CoreWeave Stock Plunges: $9 Billion Core Scientific Merger Spooks Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave Stock Plunges: $9 Billion Core Scientific Merger Spooks Investors

CoreWeave, the rapidly growing cloud computing company specializing in AI workloads, experienced a significant stock price drop following the announcement of its $9 billion merger with Core Scientific. The news, which initially seemed like a strategic win, sent ripples of concern through the investment community, leaving many questioning the long-term viability of the combined entity. This article delves into the reasons behind the plunge, exploring the investor anxieties and analyzing the potential implications for the future of both companies.

The Merger: A Bold Move with Uncertain Outcomes

The merger, announced on [Date of announcement], aimed to create a powerhouse in the burgeoning AI infrastructure market. Core Scientific, while facing its own financial challenges, brings substantial data center infrastructure and expertise to the table. The combined company would control a vast network of computing power, positioning itself to capitalize on the explosive growth of artificial intelligence applications. However, the market reacted negatively, raising serious questions about the deal's strategic merit and financial soundness.

Why the Stock Plunge? Investor Concerns and Market Sentiment

Several factors contributed to CoreWeave's stock price plummeting:

-

High Valuation Concerns: The $9 billion price tag raised eyebrows amongst analysts and investors. Some argue that the valuation doesn't accurately reflect Core Scientific's current financial health and future prospects, particularly considering its recent bankruptcy filing. This perceived overvaluation fueled concerns about potential dilution for existing CoreWeave shareholders.

-

Debt Burden: Core Scientific carries a significant debt load, a burden that will now be assumed by the merged entity. Investors worry about the increased financial risk and the potential strain on the combined company's cash flow, hindering its ability to invest in future growth and technological advancements.

-

Market Volatility: The broader tech sector has experienced considerable volatility in recent months, exacerbating the negative reaction to the merger news. Investor sentiment towards high-growth, yet unprofitable, companies remains cautious, contributing to the sell-off.

-

Integration Challenges: Merging two large companies is never easy. The successful integration of Core Scientific's infrastructure and operations with CoreWeave's existing systems presents significant logistical and managerial challenges. Any hiccups during this process could further impact the company's performance and stock price.

Looking Ahead: Opportunities and Risks

While the immediate market reaction is negative, the merger does present some potential long-term opportunities. The combined company will possess a significant competitive advantage in the AI infrastructure market, potentially attracting large enterprise clients and fueling growth. However, the success of the merger hinges on effective management, successful integration, and a clear path to profitability. The company needs to address investor concerns regarding valuation, debt, and integration challenges to regain market confidence.

Conclusion: A Waiting Game for Investors

The CoreWeave stock plunge underscores the inherent risks associated with high-growth mergers in a volatile market. The coming months will be crucial in determining whether this merger ultimately proves to be a strategic masterstroke or a costly mistake. Investors are now left to watch and wait, carefully assessing the company's performance and future announcements to gauge the long-term impact of this bold, yet controversial, deal. Further analysis from financial experts and ongoing market trends will be key to understanding the complete implications of this significant event in the cloud computing and AI infrastructure space. The future remains uncertain, but one thing is clear: the market has spoken, and it’s expressing significant apprehension.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave Stock Plunges: $9 Billion Core Scientific Merger Spooks Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rep Goldman Probes Controversial Ice Agreement With Bop For 100 Immigrant Detainees

Jul 16, 2025

Rep Goldman Probes Controversial Ice Agreement With Bop For 100 Immigrant Detainees

Jul 16, 2025 -

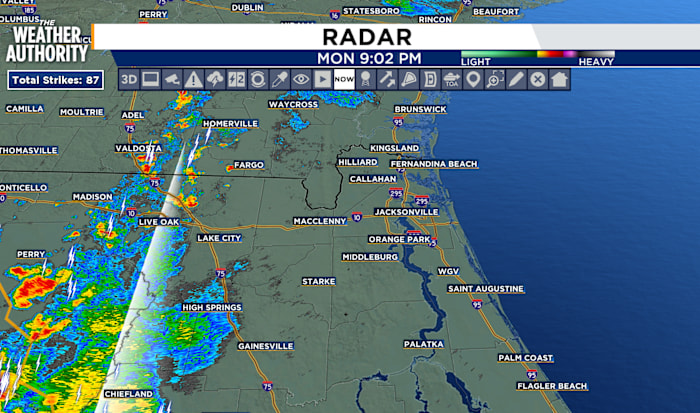

Weather Shift Boosts Invest 93 Soggy Conditions And Development Outlook

Jul 16, 2025

Weather Shift Boosts Invest 93 Soggy Conditions And Development Outlook

Jul 16, 2025 -

Tropical Disturbance Invest 93 L Monitoring The Threat To Florida

Jul 16, 2025

Tropical Disturbance Invest 93 L Monitoring The Threat To Florida

Jul 16, 2025 -

Chelsea 3 0 Psg Tactical Breakdown Of A Dominant Win July 13 2025

Jul 16, 2025

Chelsea 3 0 Psg Tactical Breakdown Of A Dominant Win July 13 2025

Jul 16, 2025 -

Florida East Coast On Alert Monitoring Tropical Disturbance Invest 93 L

Jul 16, 2025

Florida East Coast On Alert Monitoring Tropical Disturbance Invest 93 L

Jul 16, 2025

Wisconsin Tornado Watch Alerts Expire Friday Cleanup Begins

Wisconsin Tornado Watch Alerts Expire Friday Cleanup Begins

1 Million Deposit Investigating Dr Buckinghams B And B Activities

1 Million Deposit Investigating Dr Buckinghams B And B Activities