Earnings Impact: Predicting Adobe Stock's Trajectory

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Earnings Impact: Predicting Adobe Stock's Trajectory

Adobe Stock, the royalty-free stock photo, video, and template marketplace, is a significant component of Adobe's Creative Cloud ecosystem. Its performance directly impacts Adobe's overall earnings, making understanding its trajectory crucial for investors and creatives alike. Recent earnings reports have revealed interesting trends, prompting analysts to reassess its future potential. This article delves into the key factors influencing Adobe Stock's growth and explores potential future scenarios.

The Current Landscape: A Mixed Bag

Adobe's recent financial reports have shown a mixed performance for Adobe Stock. While subscriber growth remains steady, the average revenue per user (ARPU) has experienced some fluctuations. This complexity necessitates a deeper dive into the contributing factors.

Factors Influencing Adobe Stock's Performance:

- Competition: The stock content market is fiercely competitive. Platforms like Shutterstock, iStock, and Getty Images offer robust alternatives, forcing Adobe Stock to constantly innovate and improve its offerings. This competitive pressure impacts pricing strategies and ultimately, revenue.

- Content Quality and Variety: Adobe's success hinges on the quality and diversity of its content library. Attracting high-quality contributors and ensuring a wide range of assets are available is vital for maintaining its competitive edge. Regular updates and improvements to the platform's search functionality are also crucial.

- Pricing and Subscription Models: Adobe’s subscription models, while effective for other Creative Cloud services, need to be carefully balanced for Adobe Stock. Finding the right price point that attracts both individual users and enterprise clients is critical for maximizing ARPU.

- Integration with Creative Cloud: The seamless integration of Adobe Stock within the Creative Cloud suite is a significant advantage. This allows users to easily access and incorporate stock assets into their projects, streamlining the workflow and increasing usage.

- Economic Conditions: Macroeconomic factors, such as inflation and recessionary pressures, can significantly impact demand for creative assets. Businesses may reduce spending on stock content during economic downturns, impacting Adobe Stock's revenue.

Predicting the Trajectory: Challenges and Opportunities

Predicting the future performance of Adobe Stock is challenging due to the interplay of these factors. However, several key trends suggest potential scenarios:

- Continued Growth, but at a Slower Pace: While significant growth is unlikely to match previous years, steady expansion seems plausible, driven by continued integration within the Creative Cloud and the expansion into new markets.

- Focus on High-Value Content: Adobe might prioritize attracting high-quality, specialized content, commanding higher prices and potentially improving ARPU. This could involve strategic partnerships with professional photographers and videographers.

- AI-Driven Enhancements: The integration of AI tools for content creation and search could revolutionize Adobe Stock. This could enhance content discovery, automate workflows, and ultimately drive increased usage.

Conclusion: Navigating the Uncertainties

Adobe Stock's future is intertwined with the broader creative industry and the ever-evolving technological landscape. While challenges remain, strategic investments in content quality, AI integration, and robust marketing could position Adobe Stock for continued growth, albeit possibly at a moderated pace. Monitoring Adobe's future earnings reports and announcements regarding strategic initiatives will be crucial for understanding the evolution of this important component of the company's overall portfolio. Investors should pay close attention to ARPU trends and the competitive landscape to accurately assess its long-term potential. For creatives, the focus remains on the platform's ease of use, content quality, and integration with other Adobe products. The coming year promises significant developments within the stock content market, making it a space to watch closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Earnings Impact: Predicting Adobe Stock's Trajectory. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

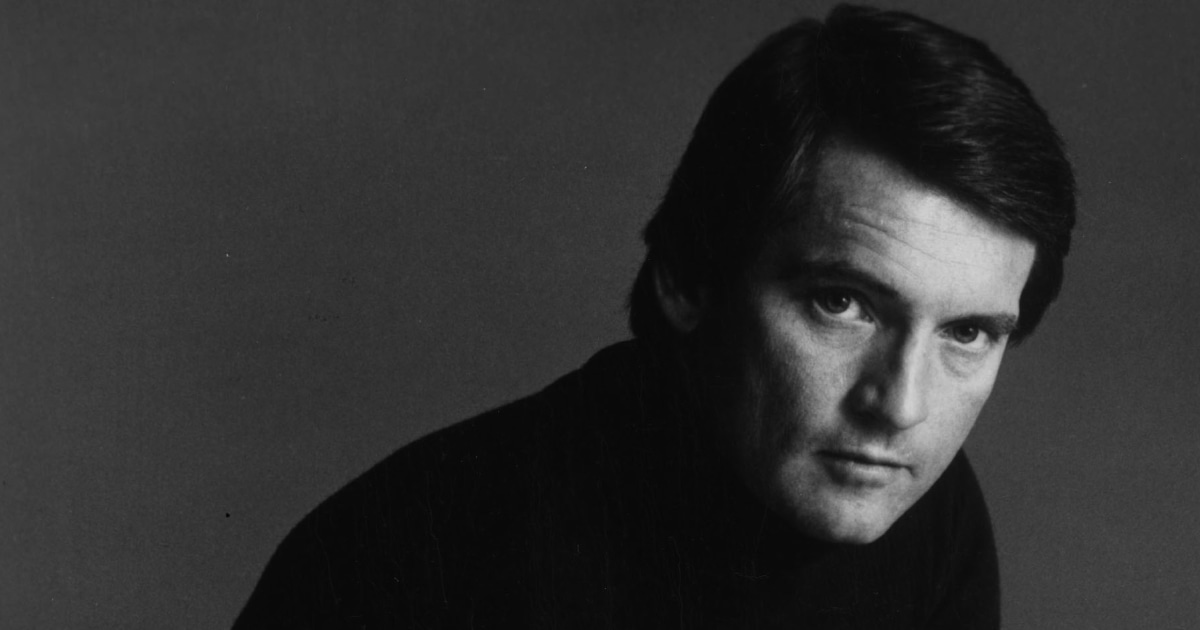

Chris Robinson Beloved General Hospital Star Passes Away At 86

Jun 13, 2025

Chris Robinson Beloved General Hospital Star Passes Away At 86

Jun 13, 2025 -

Scottie Schefflers U S Open Reign A Look At The Contenders Strategies

Jun 13, 2025

Scottie Schefflers U S Open Reign A Look At The Contenders Strategies

Jun 13, 2025 -

Republican Lawmaker Faces Backlash At Heated Town Hall Over Trump Bill

Jun 13, 2025

Republican Lawmaker Faces Backlash At Heated Town Hall Over Trump Bill

Jun 13, 2025 -

2025 Indy Car St Louis Race Odds And Predictions For Josef Newgarden

Jun 13, 2025

2025 Indy Car St Louis Race Odds And Predictions For Josef Newgarden

Jun 13, 2025 -

Doping Concerns Escalate Wada Targets Enhanced Games Demands Action

Jun 13, 2025

Doping Concerns Escalate Wada Targets Enhanced Games Demands Action

Jun 13, 2025