Declining Returns For Experian (LON:EXPN) Investors: A Market Overview

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Declining Returns for Experian (LON:EXPN) Investors: A Market Overview

Experian (LON:EXPN), a global leader in information services, has recently seen its stock performance falter, leaving many investors questioning the future of their returns. This market overview examines the factors contributing to this decline and explores potential implications for the future. While Experian remains a significant player in its field, understanding the current challenges is crucial for informed investment decisions.

The Dip in Experian's Stock Performance:

Experian's share price has experienced a noticeable downturn in recent months, prompting concerns among shareholders. Several factors are contributing to this decline, ranging from macroeconomic headwinds to specific challenges within the company's operational landscape.

Macroeconomic Headwinds:

-

Global Economic Slowdown: The global economy faces significant uncertainties, with inflation and potential recessionary pressures impacting consumer spending and business investment. This creates a less favorable environment for Experian's various data-driven services, impacting revenue growth. [Link to a reputable source discussing global economic slowdown]

-

Rising Interest Rates: Increased interest rates, a tool used to combat inflation, generally impact the valuation of growth stocks like Experian. Higher borrowing costs can reduce company profitability and investor appetite for riskier investments. [Link to a reputable source discussing interest rate impacts on stock markets]

Company-Specific Challenges:

-

Increased Competition: Experian operates in a competitive market, facing pressure from both established players and emerging fintech companies. Innovations in data analytics and the rise of open banking are further intensifying this competitive landscape.

-

Regulatory Scrutiny: The information services sector is subject to increasing regulatory scrutiny regarding data privacy and security. Compliance costs and potential penalties can negatively impact profitability. [Link to relevant regulatory news or reports]

-

Currency Fluctuations: As a global company, Experian is exposed to currency fluctuations. Adverse exchange rates can negatively impact reported financial results.

Analyzing the Future Outlook for Experian:

Despite these challenges, Experian possesses several strengths:

-

Strong Brand Recognition and Market Share: Experian benefits from a well-established brand and substantial market share across its various segments.

-

Diversified Revenue Streams: The company's revenue streams are diversified across several sectors, offering some resilience against economic downturns.

-

Investment in Technology and Innovation: Experian consistently invests in technological advancements to maintain its competitive edge and develop new data-driven products and services.

Investment Strategy Considerations:

Investors should carefully assess their risk tolerance and investment horizon before making decisions regarding Experian. Long-term investors might view the current dip as a buying opportunity, given the company's fundamental strengths. However, short-term investors may be more cautious given the prevailing uncertainties. Diversification within a broader investment portfolio remains a key strategy to mitigate risk.

Conclusion:

The recent decline in Experian's stock performance is a complex issue influenced by both macroeconomic and company-specific factors. While the short-term outlook presents challenges, Experian's long-term prospects depend on its ability to navigate these headwinds and capitalize on emerging opportunities. Thorough due diligence and a well-defined investment strategy are essential for investors navigating this evolving market landscape.

Disclaimer: This article provides general market commentary and is not financial advice. Investors should conduct their own thorough research and consider seeking professional financial advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Declining Returns For Experian (LON:EXPN) Investors: A Market Overview. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Latest Acquisition Enables Experian To Enhance Share Repurchase

Aug 12, 2025

Latest Acquisition Enables Experian To Enhance Share Repurchase

Aug 12, 2025 -

Acquisition Fuels Experians Enhanced Share Repurchase Plan

Aug 12, 2025

Acquisition Fuels Experians Enhanced Share Repurchase Plan

Aug 12, 2025 -

Another Ejection For Aaron Boone Yankees Managers Season Of Controversy Continues

Aug 12, 2025

Another Ejection For Aaron Boone Yankees Managers Season Of Controversy Continues

Aug 12, 2025 -

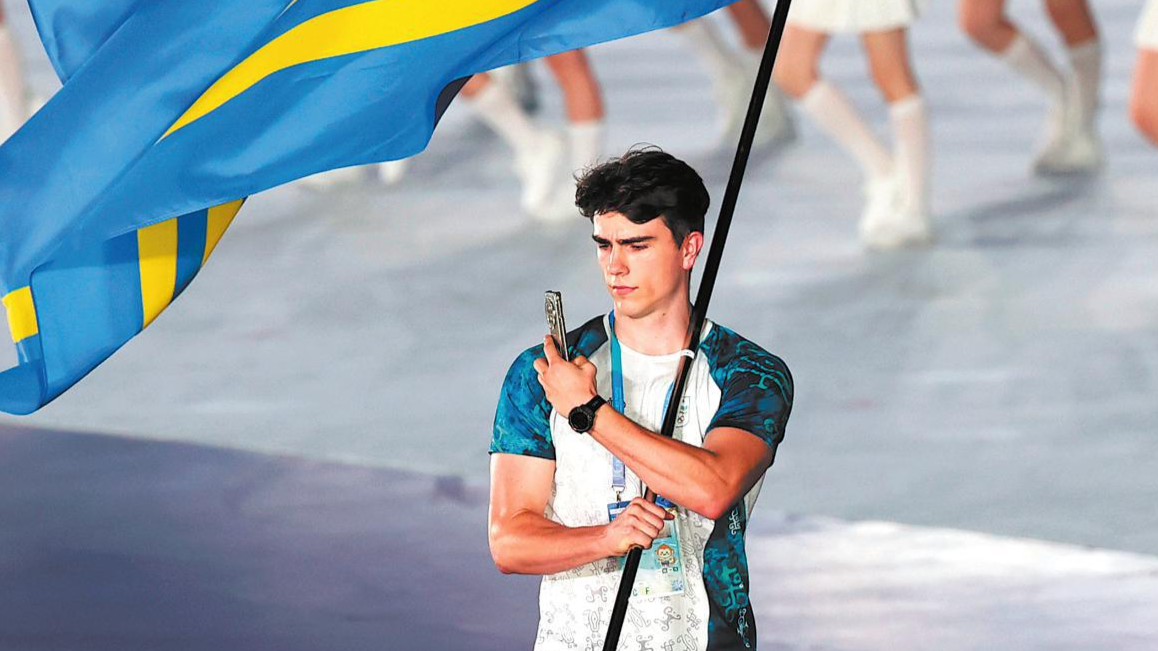

Aruban Karate Star Shines At Chengdu World Games

Aug 12, 2025

Aruban Karate Star Shines At Chengdu World Games

Aug 12, 2025 -

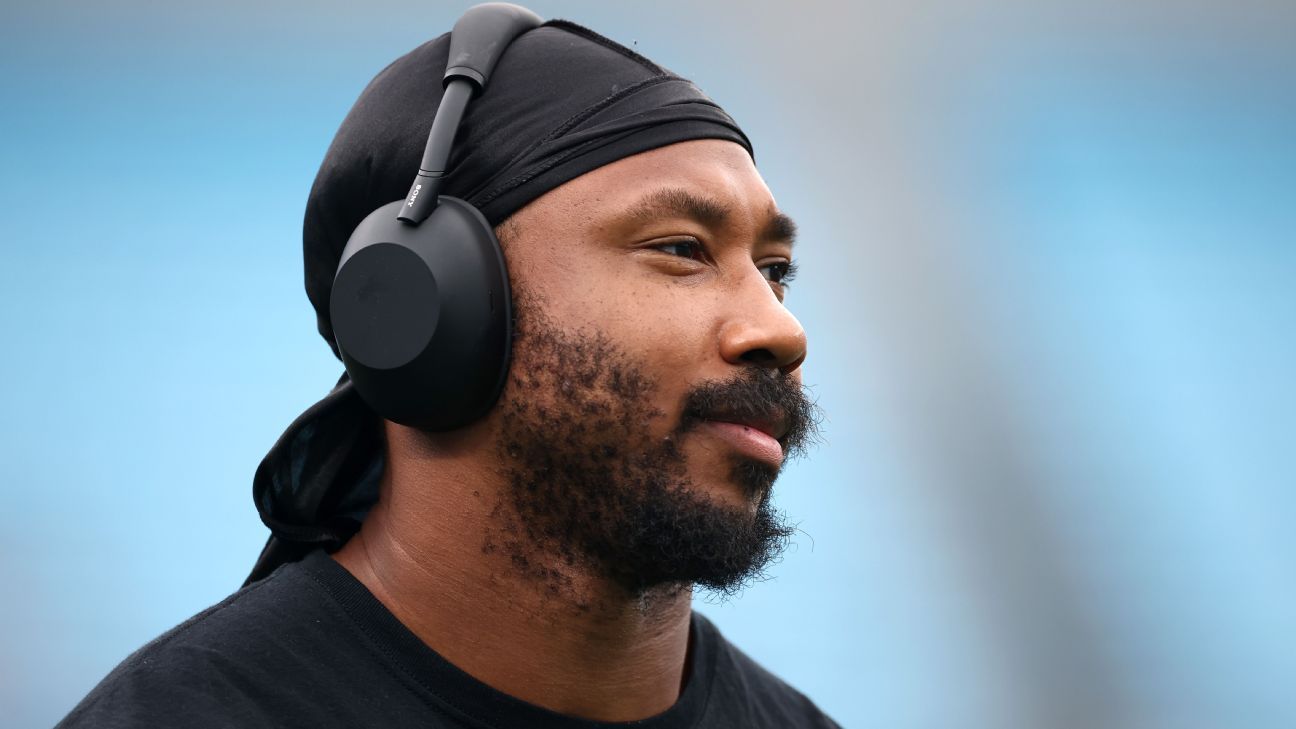

Jermaine Johnsons Pup List Return Analyzing The Jets Defensive Upgrade

Aug 12, 2025

Jermaine Johnsons Pup List Return Analyzing The Jets Defensive Upgrade

Aug 12, 2025

Latest Posts

-

49ers Facing Wide Receiver Crisis Aiyuks Potential Week 6 Comeback

Aug 13, 2025

49ers Facing Wide Receiver Crisis Aiyuks Potential Week 6 Comeback

Aug 13, 2025 -

Lluvia De Perseidas 2025 Mejor Momento Y Lugar Para Verlas En Espana

Aug 13, 2025

Lluvia De Perseidas 2025 Mejor Momento Y Lugar Para Verlas En Espana

Aug 13, 2025 -

Cleveland Browns Garrett Cited For Reckless Driving 100 Mph Speed

Aug 13, 2025

Cleveland Browns Garrett Cited For Reckless Driving 100 Mph Speed

Aug 13, 2025 -

2025 Nfl Preseason Week 2 Complete Guide To Betting Lines And Spreads

Aug 13, 2025

2025 Nfl Preseason Week 2 Complete Guide To Betting Lines And Spreads

Aug 13, 2025 -

Get Ready To Rumble Laila Ali Presents Chef Grudge Match A Culinary Throwdown

Aug 13, 2025

Get Ready To Rumble Laila Ali Presents Chef Grudge Match A Culinary Throwdown

Aug 13, 2025