CRDO Stock Vs. AVGO Stock: Which Offers Better AI Growth Potential?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CRDO Stock vs. AVGO Stock: Which Offers Better AI Growth Potential?

The artificial intelligence (AI) revolution is reshaping industries, and savvy investors are looking for ways to capitalize on this explosive growth. Two prominent players often mentioned in the conversation are CRDO (Cruden) and AVGO (Broadcom). But which stock offers the better AI growth potential? This in-depth analysis will compare CRDO and AVGO, examining their current positions, future prospects, and potential returns in the burgeoning AI market.

Understanding the Contenders:

Before diving into the comparison, let's briefly profile each company:

-

CRDO (Cruden): While less immediately recognizable than Broadcom, Cruden plays a crucial role in the development of high-performance computing (HPC) systems vital for AI development and deployment. Their expertise lies in providing precision components and advanced solutions for demanding applications, often underpinning the infrastructure necessary for AI breakthroughs. This often makes their involvement less visible to the average consumer, but highly significant to the industry's success. Therefore, understanding their market position and potential for expansion within AI-related infrastructure is key.

-

AVGO (Broadcom): A semiconductor giant, Broadcom is a well-established player with a diverse product portfolio. Their chips are integral to numerous technological advancements, including those driving the AI revolution. Their involvement is more direct and visible, encompassing various aspects of AI hardware and infrastructure. This broad reach, however, also means a more diluted exposure to pure AI growth compared to a company more focused on niche AI-related technologies like Cruden.

CRDO's AI Growth Potential:

Cruden's strength lies in its specialized components and solutions critical for the demanding computational needs of AI. Their focus on precision and high performance positions them to benefit significantly from:

- Increased demand for HPC: The insatiable hunger for processing power to train and deploy sophisticated AI models fuels the growth of HPC. Cruden's involvement in this critical area suggests a strong correlation with future AI expansion.

- Edge computing advancements: As AI moves beyond the cloud and closer to the user ("edge computing"), the need for robust, efficient, and precise components will increase, further strengthening Cruden's position.

- Technological innovation: Continuous advancements in AI algorithms and model complexity will necessitate ever more powerful hardware, potentially leading to heightened demand for Cruden's specialized products.

AVGO's AI Growth Potential:

Broadcom's massive scale and diverse product portfolio offer exposure to various aspects of the AI ecosystem. However, this diversification also means its AI-related revenue is not as concentrated as Cruden's. Broadcom's AI growth potential stems from:

- Broad market reach: Their chips find applications across numerous AI-related fields, offering broader, albeit potentially less concentrated, growth opportunities.

- Established relationships: Broadcom enjoys strong relationships with major technology companies heavily invested in AI, providing a stable foundation for continued growth.

- Diversification: While this can dilute AI-specific growth, it also provides resilience against sector-specific downturns.

Which Stock Offers Better AI Growth Potential?

The choice between CRDO and AVGO depends heavily on your risk tolerance and investment strategy.

-

Higher Risk, Higher Reward: CRDO offers potentially higher growth, but with increased risk due to its smaller size and more niche focus. Their success hinges directly on the continued expansion of HPC and edge computing, making them more susceptible to market fluctuations in these specific sectors.

-

Lower Risk, Moderate Reward: AVGO presents a lower-risk, more moderate-growth opportunity. Their diversification offers some protection against sector-specific downturns, making them a more stable, albeit potentially less explosive, investment.

Conclusion:

Both CRDO and AVGO offer exposure to the AI revolution, but through different lenses. Investors seeking higher potential returns, despite greater risk, may favor CRDO. Those prioritizing stability and diversification might lean towards AVGO. Thorough due diligence, considering your personal investment goals and risk tolerance, is crucial before making any investment decisions. Remember to consult with a qualified financial advisor before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CRDO Stock Vs. AVGO Stock: Which Offers Better AI Growth Potential?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kyle Busch At Rcr A Year Two Perspective And Future Predictions

May 27, 2025

Kyle Busch At Rcr A Year Two Perspective And Future Predictions

May 27, 2025 -

Coca Cola 600 Ross Chastains Last Lap Pass Secures Victory

May 27, 2025

Coca Cola 600 Ross Chastains Last Lap Pass Secures Victory

May 27, 2025 -

Apple Vs Amd Morgan Stanleys Top Tech Stock Pick

May 27, 2025

Apple Vs Amd Morgan Stanleys Top Tech Stock Pick

May 27, 2025 -

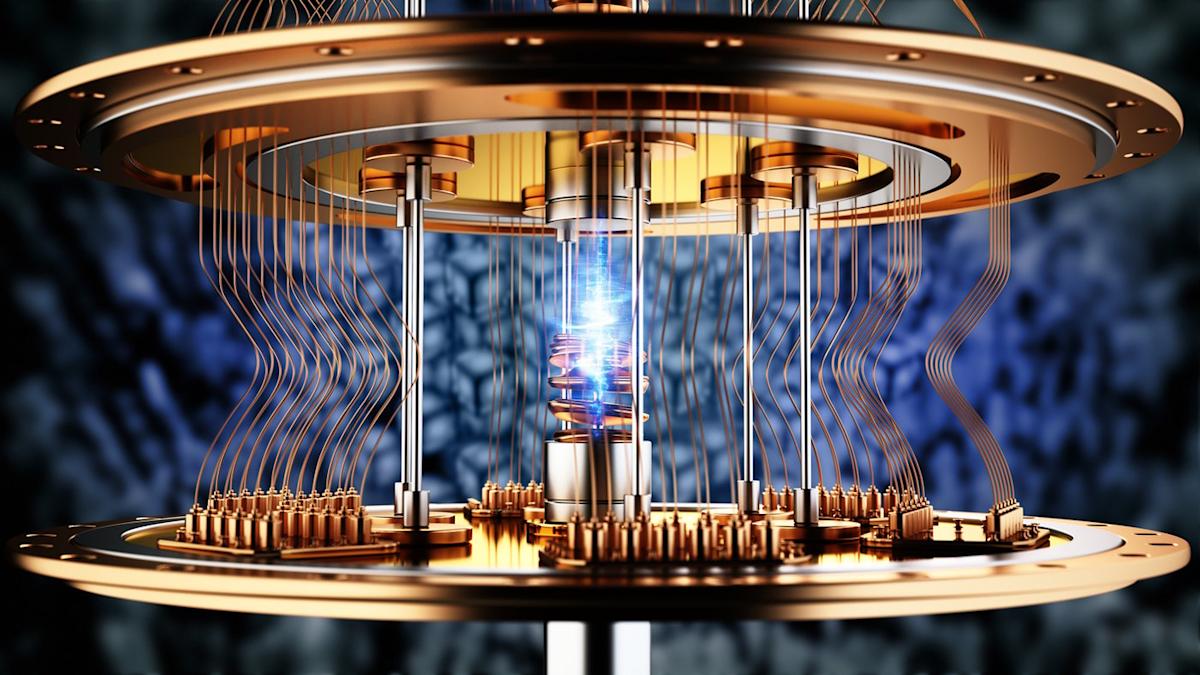

Investing In Quantum Ai A Head To Head Analysis Of Rigetti And D Wave Stocks

May 27, 2025

Investing In Quantum Ai A Head To Head Analysis Of Rigetti And D Wave Stocks

May 27, 2025 -

Watch Best Plays And Final Score Panthers Vs Stallions Ufl Week 9

May 27, 2025

Watch Best Plays And Final Score Panthers Vs Stallions Ufl Week 9

May 27, 2025