challenges, including competition, management issues, and technological disruption. Thorough due diligence is crucial.

- Valuation Uncertainty: Even with discounted prices, accurately valuing tech companies remains challenging due to their often intangible assets and future-oriented business models.

Diversification and Due Diligence are Key:

Investing in the tech sector, especially during periods of volatility, requires a diversified portfolio and meticulous due diligence. Never invest more than you can afford to lose. Consult with a qualified financial advisor before making any significant investment decisions.

Conclusion:

The current market presents both opportunities and significant risks. While "cheap" tech stocks might seem tempting, thorough research and a clear understanding of the market dynamics are paramount. Focus on strong fundamentals, innovative businesses, and diversify your portfolio to mitigate risk. Only invest what you can afford to lose, and remember that past performance is not indicative of future results. By carefully evaluating the risks and focusing on well-researched opportunities, investors can potentially capitalize on this volatile market. Are you ready to take the plunge?

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating The Risk: Is Now The Time To Buy Cheap Tech Stocks?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Follow Emma Navarro At Roland Garros 2025 Daily Match Schedule And Live Scores

May 27, 2025

Follow Emma Navarro At Roland Garros 2025 Daily Match Schedule And Live Scores

May 27, 2025 -

No More Room The Indy 500 Trophys Capacity Problem

May 27, 2025

No More Room The Indy 500 Trophys Capacity Problem

May 27, 2025 -

Nfl 2024 Playoff Contenders Backup Quarterbacks With The Potential To Deliver

May 27, 2025

Nfl 2024 Playoff Contenders Backup Quarterbacks With The Potential To Deliver

May 27, 2025 -

New Action Thriller Tin Soldier Pits Eastwood And De Niro Against Foxx

May 27, 2025

New Action Thriller Tin Soldier Pits Eastwood And De Niro Against Foxx

May 27, 2025 -

Ice Hockey World Championship Team Usa Claims Gold After Close Match Against Switzerland

May 27, 2025

Ice Hockey World Championship Team Usa Claims Gold After Close Match Against Switzerland

May 27, 2025

Latest Posts

-

Regarding The 2025 Cif State Track And Field Championships A Public Statement

May 31, 2025

Regarding The 2025 Cif State Track And Field Championships A Public Statement

May 31, 2025 -

Newark Airport Delays Sec Duffys Air Traffic Control Overhaul Plan Faces Headwinds

May 31, 2025

Newark Airport Delays Sec Duffys Air Traffic Control Overhaul Plan Faces Headwinds

May 31, 2025 -

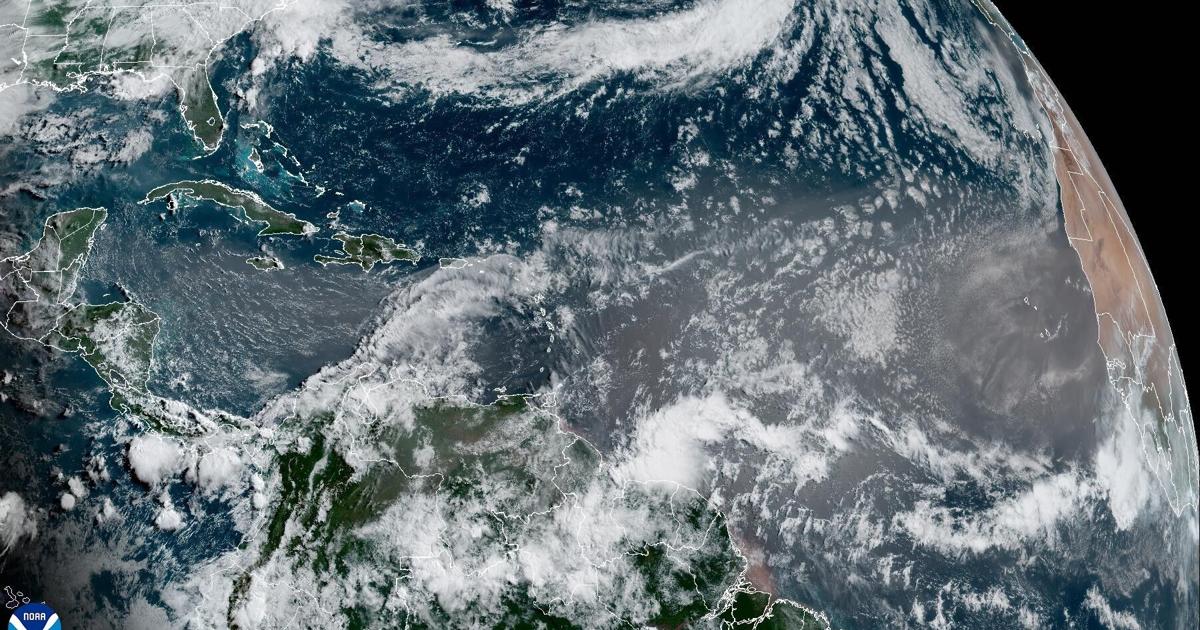

Forecast Saharan Dust To Enhance Louisiana Sunsets

May 31, 2025

Forecast Saharan Dust To Enhance Louisiana Sunsets

May 31, 2025 -

Denver Nuggets New Coach Adelman Seeks Improved Fitness Welcomes New Ideas

May 31, 2025

Denver Nuggets New Coach Adelman Seeks Improved Fitness Welcomes New Ideas

May 31, 2025 -

Tragedy Strikes Today Show Sheinelle Jones Husband Dies At 45

May 31, 2025

Tragedy Strikes Today Show Sheinelle Jones Husband Dies At 45

May 31, 2025