Deutsche Bank AG Adds AMC Entertainment Stock To Portfolio: Implications For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deutsche Bank AG Adds AMC Entertainment Stock to Portfolio: Implications for Investors

Deutsche Bank's recent investment in AMC Entertainment Holdings Inc. (AMC) has sent ripples through the financial world, prompting investors to re-evaluate the struggling movie theater chain's prospects. The move, revealed in recent regulatory filings, marks a significant shift in perception for a company that has been battling financial headwinds and meme-stock volatility for some time. This article delves into the implications of Deutsche Bank's decision and what it means for current and potential investors.

Why is Deutsche Bank's Investment Significant?

Deutsche Bank, a global financial powerhouse, doesn't make investment decisions lightly. Their addition of AMC stock to their portfolio suggests a degree of confidence in the company's future, potentially indicating a belief that the current market valuation undervalues AMC's assets and potential for growth. This move carries weight, potentially influencing other institutional investors and bolstering AMC's stock price. The inherent risk associated with AMC, however, remains a crucial factor.

AMC's Recent Performance and Challenges:

AMC's journey has been turbulent. The company faced significant challenges during the pandemic, with closures and reduced attendance impacting revenues heavily. While box office numbers have begun to recover, competition from streaming services and changing consumer habits continue to pose significant threats. The company's substantial debt load also remains a concern for many analysts. [Link to a reputable financial news source discussing AMC's financial performance].

Potential Upsides and Downsides for Investors:

-

Potential Upsides:

- Increased Institutional Confidence: Deutsche Bank's investment could signal a turning point, attracting further institutional interest and potentially driving up the share price.

- Strategic Initiatives: AMC has implemented various strategies to diversify its revenue streams and improve its financial position, including exploring new content and enhancing the movie-going experience. [Link to AMC's investor relations page].

- Market Recovery: A potential recovery in the movie industry could significantly benefit AMC, leading to increased profitability.

-

Potential Downsides:

- Continued Competition: The persistent threat from streaming platforms and changing viewer habits remains a significant risk.

- Debt Burden: AMC's substantial debt could continue to pose a challenge, impacting its financial flexibility.

- Market Volatility: AMC's stock has historically demonstrated significant volatility, making it a high-risk investment.

What Should Investors Do?

Deutsche Bank's investment provides a compelling argument for reevaluating AMC's potential. However, it's crucial for investors to conduct thorough due diligence before making any investment decisions. Considering the inherent risks associated with AMC, it's important to carefully assess your risk tolerance and diversify your portfolio appropriately. This isn't a recommendation to buy or sell AMC stock, but rather an analysis of the implications of a major institutional investor's move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always consult with a qualified financial advisor before making any investment decisions.

Keywords: AMC Entertainment, AMC Stock, Deutsche Bank, Stock Market, Investment, Movie Theaters, Institutional Investors, Financial News, Stock Analysis, Investment Strategy, Risk Assessment, Market Volatility, Streaming Services.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deutsche Bank AG Adds AMC Entertainment Stock To Portfolio: Implications For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Josef Newgardens Bid For Indy 500 Three Peat Ends In Frustration

May 27, 2025

Josef Newgardens Bid For Indy 500 Three Peat Ends In Frustration

May 27, 2025 -

Liberty Defeat Fever Caitlin Clarks Performance Overshadowed By Referee Controversy

May 27, 2025

Liberty Defeat Fever Caitlin Clarks Performance Overshadowed By Referee Controversy

May 27, 2025 -

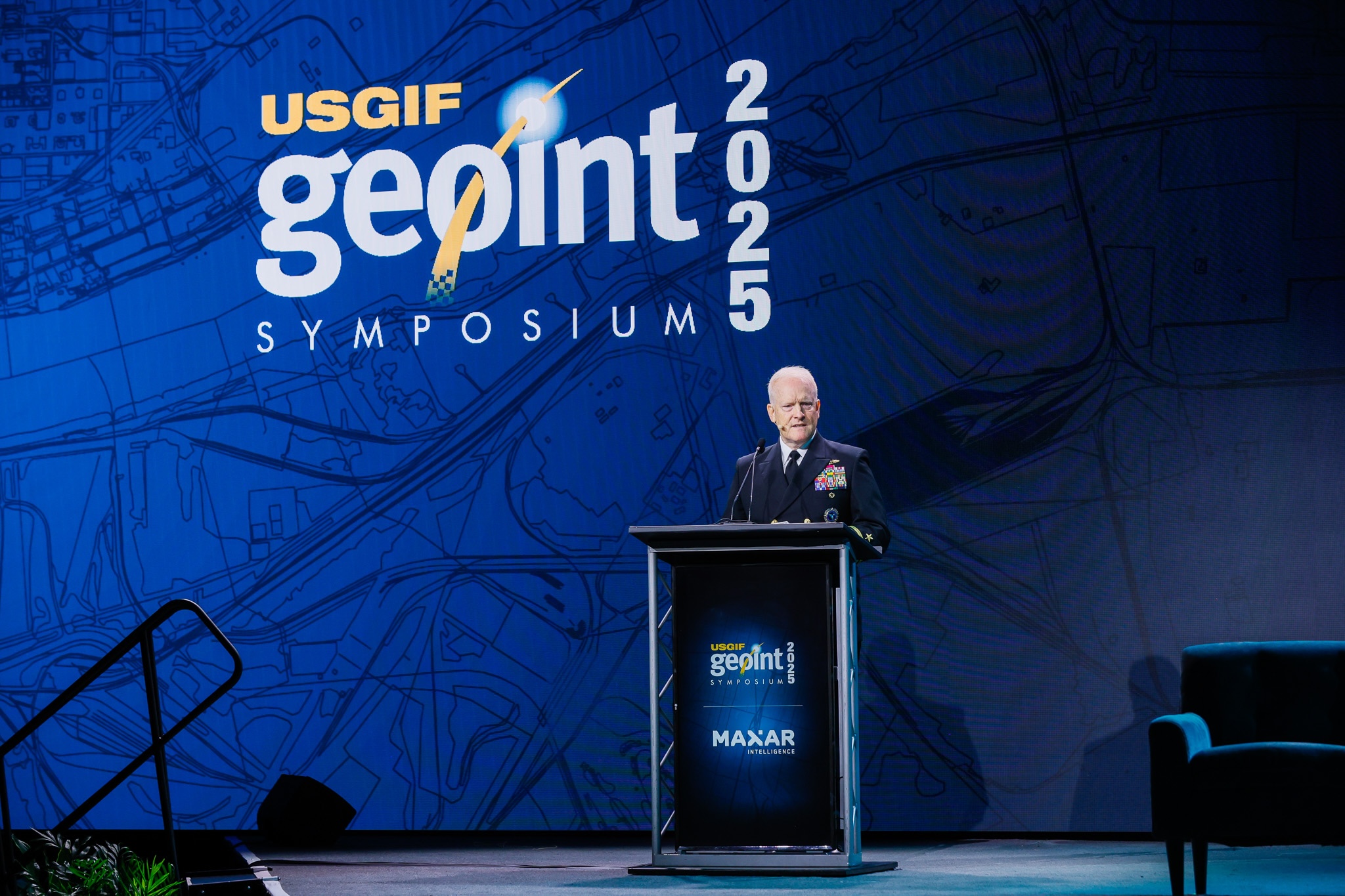

Palantirs Ai Role In Project Maven Grows As Pentagon Increases Budget

May 27, 2025

Palantirs Ai Role In Project Maven Grows As Pentagon Increases Budget

May 27, 2025 -

Super Micro Computers Stock Price When To Expect A Correction

May 27, 2025

Super Micro Computers Stock Price When To Expect A Correction

May 27, 2025 -

Live Game Updates Watch Defenders Battle Roughnecks In Ufl Week 9

May 27, 2025

Live Game Updates Watch Defenders Battle Roughnecks In Ufl Week 9

May 27, 2025