Deutsche Bank AG Adds To AMC Entertainment Holdings (AMC) Stake: Market Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deutsche Bank AG Boosts AMC Entertainment Holdings Stake: Market Implications Analyzed

Deutsche Bank AG's increased investment in AMC Entertainment Holdings (AMC) has sent ripples through the market, prompting speculation and analysis of the potential implications for the struggling movie theater chain and the broader investment landscape. The move, revealed in recent SEC filings, signals a surprising vote of confidence in AMC, a company that has navigated turbulent waters in recent years, facing challenges from streaming services and the pandemic's impact on box office revenue.

This article delves into the details of Deutsche Bank's increased stake, examines the potential reasons behind the investment, and explores the broader market implications of this significant development.

Understanding Deutsche Bank's Move

Deutsche Bank's decision to add to its AMC holdings is noteworthy for several reasons. First, it represents a significant financial commitment to a company that many analysts still consider a high-risk investment. AMC's stock price has experienced dramatic volatility, making it a favored target for both retail and institutional traders engaging in meme stock trading. However, Deutsche Bank, a major global financial institution, is known for its rigorous due diligence and risk assessment processes. This suggests that the bank may have identified potential catalysts for future growth in AMC's business.

Secondly, the timing of the investment is intriguing. The movie industry is still recovering from the pandemic, and the long-term viability of traditional movie theaters continues to be debated. However, recent box office successes and the increasing popularity of blockbuster films suggest a possible resurgence in the industry. Deutsche Bank's investment could be viewed as a bet on this anticipated recovery.

Potential Reasons Behind the Investment

While the exact reasoning behind Deutsche Bank's investment remains unknown, several factors could have influenced their decision:

- Value Investing Strategy: The bank may have identified AMC as undervalued, believing that the current market price doesn't accurately reflect the company's intrinsic value or its future growth potential. This would align with a classic value investing strategy.

- Turnaround Potential: AMC has undertaken several strategic initiatives in recent years to improve its financial position and adapt to the changing media landscape. These initiatives, such as debt reduction and diversification efforts, may have convinced Deutsche Bank of a potential turnaround.

- Short Squeeze Potential: Given AMC's status as a meme stock, the possibility of a short squeeze, where short sellers are forced to buy shares to cover their positions, driving the price higher, could have also factored into the decision. However, relying solely on a short squeeze for profit is generally considered a high-risk strategy.

Market Implications and Future Outlook

Deutsche Bank's move has already sparked renewed interest in AMC stock, with some investors interpreting it as a bullish signal. However, it's crucial to remember that investing in AMC remains a high-risk proposition. The company's long-term prospects are still dependent on several factors, including the ongoing health of the box office and the continued competition from streaming services.

The implications extend beyond AMC itself. The investment could influence other investors to re-evaluate their positions in the entertainment sector and potentially trigger further investment in similar companies. It also highlights the ongoing debate surrounding the role of institutional investors in shaping the price movements of volatile stocks.

Conclusion:

Deutsche Bank's increased stake in AMC Entertainment Holdings represents a significant development with potentially far-reaching consequences. While it signifies a degree of confidence in AMC's future, investors should proceed with caution, carefully considering the inherent risks associated with this volatile stock. Further analysis and monitoring of AMC's performance will be crucial in assessing the long-term implications of this surprising investment. Staying informed about market trends and conducting thorough due diligence remains paramount for all investors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deutsche Bank AG Adds To AMC Entertainment Holdings (AMC) Stake: Market Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paolinis French Open Fear The Point That Almost Ended Her Run

May 28, 2025

Paolinis French Open Fear The Point That Almost Ended Her Run

May 28, 2025 -

Nhl Playoffs Hurricanes Game 4 Win Ends 15 Year Eastern Conference Finals Skid

May 28, 2025

Nhl Playoffs Hurricanes Game 4 Win Ends 15 Year Eastern Conference Finals Skid

May 28, 2025 -

Gulf Moisture Surge To Bring Widespread Heavy Rainfall

May 28, 2025

Gulf Moisture Surge To Bring Widespread Heavy Rainfall

May 28, 2025 -

Investing In Super Micro Understanding Market Corrections

May 28, 2025

Investing In Super Micro Understanding Market Corrections

May 28, 2025 -

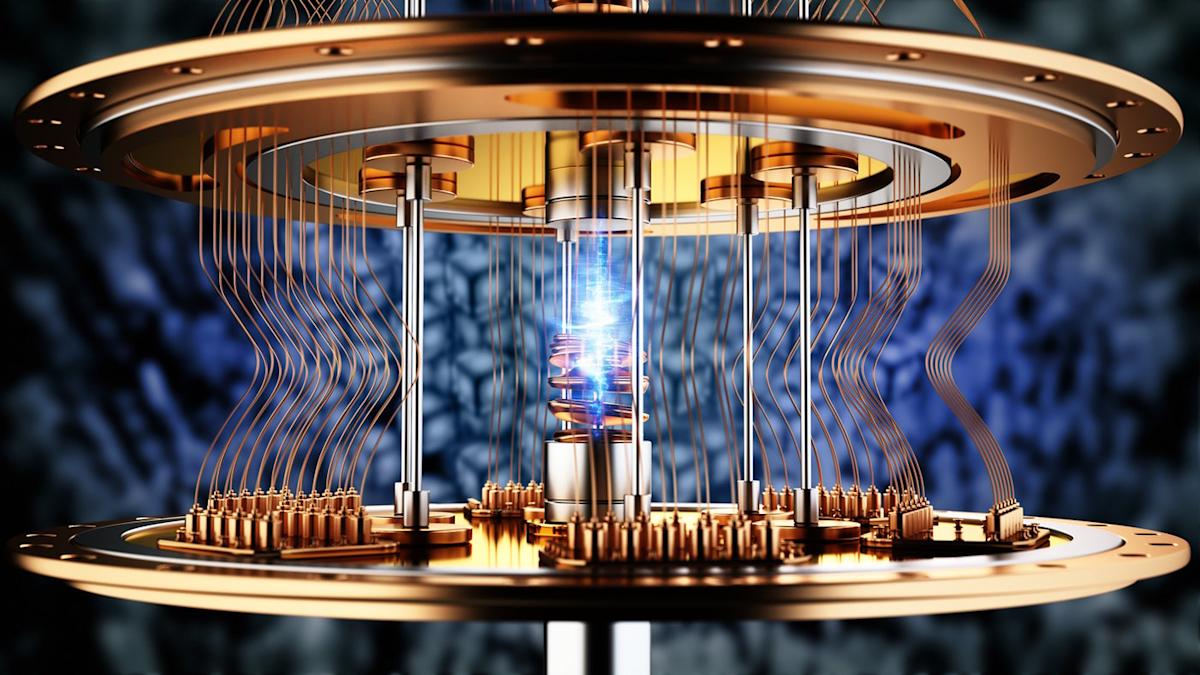

Rigetti Computing Vs D Wave Analyzing The Potential Of Quantum Computing Stocks

May 28, 2025

Rigetti Computing Vs D Wave Analyzing The Potential Of Quantum Computing Stocks

May 28, 2025