Evaluating Robinhood Stock: Risks And Rewards For Potential Investors.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating Robinhood Stock: Risks and Rewards for Potential Investors

Robinhood, the commission-free trading app that revolutionized retail investing, has had a tumultuous journey since its IPO. While its disruptive model attracted millions of users, its stock performance has been a rollercoaster, leaving potential investors wondering: is now the time to buy, sell, or hold? This in-depth analysis explores the risks and rewards associated with investing in Robinhood Markets, Inc. (HOOD).

The Allure of Robinhood: A User-Friendly Approach to Investing

Robinhood's initial success stemmed from its user-friendly interface and commission-free trading, making investing accessible to a younger demographic. Its gamified approach, featuring celebratory confetti upon successful trades, attracted a wave of new investors, significantly increasing market participation. This democratization of finance, however, also presents inherent risks.

Risks Associated with Investing in HOOD Stock:

-

Regulatory Scrutiny: Robinhood has faced intense regulatory scrutiny, including investigations into its practices and allegations of misleading users. These regulatory hurdles can significantly impact the company's financial performance and future growth. Increased compliance costs and potential fines could eat into profits.

-

Competition: The brokerage industry is fiercely competitive. Established players like Fidelity, Charles Schwab, and Vanguard, along with newer fintech companies, constantly innovate and offer competitive services. Robinhood needs to maintain its competitive edge to retain its user base and attract new customers.

-

Dependence on Trading Revenue: Robinhood's revenue is heavily reliant on transaction-based revenue. Periods of low market volatility or decreased trading activity can negatively impact its financial health. Diversifying revenue streams is crucial for long-term sustainability.

-

Volatile Stock Price: The HOOD stock price has demonstrated considerable volatility since its IPO. This volatility reflects the inherent risks associated with investing in a relatively young and rapidly evolving company. Investors with a lower risk tolerance may find HOOD unsuitable for their portfolio.

-

Negative Publicity and Brand Image: Past controversies and negative press coverage can damage Robinhood's brand image and erode investor confidence. Rebuilding trust and enhancing its reputation will be crucial for long-term success.

Potential Rewards of Investing in HOOD:

-

Growth Potential: Despite the challenges, Robinhood possesses significant growth potential. Expanding its product offerings, targeting new demographics, and penetrating international markets could fuel future growth. Its potential to become a leading player in the evolving fintech landscape is undeniable.

-

Innovation and Technological Advantage: Robinhood's commitment to technological innovation and its user-friendly platform provide a competitive advantage. Continued investment in technology and new features could attract and retain users.

-

Increasing User Base: Robinhood continues to attract new users, indicating a strong demand for its services. Growing user adoption translates to increased revenue potential and long-term value creation.

-

Expansion into New Markets: Diversification into new financial products and services, such as crypto trading and wealth management, could unlock additional revenue streams and contribute to sustainable growth.

Should You Invest in Robinhood?

The decision to invest in Robinhood stock depends on your individual risk tolerance, investment goals, and overall portfolio diversification. While the potential for substantial rewards exists, the inherent risks are significant. Thoroughly research the company's financial performance, regulatory landscape, and competitive environment before making any investment decisions. Consider consulting with a qualified financial advisor to assess whether HOOD aligns with your investment strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating Robinhood Stock: Risks And Rewards For Potential Investors.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Maxwell Anderson Trial Sade Robinsons Murder On June 6th

Jun 06, 2025

Maxwell Anderson Trial Sade Robinsons Murder On June 6th

Jun 06, 2025 -

Nations League Semifinal France Vs Spain Live Stream Details And Tv Listings

Jun 06, 2025

Nations League Semifinal France Vs Spain Live Stream Details And Tv Listings

Jun 06, 2025 -

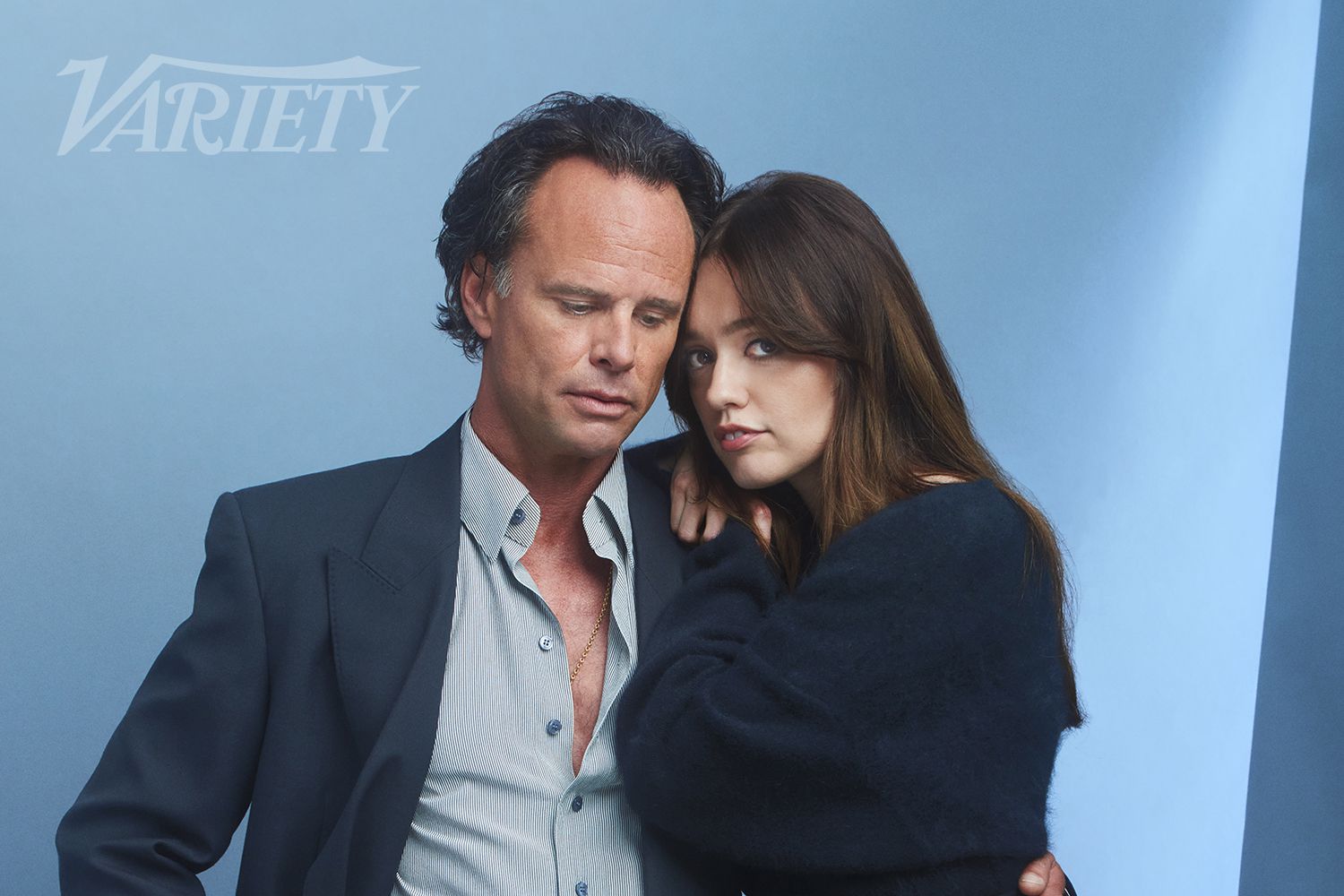

Actor Walton Goggins Addresses Aimee Lou Wood Instagram Situation

Jun 06, 2025

Actor Walton Goggins Addresses Aimee Lou Wood Instagram Situation

Jun 06, 2025 -

Four Goal Victory Uswnt Finishes Unbeaten International Window Against Jamaica

Jun 06, 2025

Four Goal Victory Uswnt Finishes Unbeaten International Window Against Jamaica

Jun 06, 2025 -

Goggins And Wood Break Silence On Reported Feud

Jun 06, 2025

Goggins And Wood Break Silence On Reported Feud

Jun 06, 2025