Diablo Canyon Nuclear Plant: Scrutinizing PG&E's Funding

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Diablo Canyon Nuclear Plant: Scrutinizing PG&E's Funding for Decommissioning

California's Diablo Canyon nuclear power plant, slated for closure in 2025, is at the center of a growing debate surrounding the funding of its eventual decommissioning. Pacific Gas and Electric Company (PG&E), the plant's operator, faces intense scrutiny over the financial plan designed to safely dismantle the facility and manage the resulting radioactive waste. This raises crucial questions about the long-term costs and environmental responsibility associated with nuclear power generation.

The sheer scale of the decommissioning process is daunting. Diablo Canyon, one of the largest nuclear power plants in the United States, requires a multi-billion dollar investment to safely remove spent nuclear fuel, dismantle reactor vessels, and remediate the site. PG&E's proposed funding model is under the microscope, with concerns arising from multiple angles:

H2: Concerns Regarding PG&E's Financial Plan:

-

Transparency and Accountability: Critics argue that PG&E’s financial plan lacks sufficient transparency, making it difficult to independently verify its feasibility and ensure accountability. Details on projected costs, funding sources, and contingency plans are often shrouded in complexity, leading to public mistrust. A clearer breakdown of expenses, including potential cost overruns, is vital for public confidence.

-

Ratepayer Burden: A significant portion of the decommissioning costs is expected to be passed on to California ratepayers through increased electricity bills. This has sparked outrage among consumer advocates who argue that PG&E should bear a greater share of the responsibility, given its role in operating the plant for decades. The debate hinges on the fairness of distributing such immense costs across the state's population.

-

Long-Term Financial Stability: The long-term financial stability of PG&E itself is a point of concern. The company has a history of financial challenges, raising doubts about its ability to fully fund the decommissioning process over the decades it will take. Independent financial audits and robust regulatory oversight are crucial to mitigate these risks.

-

Environmental Impact: The environmental impact of the decommissioning process, including the safe storage and eventual disposal of high-level radioactive waste, is another critical aspect. The long-term responsibility for managing this waste needs careful consideration, along with the potential environmental consequences of any unforeseen complications.

H2: The Role of State and Federal Regulation:

The California Public Utilities Commission (CPUC) and the Nuclear Regulatory Commission (NRC) play crucial roles in overseeing the decommissioning process and scrutinizing PG&E's financial plans. Their ability to effectively regulate and ensure the safety and financial soundness of the project is paramount. Increased regulatory oversight and public participation are necessary to prevent future financial and environmental risks.

H2: Looking Ahead: Lessons Learned and Future Implications:

The Diablo Canyon decommissioning presents a crucial opportunity to learn lessons about the long-term financial and environmental responsibilities associated with nuclear power. The scrutiny surrounding PG&E's funding underscores the need for greater transparency, robust regulatory oversight, and a clearer understanding of who ultimately bears the cost of this complex and long-term undertaking. This case will undoubtedly influence future nuclear power projects and policies, impacting how we approach the responsible management of nuclear waste and the financial burdens associated with this energy source.

Call to Action: Stay informed about the ongoing developments surrounding Diablo Canyon's decommissioning. Engage with your local representatives and advocate for transparency and accountability in the process. Understanding the financial implications and environmental risks is essential for informed decision-making.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Diablo Canyon Nuclear Plant: Scrutinizing PG&E's Funding. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Match Point Masterclass Safiullins Lob Secures Win Against Mpetshi Perricard At Stuttgart Open

Jun 10, 2025

Match Point Masterclass Safiullins Lob Secures Win Against Mpetshi Perricard At Stuttgart Open

Jun 10, 2025 -

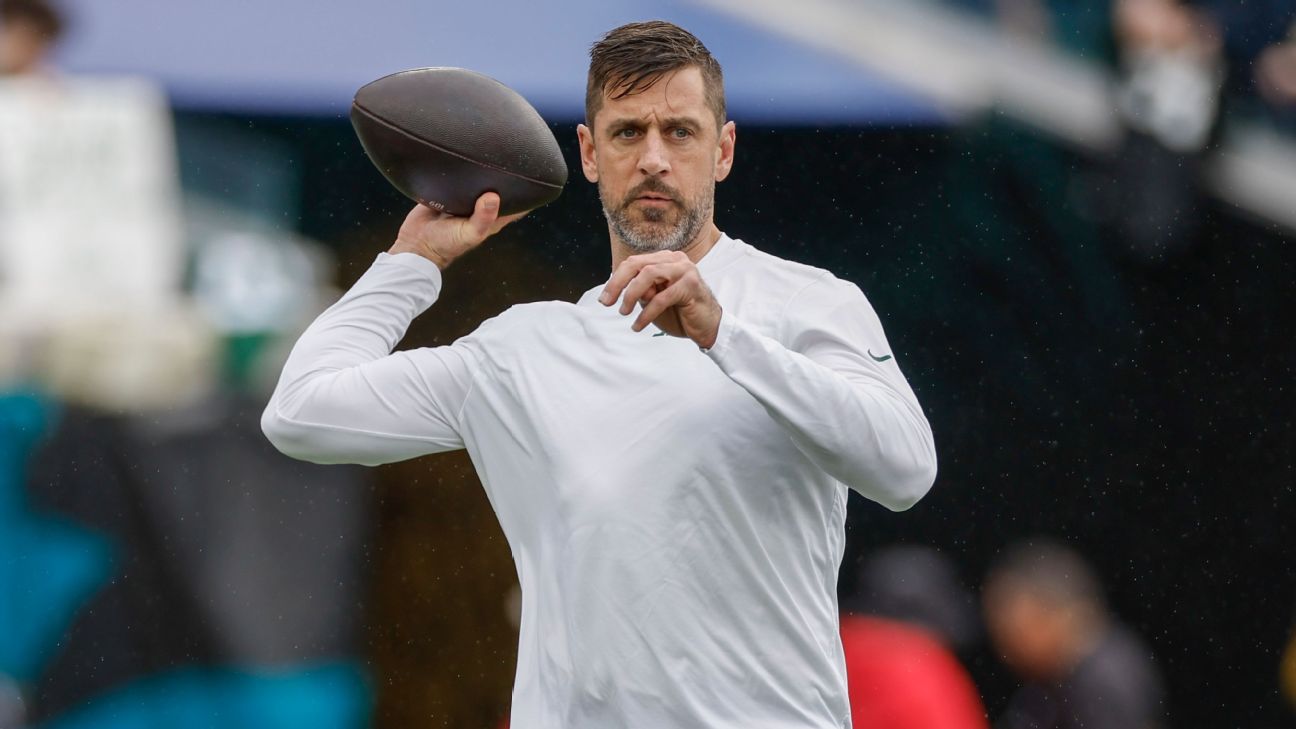

Espn Confirms Rodgers Joins Steelers On One Year 13 65 Million Contract

Jun 10, 2025

Espn Confirms Rodgers Joins Steelers On One Year 13 65 Million Contract

Jun 10, 2025 -

Can Snap Inc Stock Rebound In 2025 After A 90 Drop

Jun 10, 2025

Can Snap Inc Stock Rebound In 2025 After A 90 Drop

Jun 10, 2025 -

Severe Illness Lands Former Mma Champion Ben Askren In Hospital

Jun 10, 2025

Severe Illness Lands Former Mma Champion Ben Askren In Hospital

Jun 10, 2025 -

2026 Fifa World Cup Qualifying Serbias Match Against Andorra Preview And Prediction

Jun 10, 2025

2026 Fifa World Cup Qualifying Serbias Match Against Andorra Preview And Prediction

Jun 10, 2025