Do Trump's Tax Deductions For Tips, Car Loans, Etc., Benefit Low Earners?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

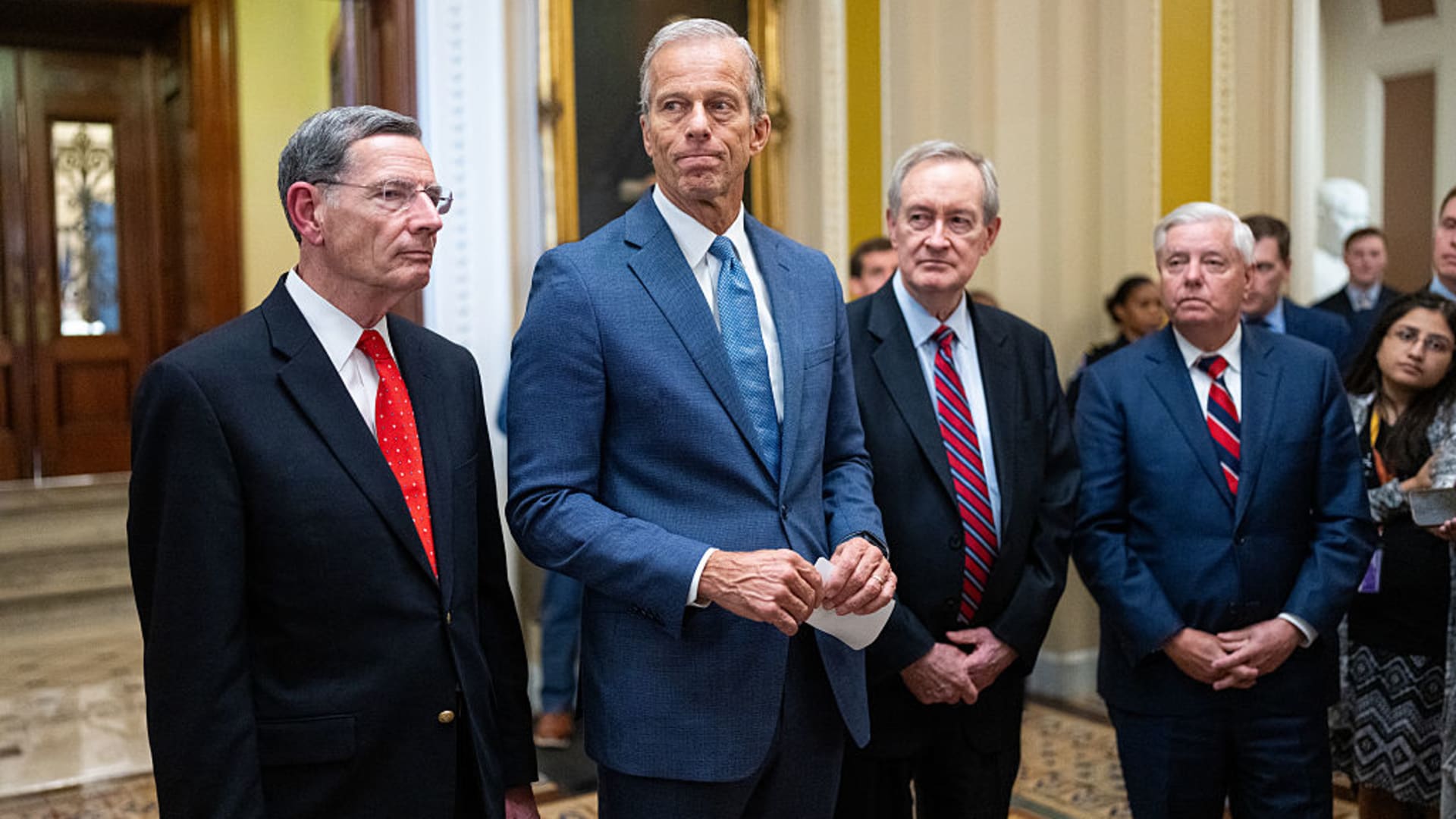

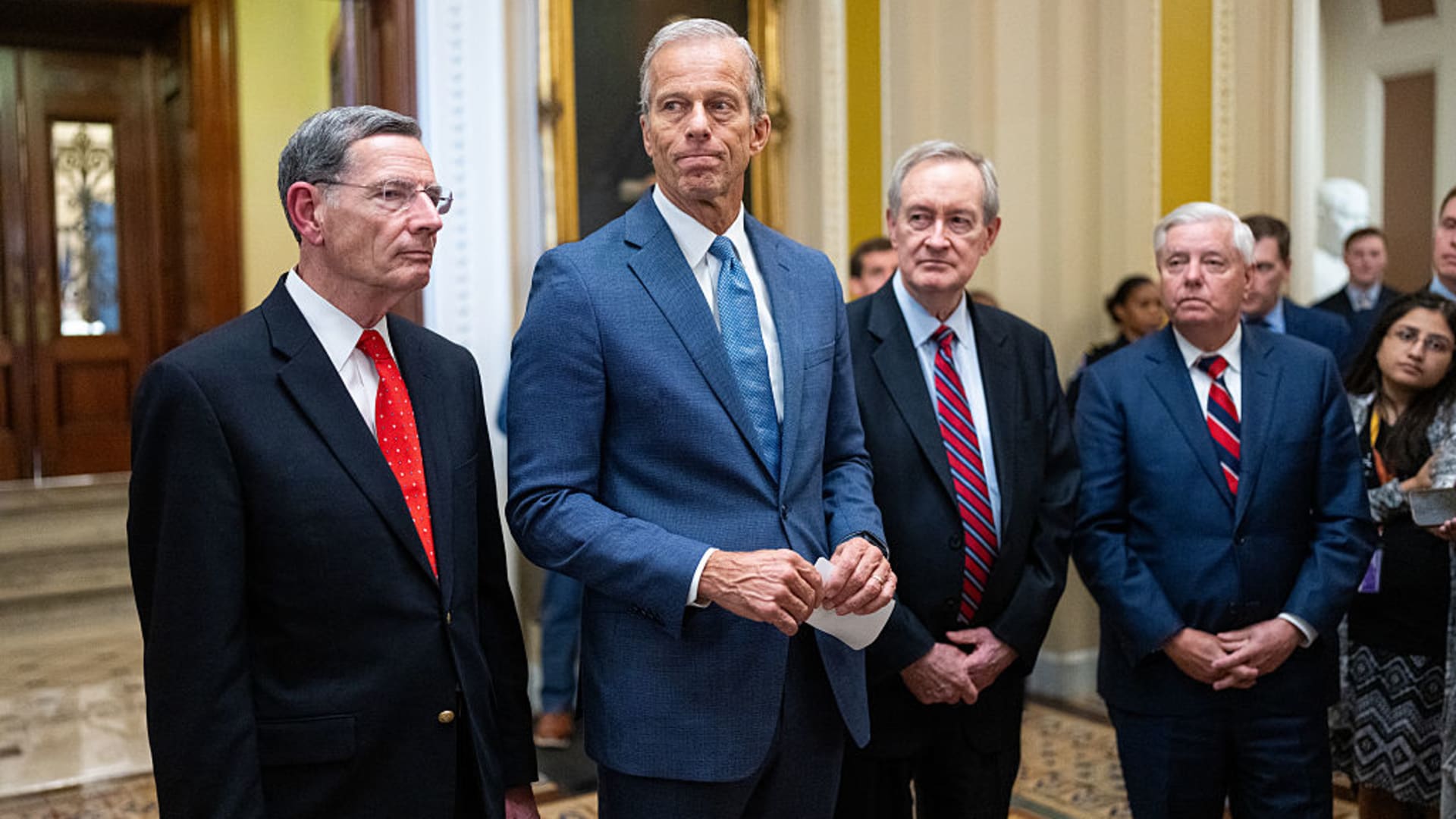

Do Trump's Proposed Tax Deductions Really Help Low Earners? A Closer Look

Donald Trump's proposed tax deductions, often touted as beneficial for low-income earners, have sparked intense debate. While the plan initially promised relief for those struggling financially, a deeper dive reveals a more nuanced reality. This article examines whether the deductions for tips, car loans, and other expenses genuinely alleviate the tax burden for low-wage workers, or if the benefits are disproportionately skewed towards higher earners.

Understanding the Proposed Deductions

Trump's plan included provisions for increased deductions related to various expenses. These included deductions for unreimbursed employee business expenses (like those incurred by tipped workers), and potentially, interest payments on car loans. The premise was that these deductions would reduce taxable income, leading to lower tax liabilities for individuals in lower income brackets.

The Reality: A Complex Picture

While the idea of reducing the tax burden for low-income individuals is appealing, the practical impact of these deductions is far from straightforward. Several factors complicate the analysis:

-

Itemized vs. Standard Deduction: Many low-income taxpayers utilize the standard deduction, meaning they wouldn't benefit from itemizing additional deductions like those for business expenses or car loan interest. The standard deduction often provides a greater tax break than itemizing for those with simpler tax situations.

-

Complexity and Accessibility: Successfully claiming these deductions requires meticulous record-keeping and a thorough understanding of tax laws. For individuals with limited financial literacy or access to tax preparation services, navigating these complexities can be a significant hurdle. This effectively excludes many who could potentially benefit.

-

Proportionate Benefit: Even if eligible, the actual tax savings from these deductions might be minimal for those with very low incomes. A small reduction on a small tax bill results in a comparatively small overall benefit.

-

Unintended Consequences: Some argue that focusing on deductions rather than direct tax credits or raising the standard deduction is less efficient in providing targeted relief to low-income individuals. Deductions benefit taxpayers proportionally to their tax bracket, meaning higher earners gain more, even with the same percentage reduction.

Who Really Benefits?

The reality is that while the intention might have been to help low-wage earners, the design of these deductions disproportionately favors those with higher incomes. Individuals with larger incomes and more complex tax situations are more likely to itemize and benefit significantly from additional deductions. They are also better equipped to navigate the complex process of claiming these deductions.

Alternatives for Supporting Low-Income Earners

Instead of relying on potentially inefficient deductions, policymakers could consider more direct and effective methods to support low-income individuals, such as:

- Expanding the Earned Income Tax Credit (EITC): The EITC is a refundable tax credit designed to help low-to-moderate-income working individuals and families. Expanding this program would provide more direct and targeted relief.

- Raising the Minimum Wage: Increasing the minimum wage directly boosts the earning potential of low-wage workers, providing a more sustainable solution to financial hardship.

- Improving Access to Affordable Healthcare and Childcare: Addressing these significant expenses would alleviate financial burdens for many low-income families.

Conclusion:

While Trump's proposed deductions aimed to support low-income earners, their actual impact is questionable. The complexity of claiming these deductions, coupled with the fact that the standard deduction often provides a greater benefit, means that the advantages are largely diluted, particularly for those who need it most. More effective strategies, like expanding existing programs and addressing systemic issues, are needed to genuinely alleviate financial burdens on low-wage workers. The debate highlights the importance of carefully considering the design and implementation of tax policies to ensure they achieve their intended goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Do Trump's Tax Deductions For Tips, Car Loans, Etc., Benefit Low Earners?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Country Star Lainey Wilson Celebrating Independence Day In Louisiana

Jul 04, 2025

Country Star Lainey Wilson Celebrating Independence Day In Louisiana

Jul 04, 2025 -

Season Over Schwellenbachs Elbow Fracture And The Braves Roster

Jul 04, 2025

Season Over Schwellenbachs Elbow Fracture And The Braves Roster

Jul 04, 2025 -

Chisholms Candid Assessment Yankees Defense And His All In Approach

Jul 04, 2025

Chisholms Candid Assessment Yankees Defense And His All In Approach

Jul 04, 2025 -

Report Nicky Lopez Signs Minor League Contract With Yankees

Jul 04, 2025

Report Nicky Lopez Signs Minor League Contract With Yankees

Jul 04, 2025 -

Ben Sheltons Meteoric Rise In Professional Tennis

Jul 04, 2025

Ben Sheltons Meteoric Rise In Professional Tennis

Jul 04, 2025