CoreWeave's (CRWV) Market Value Plummets Following Core Scientific Deal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave's (CRWV) Market Value Takes a Dive After Core Scientific Deal

CoreWeave (CRWV), a prominent player in the cloud computing space specializing in high-performance computing (HPC) for AI, saw its market value significantly plummet following its recent deal with bankrupt cryptocurrency mining firm, Core Scientific. The news sent ripples through the tech sector, raising questions about the long-term implications for CoreWeave and the broader AI infrastructure market. This unexpected downturn highlights the inherent risks associated with acquisitions, particularly those involving distressed companies.

The acquisition, announced [Date of announcement], involved CoreWeave purchasing Core Scientific's substantial computing assets, including thousands of ASICs (Application-Specific Integrated Circuits) – powerful chips crucial for cryptocurrency mining and increasingly vital for AI processing. While initially perceived as a strategic move to expand CoreWeave's computing capacity and solidify its position in the competitive AI cloud market, the market reacted negatively, suggesting concerns about the deal's financial viability and potential unforeseen liabilities.

The Market's Reaction and Underlying Concerns:

The stock price of CRWV experienced a sharp decline following the announcement, reflecting investor anxieties. Several factors contributed to this negative sentiment:

-

Financial Burden: Acquiring a bankrupt company often involves significant hidden costs and unforeseen liabilities. Investors worry about the potential for unexpected expenses related to Core Scientific's debt and ongoing legal battles. This uncertainty makes it difficult to accurately assess CoreWeave's future profitability.

-

Integration Challenges: Integrating a large, complex asset base like Core Scientific's requires substantial resources and expertise. A smooth integration is crucial for realizing the intended synergies and avoiding operational disruptions. Any hiccups during this process could further impact CoreWeave's performance and investor confidence.

-

Market Saturation: The cloud computing market, particularly the segment focused on AI, is becoming increasingly crowded. Competition is fierce, and the success of any new player depends on its ability to differentiate itself and offer unique value propositions. The Core Scientific acquisition might not have been the most strategic move given this competitive landscape.

-

Dependence on Cryptocurrency: While ASICs are increasingly valuable for AI, CoreWeave's reliance on assets previously used for cryptocurrency mining might raise concerns among investors seeking exposure to more stable, less volatile technology sectors.

Looking Ahead: Analysis and Potential Outcomes:

The long-term impact of this acquisition remains uncertain. CoreWeave's management will need to effectively address investor concerns and demonstrate a clear path towards profitability. This will likely involve:

-

Transparent Communication: Openly communicating the integration plan, addressing potential risks, and providing regular updates on progress is crucial for regaining investor trust.

-

Strategic Partnerships: Forming strategic alliances with key players in the AI ecosystem could help mitigate some of the risks and unlock new growth opportunities.

-

Focus on Innovation: Investing in research and development to maintain a competitive edge in the rapidly evolving AI landscape will be vital for long-term success.

The CoreWeave-Core Scientific deal serves as a cautionary tale, reminding investors and businesses alike of the complexities and potential pitfalls of acquiring distressed assets, even within seemingly promising sectors like AI. The coming months will be critical in determining whether CoreWeave can successfully navigate these challenges and ultimately realize the benefits of its acquisition.

Further Reading:

- [Link to CoreWeave's official press release]

- [Link to relevant financial news articles]

- [Link to an article about the competitive landscape of the AI cloud computing market]

Disclaimer: This article provides general information and should not be considered financial advice. Investors should conduct their own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave's (CRWV) Market Value Plummets Following Core Scientific Deal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Colorado Rockies Mlb Draft Pick Ethan Holliday Carves His Own Path

Jul 16, 2025

Colorado Rockies Mlb Draft Pick Ethan Holliday Carves His Own Path

Jul 16, 2025 -

Congressman Goldman Questions Ice Agreement To Hold Immigrants At Mdc Brooklyn

Jul 16, 2025

Congressman Goldman Questions Ice Agreement To Hold Immigrants At Mdc Brooklyn

Jul 16, 2025 -

Eli Willits Nationals Top Pick In 2025 Mlb Draft

Jul 16, 2025

Eli Willits Nationals Top Pick In 2025 Mlb Draft

Jul 16, 2025 -

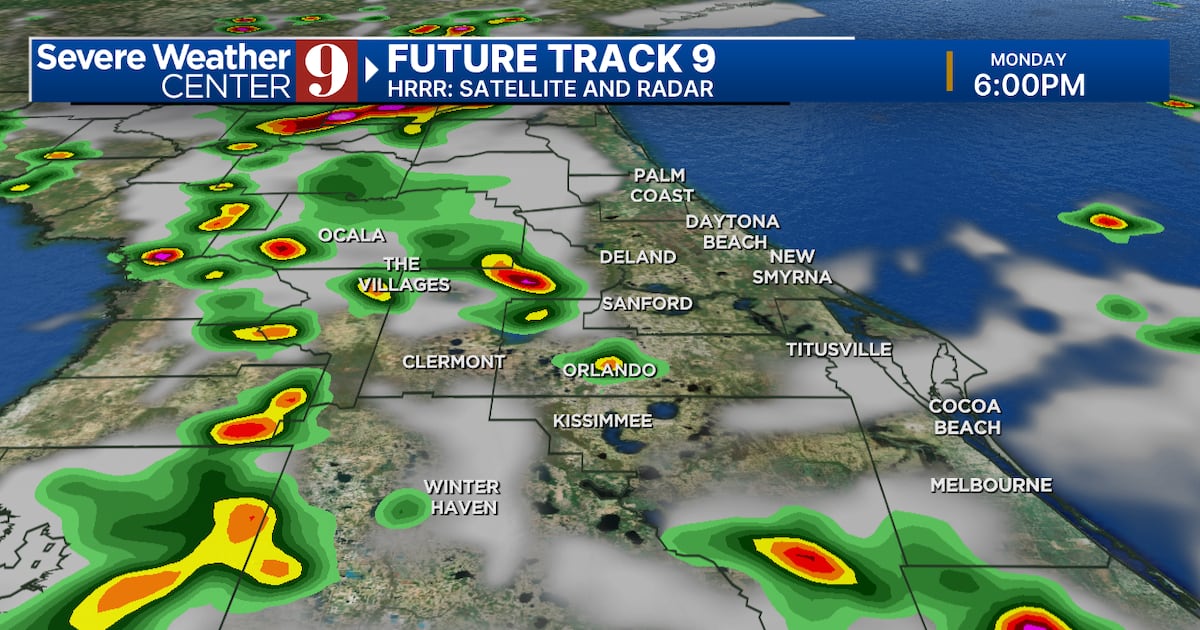

Showers And Thunderstorms To Drench Central Florida Through Mid Week

Jul 16, 2025

Showers And Thunderstorms To Drench Central Florida Through Mid Week

Jul 16, 2025 -

Boston Celtics Offseason Plans Analyzing The Likelihood Of A Lillard Tatum Pairing In 2025

Jul 16, 2025

Boston Celtics Offseason Plans Analyzing The Likelihood Of A Lillard Tatum Pairing In 2025

Jul 16, 2025

Latest Posts

-

Divorce Rumors Swirl Michelle And Barack Obama Issue Statement

Jul 17, 2025

Divorce Rumors Swirl Michelle And Barack Obama Issue Statement

Jul 17, 2025 -

Do All Star Games Doom Hosts The Atlanta Braves Case Study

Jul 17, 2025

Do All Star Games Doom Hosts The Atlanta Braves Case Study

Jul 17, 2025 -

Uncaged Johnny Cage Takes Center Stage In New Mortal Kombat Ii Poster

Jul 17, 2025

Uncaged Johnny Cage Takes Center Stage In New Mortal Kombat Ii Poster

Jul 17, 2025 -

Pre Mortal Kombat 2 Hype Warner Bros Johnny Cage Imdb Hoax

Jul 17, 2025

Pre Mortal Kombat 2 Hype Warner Bros Johnny Cage Imdb Hoax

Jul 17, 2025 -

Hilarious Moment Kings Guards Reaction To Being Zoomed In During Nba Summer League Game

Jul 17, 2025

Hilarious Moment Kings Guards Reaction To Being Zoomed In During Nba Summer League Game

Jul 17, 2025