Directional Bets Fuel $5 Billion+ Bitcoin ETF Investment Boom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Directional Bets Fuel $5 Billion+ Bitcoin ETF Investment Boom

The world of finance is buzzing. Investment in Bitcoin exchange-traded funds (ETFs) has exploded, surpassing a staggering $5 billion in assets under management (AUM) in a remarkably short timeframe. This unprecedented surge isn't just about the allure of Bitcoin itself; it's fueled by increasingly sophisticated directional betting strategies employed by institutional and individual investors alike.

This rapid growth signifies a significant shift in the perception of Bitcoin as an asset class. No longer relegated to the fringes of the financial world, Bitcoin is steadily gaining mainstream acceptance, driven in part by the convenience and regulatory clarity offered by ETFs. This influx of capital into Bitcoin ETFs marks a pivotal moment, indicating a growing confidence in the cryptocurrency's long-term potential, even amidst market volatility.

The Driving Force: Directional Bets and Market Sentiment

The key driver behind this investment boom is the ability of ETFs to facilitate directional bets. Investors can now easily express their bullish or bearish sentiment on Bitcoin's price without needing to directly handle the complexities of cryptocurrency exchanges. This streamlined access has opened the doors to a wider range of investors, including those traditionally hesitant to engage directly with the volatile cryptocurrency market.

Several factors contribute to this positive market sentiment:

- Regulatory Clarity: The approval of Bitcoin ETFs in major markets like the US has significantly reduced regulatory uncertainty, attracting institutional investors seeking regulated investment vehicles.

- Institutional Adoption: Large institutional investors are increasingly allocating a portion of their portfolios to Bitcoin, driven by diversification strategies and the potential for high returns.

- Increased Accessibility: Bitcoin ETFs offer a user-friendly way for retail investors to gain exposure to Bitcoin without the technical hurdles associated with direct ownership.

- Inflation Hedge: Many investors see Bitcoin as a potential hedge against inflation, particularly in times of economic uncertainty.

Beyond the Hype: Understanding the Risks

While the current surge is undeniably impressive, it's crucial to acknowledge the inherent risks associated with Bitcoin and Bitcoin ETFs. The cryptocurrency market remains highly volatile, susceptible to sharp price swings influenced by factors ranging from regulatory changes to market sentiment and technological developments. Investors should carefully consider their risk tolerance before investing in any Bitcoin ETF. Remember to always conduct thorough research and consider seeking advice from a qualified financial advisor.

The Future of Bitcoin ETFs: What Lies Ahead?

The $5 billion+ AUM milestone is a significant achievement, but it's likely just the beginning. As regulatory frameworks mature and investor confidence grows, we can anticipate further expansion of the Bitcoin ETF market. The development of innovative ETF products, such as those tracking specific Bitcoin-related indices or offering leveraged exposure, could further fuel this growth. However, the future will depend heavily on factors like regulatory developments, wider adoption by institutional investors, and overall market sentiment. The journey of Bitcoin ETFs is far from over; it's a story still unfolding, promising both significant opportunities and considerable challenges.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk and may not be suitable for all investors.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Cryptocurrency ETF, Bitcoin Investment, ETF Investment, Bitcoin Price, Cryptocurrency Investment, Financial Markets, Investment Strategies, Directional Bets, Market Volatility, Regulatory Clarity, Institutional Investors, Asset Under Management (AUM).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Directional Bets Fuel $5 Billion+ Bitcoin ETF Investment Boom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

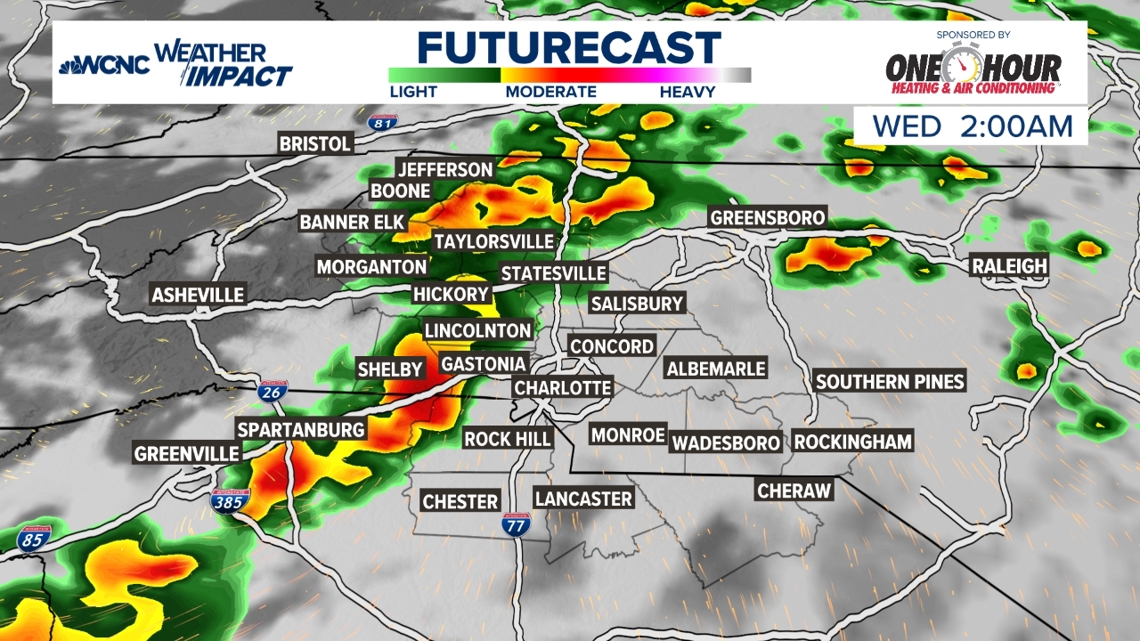

Isolated Strong Storms Possible Late Tuesday Night Weather Alert

May 21, 2025

Isolated Strong Storms Possible Late Tuesday Night Weather Alert

May 21, 2025 -

From College Star To Nfl Rookie The First Months Reality Check

May 21, 2025

From College Star To Nfl Rookie The First Months Reality Check

May 21, 2025 -

Watch Tyler Vaughns Spectactular One Handed Td In Ufl Week 8

May 21, 2025

Watch Tyler Vaughns Spectactular One Handed Td In Ufl Week 8

May 21, 2025 -

Colder Weather Arrives Rain Chances Continue Throughout The Week

May 21, 2025

Colder Weather Arrives Rain Chances Continue Throughout The Week

May 21, 2025 -

Oklahoma City Thunder Shock Denver Game 7 Victory Silences Critics

May 21, 2025

Oklahoma City Thunder Shock Denver Game 7 Victory Silences Critics

May 21, 2025