CRDO Or AVGO: Which Is The Superior Investment In The AI Chip Market?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CRDO vs. AVGO: The AI Chip Investment Showdown

The artificial intelligence (AI) market is exploding, and savvy investors are scrambling to position themselves for the inevitable boom. Two prominent players, CRDO (Cree, Inc.) and AVGO (Broadcom Inc.), are attracting significant attention, but which offers the superior investment opportunity in this rapidly evolving landscape? This in-depth analysis will dissect both companies, comparing their strengths, weaknesses, and overall potential within the burgeoning AI chip sector.

Understanding the AI Chip Landscape:

Before diving into a CRDO vs. AVGO comparison, it's crucial to understand the AI chip market's dynamics. The demand for high-performance computing power to fuel AI applications, from machine learning to deep learning, is driving unprecedented growth. This demand fuels the need for specialized chips, particularly GPUs (Graphics Processing Units) and specialized AI accelerators. Both CRDO and AVGO play vital, albeit different, roles in this ecosystem.

CRDO (Cree, Inc.): A Focus on Power and Efficiency

Cree, Inc., now Wolfspeed, is a significant player in the wide bandgap semiconductor market, specializing in silicon carbide (SiC) and gallium nitride (GaN) materials. These materials are crucial for building more efficient and powerful power semiconductors, essential components in AI data centers and high-performance computing systems. While not directly producing AI chips themselves, CRDO's technology is indirectly fueling the AI revolution by improving power efficiency and thermal management within these systems.

Strengths of CRDO:

- Essential Technology: SiC and GaN are vital for next-generation power electronics, a critical component of AI infrastructure.

- Growing Market Demand: The need for energy-efficient power solutions is only increasing with the expansion of AI data centers.

- Strong Partnerships: CRDO collaborates with leading players in the semiconductor industry, strengthening its market position.

Weaknesses of CRDO:

- Indirect Exposure: CRDO's impact on the AI market is less direct compared to companies producing AI chips themselves.

- Competition: The wide bandgap semiconductor market is becoming increasingly competitive.

- Market Volatility: The semiconductor industry is susceptible to cyclical market fluctuations.

AVGO (Broadcom Inc.): A Broad Reach in the Semiconductor Ecosystem

Broadcom is a major player in the semiconductor industry, with a diverse portfolio encompassing networking, infrastructure, and wireless technologies. While not solely focused on AI, AVGO's components play a crucial role in various aspects of AI infrastructure, including data centers and high-speed networking. Their strength lies in their broad reach and established market position.

Strengths of AVGO:

- Diverse Portfolio: AVGO's broad product range offers diversified revenue streams and resilience against market fluctuations.

- Established Market Leader: AVGO possesses significant market share and brand recognition within the semiconductor industry.

- Strong Financial Performance: AVGO consistently demonstrates strong financial results, indicating a robust business model.

Weaknesses of AVGO:

- Less Direct AI Focus: Compared to dedicated AI chip manufacturers, AVGO's exposure to the AI market is less concentrated.

- Regulatory Scrutiny: Large semiconductor companies like AVGO often face regulatory scrutiny related to mergers and acquisitions.

- High Valuation: AVGO's stock price reflects its success, potentially limiting upside potential for some investors.

The Verdict: Which is the Superior Investment?

Choosing between CRDO and AVGO depends heavily on your investment strategy and risk tolerance.

-

CRDO offers higher potential upside due to its position in a rapidly growing niche within the AI infrastructure ecosystem. However, it carries higher risk due to its less established market position and indirect exposure to the AI market.

-

AVGO presents a more conservative investment, with a strong track record and diversified revenue streams. However, its valuation may limit future gains compared to smaller, faster-growing players.

Ultimately, conducting thorough due diligence and considering your individual investment goals is crucial before investing in either CRDO or AVGO. Consulting with a financial advisor is highly recommended. The AI chip market is dynamic, and staying informed about industry trends and company performance is vital for making informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CRDO Or AVGO: Which Is The Superior Investment In The AI Chip Market?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Smart Investment Strategy 2 Undervalued S And P 500 Stocks To Buy Now

May 27, 2025

Smart Investment Strategy 2 Undervalued S And P 500 Stocks To Buy Now

May 27, 2025 -

Amc Stock Performance Impact Of Deutsche Banks Recent Purchase

May 27, 2025

Amc Stock Performance Impact Of Deutsche Banks Recent Purchase

May 27, 2025 -

After A Whirlwind Month Travis Hunter And Leanna De La Fuente Are Officially Married

May 27, 2025

After A Whirlwind Month Travis Hunter And Leanna De La Fuente Are Officially Married

May 27, 2025 -

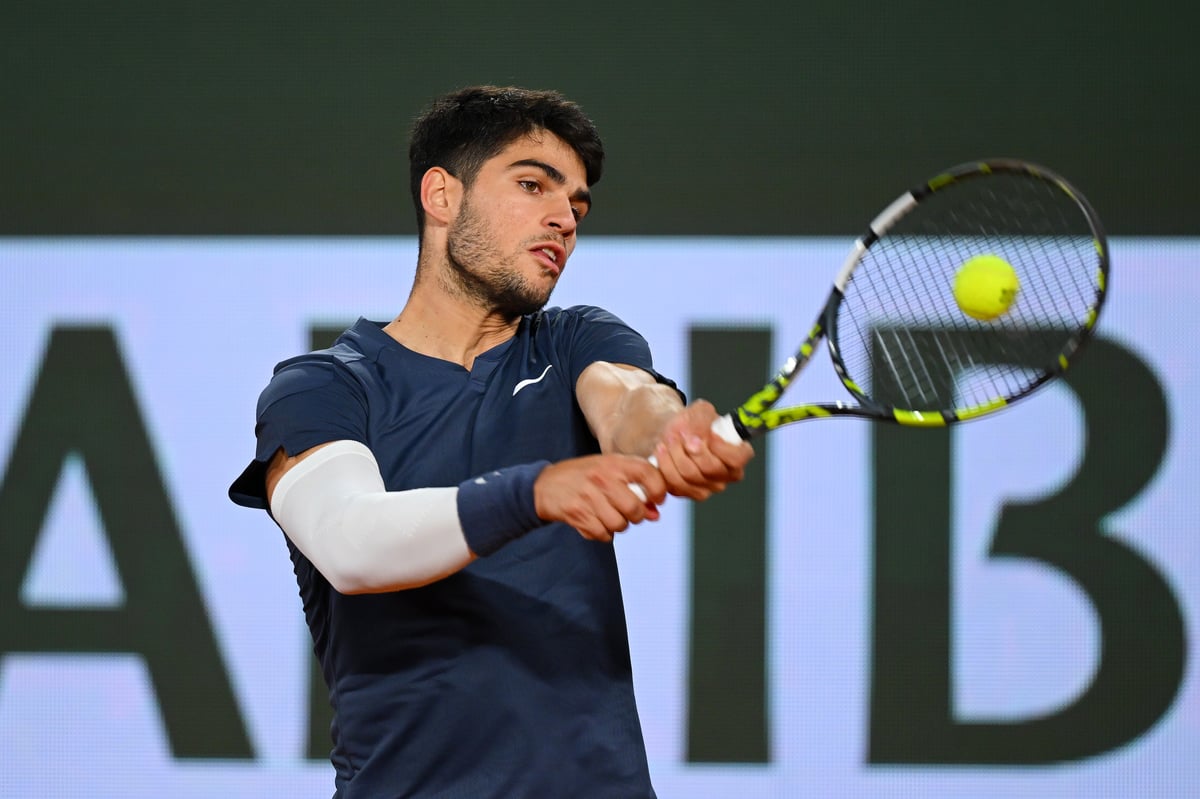

Best Ways To Watch French Open 2025 Live In The Uk

May 27, 2025

Best Ways To Watch French Open 2025 Live In The Uk

May 27, 2025 -

Roland Garros French Open Match Schedule And Draw

May 27, 2025

Roland Garros French Open Match Schedule And Draw

May 27, 2025