Decoding The Connection: US Crypto Week And Bitcoin's All-Time High

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding the Connection: US Crypto Week and Bitcoin's All-Time High

Bitcoin's recent surge to near all-time highs has coincided with a pivotal week for cryptocurrency in the US. This begs the question: is there a direct correlation between the events of "US Crypto Week" and Bitcoin's impressive price action? While no single event guarantees a price jump, the confluence of factors certainly contributed to a positive market sentiment. Let's delve into the key happenings and explore the potential connections.

US Crypto Week: A Recap of Key Events

US Crypto Week, a period encompassing various significant developments in the US cryptocurrency landscape, saw a flurry of activity impacting both regulatory and market perspectives. Several key events stand out:

-

Increased Regulatory Clarity (or Lack Thereof): While no sweeping new regulations emerged, ongoing discussions in Congress and within regulatory bodies like the SEC hinted at a potential shift towards a more defined legal framework. This ambiguity, while potentially unsettling for some, can also fuel speculation and investment, particularly among those betting on future adoption. The lack of immediate, overly restrictive action could be interpreted as a positive sign by the market.

-

Institutional Investment Growth: Reports continued to surface regarding increased institutional investment in Bitcoin and other cryptocurrencies. Large financial institutions are increasingly exploring avenues for crypto integration, showing a growing acceptance within the traditional finance world. This influx of capital naturally exerts upward pressure on prices.

-

Technological Advancements: News regarding advancements in blockchain technology, such as scalability solutions and improved security protocols, often generates positive market sentiment. These advancements signal a maturing industry and potentially increased efficiency and adoption.

-

Positive Media Coverage: Increased positive media coverage, even amidst ongoing debates about regulation, can have a significant effect on public perception and investor confidence. More mainstream acknowledgment can lead to a greater influx of new investors.

The Bitcoin Price Surge: Correlation or Causation?

While it's impossible to definitively state that US Crypto Week caused Bitcoin's price rise, the events of the week undoubtedly contributed to a more bullish market sentiment. The convergence of increased institutional interest, ongoing regulatory discussions (even if inconclusive), and positive media attention likely fueled a wave of buying pressure, pushing Bitcoin closer to its all-time high.

Factors Beyond US Crypto Week

It's crucial to acknowledge that other global macroeconomic factors also play a significant role in Bitcoin's price volatility. These include:

- Inflationary pressures: Bitcoin is often seen as a hedge against inflation, attracting investors seeking to protect their assets.

- Geopolitical instability: Periods of global uncertainty can lead to increased demand for Bitcoin as a decentralized, non-sovereign asset.

- Overall market sentiment: The overall mood in the global financial markets can significantly influence cryptocurrency prices.

Looking Ahead: What's Next for Bitcoin?

The future of Bitcoin remains uncertain, heavily influenced by evolving regulatory landscapes, technological advancements, and macroeconomic conditions. However, US Crypto Week highlighted a growing acceptance of cryptocurrencies within the US financial ecosystem. This shift, combined with ongoing institutional investment, suggests a potentially bright outlook for the asset, at least in the medium term. Further regulatory clarity could significantly impact its trajectory.

Call to Action: Stay informed about developments in the cryptocurrency market and the ongoing regulatory discussions to make informed investment decisions. Always conduct thorough research and consult with a financial advisor before investing in any cryptocurrency. This article is for informational purposes only and should not be considered financial advice.

Keywords: Bitcoin, Cryptocurrency, US Crypto Week, All-Time High, Bitcoin Price, Regulation, Institutional Investment, Blockchain Technology, Market Sentiment, Crypto Market, Investment, Financial Advice, SEC, Cryptocurrency Regulation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Decoding The Connection: US Crypto Week And Bitcoin's All-Time High. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2 000 Wins The Active Managers Closest To Joining Terry Francona

Jul 16, 2025

2 000 Wins The Active Managers Closest To Joining Terry Francona

Jul 16, 2025 -

Barberton Councilman Proposes 100 Credit For Power Outage Victims

Jul 16, 2025

Barberton Councilman Proposes 100 Credit For Power Outage Victims

Jul 16, 2025 -

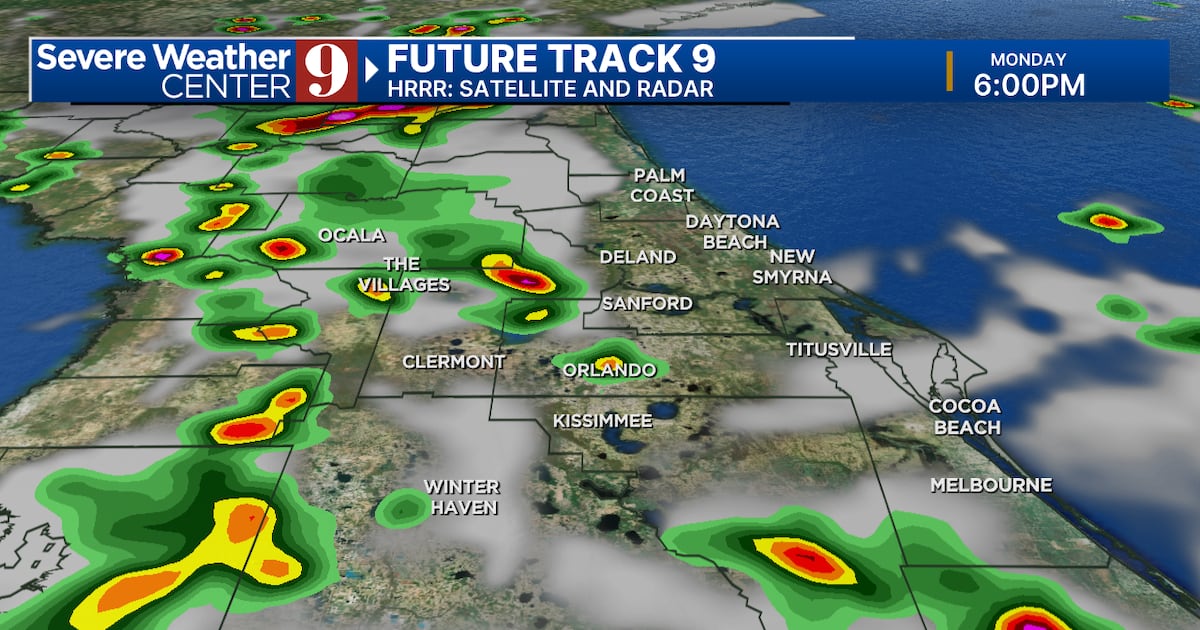

Central Florida Flood Watch Heavy Rain And Storms Expected Through Wednesday

Jul 16, 2025

Central Florida Flood Watch Heavy Rain And Storms Expected Through Wednesday

Jul 16, 2025 -

Ethan Holliday Son Of Matt Holliday Drafted By Colorado Rockies

Jul 16, 2025

Ethan Holliday Son Of Matt Holliday Drafted By Colorado Rockies

Jul 16, 2025 -

2025 Mlb Draft Willits Joins Nationals As Number One Overall Selection

Jul 16, 2025

2025 Mlb Draft Willits Joins Nationals As Number One Overall Selection

Jul 16, 2025