Earnings Reaction: Predicting Broadcom's (AVGO) Stock Price Movement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Earnings Reaction: Predicting Broadcom's (AVGO) Stock Price Movement

Broadcom (AVGO) is a semiconductor giant, and its quarterly earnings reports always send ripples through the tech market. Predicting the stock's reaction, however, is a complex game requiring careful analysis of various factors. This article will delve into the key elements influencing AVGO's post-earnings price movement, offering insights for investors looking to navigate this volatile period.

Understanding the Pre-Earnings Sentiment:

Before the actual earnings release, the market builds a certain expectation. Analyst estimates, recent news, and overall market sentiment contribute to this pre-earnings expectation. A positive surprise (earnings exceeding expectations) generally leads to a price increase, while a negative surprise often results in a decline. Tracking analyst ratings and revisions on platforms like and offers valuable insights into this pre-earnings sentiment.

Key Metrics to Watch:

Several key performance indicators (KPIs) heavily influence AVGO's stock price reaction. These include:

- Earnings Per Share (EPS): The most widely watched metric, EPS compares the company's profit to the number of outstanding shares. A significant deviation from expectations drastically impacts the stock price.

- Revenue Growth: Consistent revenue growth signals a healthy business, boosting investor confidence. Slowing revenue growth, however, can trigger sell-offs.

- Guidance: Management's outlook for future quarters is crucial. Positive guidance, indicating strong future performance, is typically well-received by the market. Conversely, lowered guidance often leads to immediate price drops.

- Operating Margins: This metric shows the company's profitability after deducting operating expenses. Improved margins are a positive indicator, suggesting efficiency and strong pricing power.

- Free Cash Flow (FCF): This represents cash generated by the business after accounting for capital expenditures. Strong FCF is essential for dividends, share buybacks, and future investments.

Analyzing the Post-Earnings Reaction:

After the earnings release, the market quickly digests the information. The immediate price movement reflects this initial reaction. However, the subsequent price action can be more complex and influenced by:

- Market Conditions: Broader market trends and overall economic sentiment significantly affect the stock's performance, even after a strong earnings report.

- Competitive Landscape: News about competitors or industry developments can overshadow even positive earnings results.

- Long-Term Growth Prospects: Investors assess the long-term potential of Broadcom, considering factors like technological advancements, market share, and strategic initiatives.

How to Prepare for AVGO's Earnings Announcement:

- Monitor Analyst Ratings: Stay updated on analyst predictions and ratings leading up to the earnings release.

- Review Past Earnings Reports: Analyze past earnings reports to identify trends and patterns in AVGO's performance.

- Understand the Company's Business: Thoroughly understanding Broadcom's business model and key drivers is crucial for interpreting the earnings report.

- Develop a Trading Strategy: Having a well-defined trading plan before the earnings release is essential to avoid impulsive decisions.

- Manage Risk: Never invest more than you can afford to lose. Diversification is key to mitigating risk.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

By carefully considering these factors, investors can better understand the potential impact of Broadcom's earnings reports on its stock price. While predicting the exact movement is impossible, a thorough analysis increases the likelihood of making informed investment decisions. Remember to always conduct your own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Earnings Reaction: Predicting Broadcom's (AVGO) Stock Price Movement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

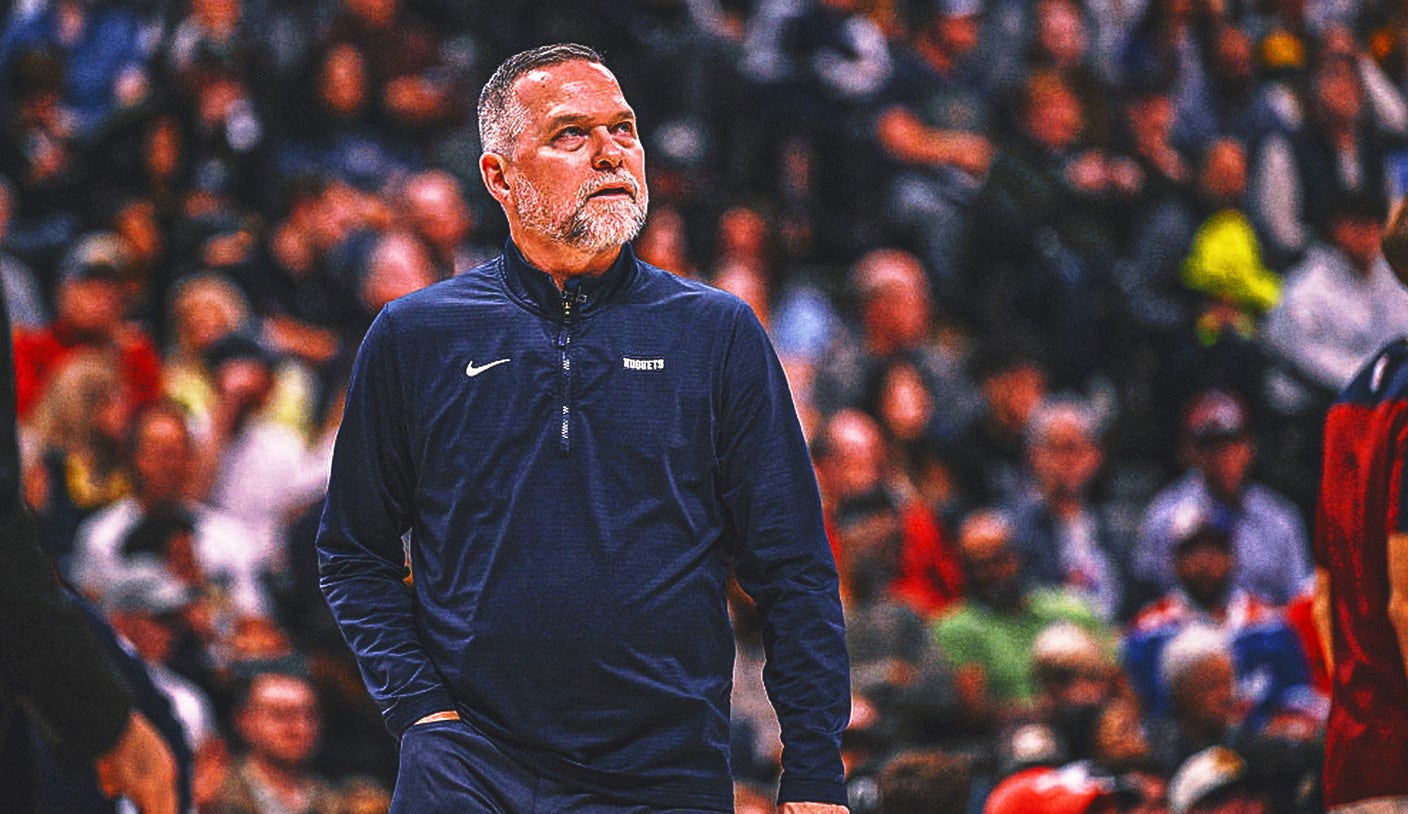

Knicks Coaching Carousel Odds And Analysis On Potential Thibodeau Successors

Jun 05, 2025

Knicks Coaching Carousel Odds And Analysis On Potential Thibodeau Successors

Jun 05, 2025 -

Nfl 2023 Playoffs The Top Fringe Contenders And Their Path To Victory

Jun 05, 2025

Nfl 2023 Playoffs The Top Fringe Contenders And Their Path To Victory

Jun 05, 2025 -

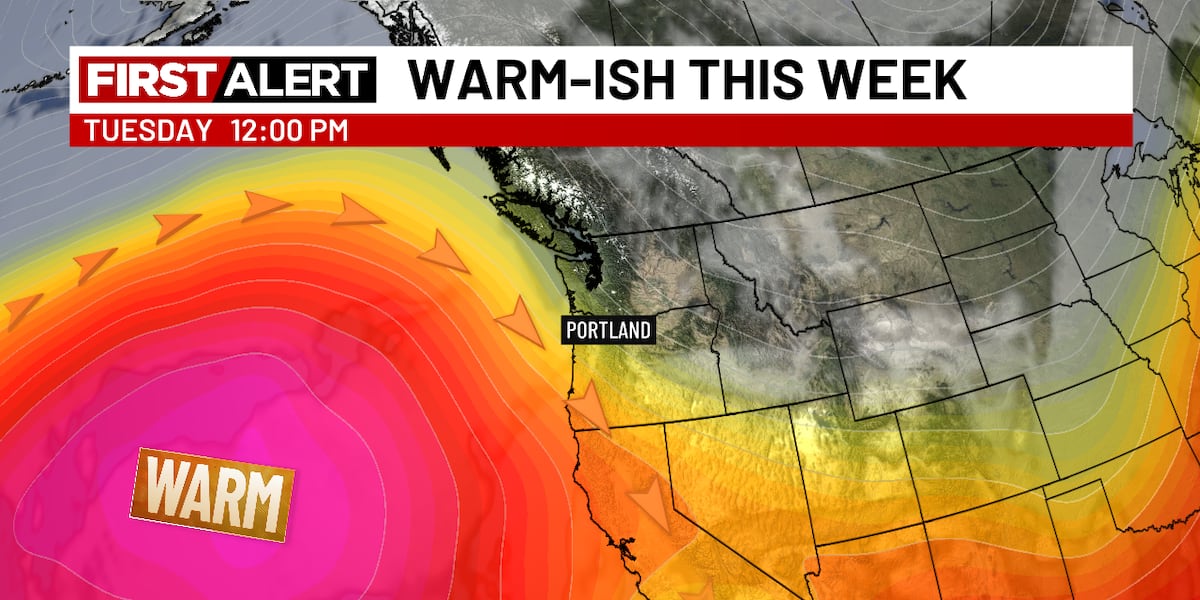

Enjoy The Sunshine Junes Warm And Dry Start

Jun 05, 2025

Enjoy The Sunshine Junes Warm And Dry Start

Jun 05, 2025 -

2025 Firekeepers Casino 400 Entry List Full Nascar Michigan Lineup

Jun 05, 2025

2025 Firekeepers Casino 400 Entry List Full Nascar Michigan Lineup

Jun 05, 2025 -

Unexpected Twists Reviewing The Most Unusual Stats Of The 2023 College Football Regular Season

Jun 05, 2025

Unexpected Twists Reviewing The Most Unusual Stats Of The 2023 College Football Regular Season

Jun 05, 2025