Does Your Retirement Plan Pass The Stress Test? A Realistic Assessment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Does Your Retirement Plan Pass the Stress Test? A Realistic Assessment

Retirement. The word conjures images of sun-drenched beaches, leisurely pursuits, and financial freedom. But the reality for many is far more complex, often clouded by anxieties about outliving their savings. Does your meticulously crafted retirement plan truly stand up to scrutiny? This article provides a realistic assessment, helping you determine if your golden years will shine as brightly as you envision.

The Unforeseen Storms: Why Stress Testing is Crucial

Retirement planning isn't a set-it-and-forget-it proposition. Life throws curveballs – unexpected medical expenses, market downturns, inflation, and even extended periods of unemployment can significantly impact your nest egg. Stress testing your retirement plan involves simulating these potential disruptions to gauge its resilience. It's a proactive measure that can uncover vulnerabilities and allow you to adjust your strategy before it's too late.

Key Areas to Stress Test:

-

Market Volatility: How would your portfolio fare during a significant market downturn, like the one experienced in 2008? Diversification is key, but even well-diversified portfolios can experience substantial losses. Consider using historical market data to simulate various scenarios. [Link to resource on portfolio diversification]

-

Inflation: The insidious erosion of purchasing power due to inflation is often underestimated. Your retirement income needs to keep pace with rising prices. Factor in a realistic inflation rate (consider consulting a financial advisor for current projections) when projecting your future expenses.

-

Unexpected Healthcare Costs: Medical expenses can quickly deplete retirement savings. Factor in potential long-term care costs, especially as you age. Consider exploring long-term care insurance options to mitigate this risk. [Link to resource on long-term care insurance]

-

Longevity Risk: People are living longer than ever before. Are your savings sufficient to cover your expenses for an extended retirement? Using online retirement calculators can help you determine if you're on track. [Link to reputable retirement calculator]

-

Unforeseen Expenses: Life is unpredictable. Unexpected home repairs, family emergencies, or even supporting loved ones can strain your finances. Building an emergency fund as part of your overall financial plan is crucial.

H3: Taking Action: Steps to Strengthen Your Retirement Plan

If your retirement plan doesn't pass the stress test, don't despair. There are steps you can take to bolster your financial security:

-

Increase Contributions: If possible, increase your contributions to retirement accounts like 401(k)s and IRAs. Even small increases can make a significant difference over time.

-

Adjust Your Investment Strategy: Re-evaluate your asset allocation to ensure it aligns with your risk tolerance and time horizon. Consider consulting a financial advisor for personalized guidance.

-

Delay Retirement: If feasible, delaying retirement even by a few years can significantly increase your savings and reduce the duration you'll need to rely on your nest egg.

-

Explore Part-Time Work: Supplementing your retirement income with part-time work can provide extra financial security and maintain a sense of purpose.

-

Reduce Expenses: Identify areas where you can cut back on spending and redirect those funds towards your retirement savings.

Conclusion: A Proactive Approach to a Secure Future

Stress testing your retirement plan is not about fear-mongering; it's about responsible financial planning. By proactively identifying potential risks and implementing appropriate strategies, you can significantly increase your chances of enjoying a comfortable and secure retirement. Don't hesitate to seek professional advice from a financial advisor to tailor a plan that best suits your individual circumstances and goals. Your future self will thank you for it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Does Your Retirement Plan Pass The Stress Test? A Realistic Assessment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Warren Buffetts Portfolio Shakeup Two Us Stocks Sold After Years Of Endorsement

Jun 05, 2025

Warren Buffetts Portfolio Shakeup Two Us Stocks Sold After Years Of Endorsement

Jun 05, 2025 -

Bruno Fernandes Future Decided Hes Staying At Manchester United

Jun 05, 2025

Bruno Fernandes Future Decided Hes Staying At Manchester United

Jun 05, 2025 -

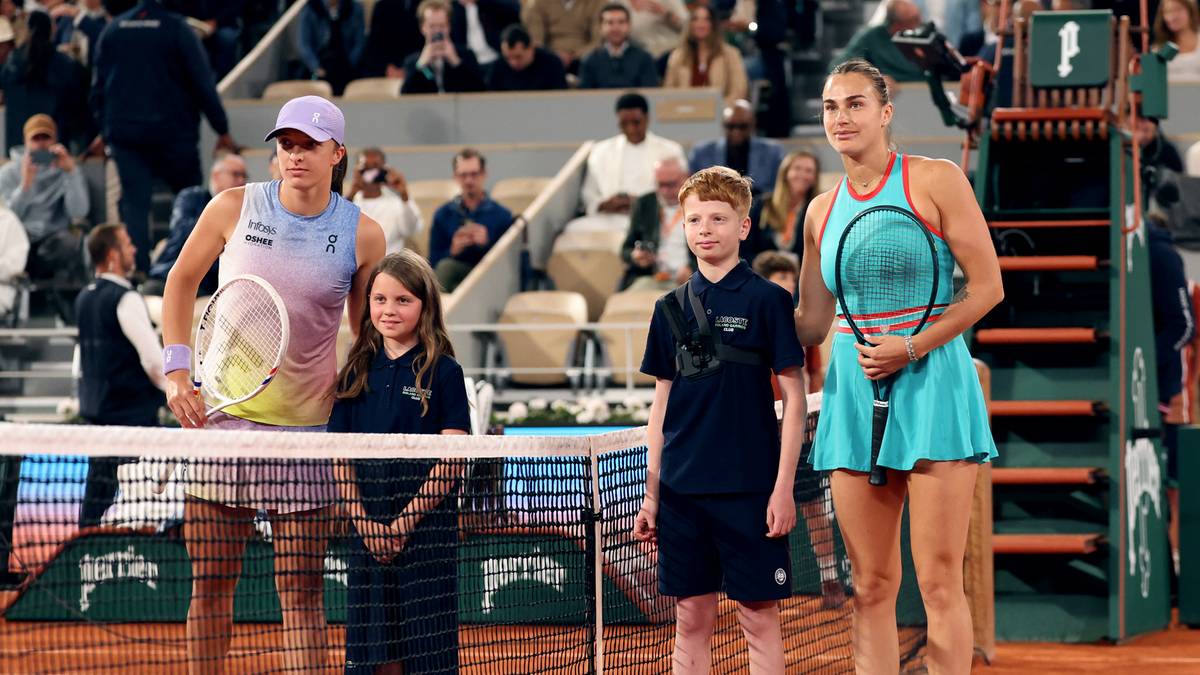

Swiatek Sabalenka Wynik Na Zywo Z Roland Garros I Pelna Relacja Meczu

Jun 05, 2025

Swiatek Sabalenka Wynik Na Zywo Z Roland Garros I Pelna Relacja Meczu

Jun 05, 2025 -

Grace Potter On The Making Of Her Forgotten Album A Deep Dive

Jun 05, 2025

Grace Potter On The Making Of Her Forgotten Album A Deep Dive

Jun 05, 2025 -

2024 Nfl Playoffs Assessing The Backup Quarterbacks Super Bowl Chances

Jun 05, 2025

2024 Nfl Playoffs Assessing The Backup Quarterbacks Super Bowl Chances

Jun 05, 2025