CRDO Vs. AVGO: Choosing The Best AI Semiconductor Stock For Your Portfolio

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>CRDO vs. CRUS: Choosing the Best AI Semiconductor Stock for Your Portfolio</h1>

The artificial intelligence (AI) boom is driving explosive growth in the semiconductor industry, making it a prime area for investment. Two companies frequently mentioned in discussions about AI semiconductor stocks are Coherent (COHR) and Analog Devices (AD). But which one offers the better investment opportunity for your portfolio? This in-depth analysis compares CRDO and AVGO, examining their strengths, weaknesses, and overall potential to help you make an informed decision.

<h2>Understanding the AI Semiconductor Landscape</h2>

Before diving into a CRDO vs. AVGO comparison, it's crucial to understand the broader context. The AI revolution demands powerful, energy-efficient semiconductors for processing massive datasets. This surge in demand is fueling significant growth for companies specializing in AI-related chips, including those used in data centers, high-performance computing (HPC), and AI-powered edge devices.

<h2>Coherent (COHR): A Laser Focus on AI</h2>

Coherent, a leader in laser technology, plays a crucial role in the manufacturing of advanced semiconductors used in AI applications. Their high-precision lasers are essential for etching intricate patterns onto silicon wafers, a critical step in chip production. This positions them as a beneficiary of the increasing demand for advanced chips driven by AI.

Key Strengths of COHR:

- Essential Role in Semiconductor Manufacturing: COHR's technology is integral to the fabrication of cutting-edge chips.

- Technological Leadership: They consistently innovate, pushing the boundaries of laser technology.

- Strong Partnerships: Collaboration with major semiconductor manufacturers provides stability and access to markets.

Key Weaknesses of COHR:

- Exposure to Semiconductor Market Volatility: The performance of COHR is heavily tied to the overall health of the semiconductor industry.

- High Capital Expenditure Requirements: Maintaining a technological edge requires significant investment in R&D.

<h2>Analog Devices (AD): Broad Reach, Strong AI Presence</h2>

Analog Devices, a diversified semiconductor company, offers a wide range of chips, including those vital for AI applications. While not solely focused on AI, their products are essential components in many AI systems, particularly in areas like sensors and signal processing.

Key Strengths of AD:

- Diversified Portfolio: Reduces reliance on any single market segment, offering greater resilience.

- Established Market Leader: AD possesses a strong brand reputation and extensive market share.

- Strong Financials: Consistent profitability and healthy cash flow.

Key Weaknesses of AD:

- Less Direct AI Exposure than COHR: While AD benefits from AI growth, its exposure is less direct compared to Coherent.

- Competition in a Crowded Market: Navigating a competitive landscape requires continuous innovation and adaptation.

<h2>CRDO vs. AVGO: A Head-to-Head Comparison</h2>

| Feature | Coherent (COHR) | Analog Devices (AD) |

|---|---|---|

| Primary Focus | Laser technology for semiconductor manufacturing | Diverse semiconductor solutions, including AI components |

| AI Exposure | High, directly tied to chip production | Moderate, through various AI applications |

| Risk Profile | Higher, due to semiconductor market volatility | Moderate, due to diversified portfolio |

| Growth Potential | High, driven by AI semiconductor demand | Strong, driven by overall semiconductor growth and AI adoption |

<h2>Which Stock is Right for You?</h2>

The "best" stock depends entirely on your investment goals and risk tolerance.

-

Investors seeking higher growth potential and willing to accept higher risk: COHR may be a more suitable option. Its direct exposure to the AI semiconductor boom offers significant upside potential, but also increased volatility.

-

Investors prioritizing stability and diversification: AD might be a better choice. Its broader portfolio and established market position offer more resilience against market fluctuations, though potential growth may be less explosive.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions. Past performance is not indicative of future results.

<h2>Stay Informed on AI Semiconductor Investments</h2>

The AI semiconductor market is dynamic and rapidly evolving. Staying updated on the latest industry trends and company news is vital for informed investment decisions. Consider following industry publications and reputable financial news sources to track the progress of CRDO and AVGO and other key players in the AI semiconductor space.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CRDO Vs. AVGO: Choosing The Best AI Semiconductor Stock For Your Portfolio. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roland Garros 2024 Paolini Extends Winning Run To Seven Matches

May 28, 2025

Roland Garros 2024 Paolini Extends Winning Run To Seven Matches

May 28, 2025 -

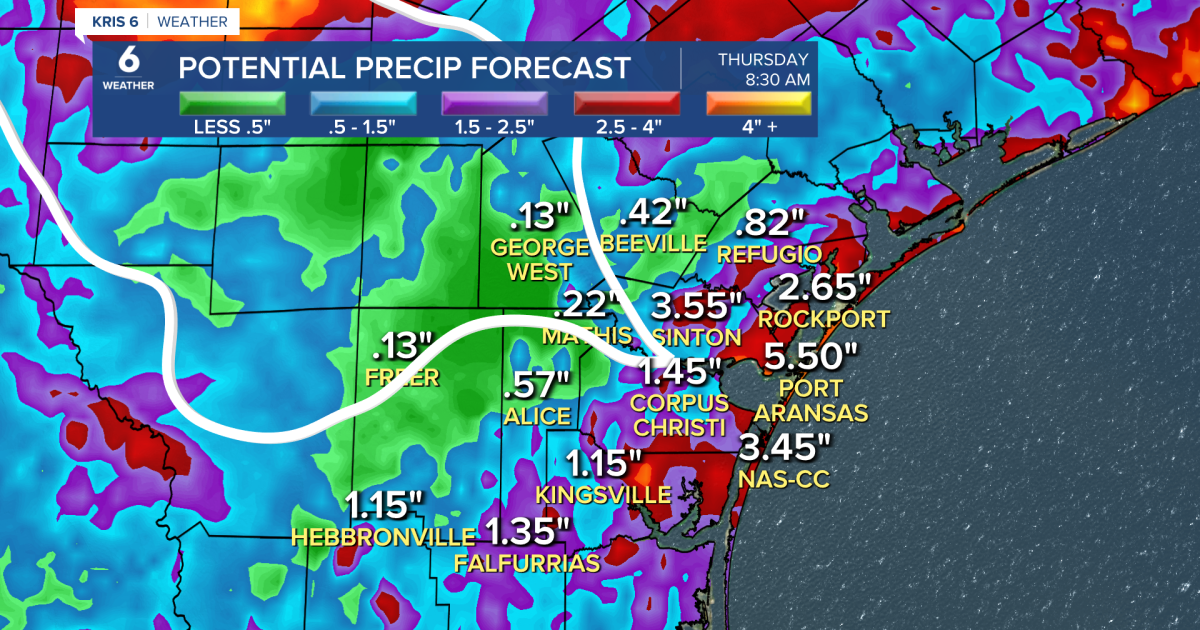

Severe Weather Alert Abundant Gulf Moisture And Disturbances Threaten Heavy Rainfall

May 28, 2025

Severe Weather Alert Abundant Gulf Moisture And Disturbances Threaten Heavy Rainfall

May 28, 2025 -

Thunder Top Timberwolves In Game 4 Seize Series Advantage

May 28, 2025

Thunder Top Timberwolves In Game 4 Seize Series Advantage

May 28, 2025 -

The Future Of Work Understanding Why Ai Hasnt Taken Your Job

May 28, 2025

The Future Of Work Understanding Why Ai Hasnt Taken Your Job

May 28, 2025 -

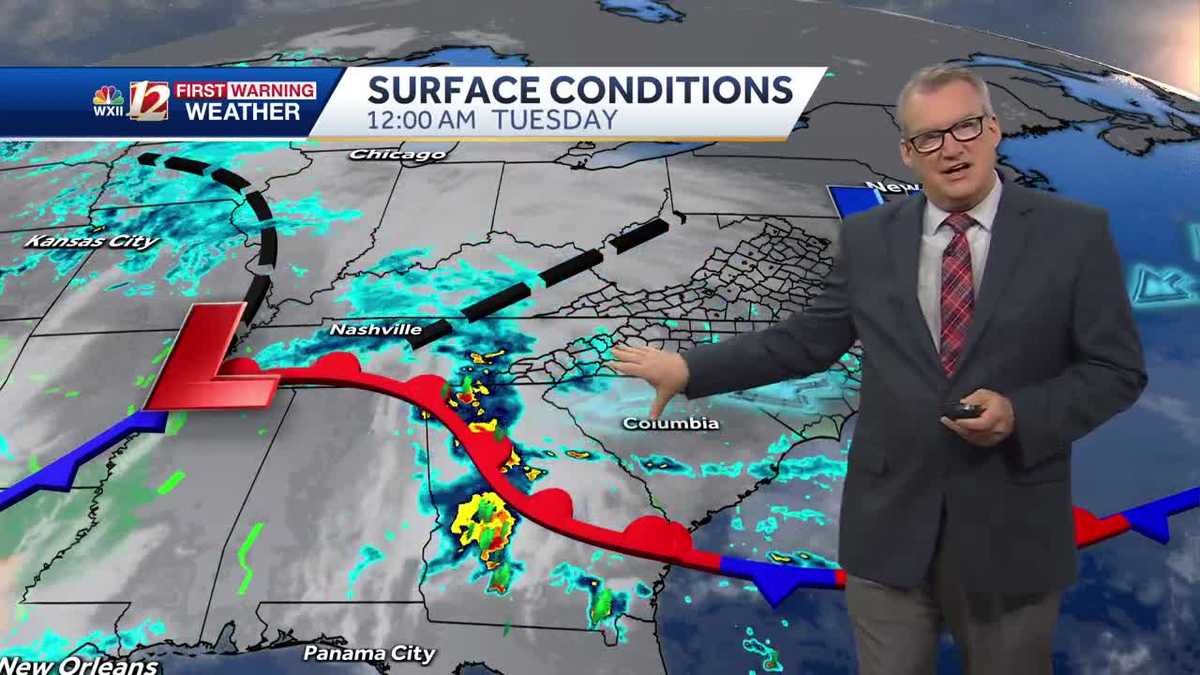

Prepare For A Cool And Wet Tuesday Weather Forecast

May 28, 2025

Prepare For A Cool And Wet Tuesday Weather Forecast

May 28, 2025