CoreWeave (NASDAQ:CRWV): A Contrarian Investment Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (NASDAQ:CRWV): A Contrarian Investment Opportunity?

The recent volatility in the tech sector has left many investors searching for hidden gems. Could CoreWeave (NASDAQ:CRWV), a company specializing in GPU cloud computing, be one such opportunity? While its stock price has experienced some turbulence, a closer look reveals a compelling narrative for contrarian investors willing to navigate short-term market fluctuations. This article delves into the potential upside and downside risks, helping you determine if CoreWeave deserves a place in your portfolio.

Understanding CoreWeave's Business Model:

CoreWeave provides scalable GPU cloud computing infrastructure, primarily targeting the rapidly growing artificial intelligence (AI) and machine learning (ML) markets. This positions them strategically at the heart of a technological revolution. Instead of companies investing heavily in expensive, on-premise hardware and infrastructure, CoreWeave offers a pay-as-you-go model, allowing for greater flexibility and cost-efficiency. This is particularly appealing for businesses experimenting with AI and ML, needing significant computing power on a project-by-project basis.

The Bull Case for CoreWeave:

- High Growth Potential: The AI and ML markets are experiencing explosive growth, fueling demand for robust cloud computing resources like those offered by CoreWeave. This presents a significant opportunity for expansion and revenue generation.

- Strong Partnerships: CoreWeave boasts partnerships with major players in the technology industry, strengthening its market position and credibility. These partnerships often translate into increased access to clients and potential for co-development opportunities.

- Scalable Infrastructure: CoreWeave's infrastructure is designed for scalability, allowing them to adapt quickly to fluctuating demand. This is crucial in a dynamic market like AI, where computational needs can vary drastically.

- First-Mover Advantage: While the GPU cloud computing market is becoming increasingly competitive, CoreWeave has established itself as an early leader, giving it a valuable head start.

The Bear Case and Potential Risks:

- Competition: The GPU cloud computing landscape is getting crowded, with established players like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure entering the fray. This intense competition could put pressure on CoreWeave's pricing and market share.

- Dependence on a Few Key Clients: Concentrated client bases can expose a company to significant risk if a key client reduces its spending. Diversifying its client base is crucial for CoreWeave's long-term stability.

- Economic Downturn: A broader economic slowdown could impact spending on AI and ML projects, potentially reducing demand for CoreWeave's services.

- Valuation Concerns: Some investors express concerns about CoreWeave's current valuation relative to its revenue and profitability. This is a key factor to consider before investing.

Is CoreWeave a Contrarian Investment Opportunity?

CoreWeave presents a compelling case for contrarian investors willing to accept some risk. The company operates in a high-growth market with significant potential, and its scalable infrastructure and partnerships provide a strong foundation. However, the competitive landscape and economic uncertainties warrant careful consideration. A thorough due diligence process, including a review of financial statements and industry analysis, is crucial before making any investment decision.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Further Research: For more information, you can visit the CoreWeave investor relations website [link to CoreWeave investor relations page] and research articles from reputable financial news sources. Analyzing financial reports and comparing CoreWeave's performance to its competitors will also be beneficial in forming your own informed opinion.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (NASDAQ:CRWV): A Contrarian Investment Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Monitoring Invest 93 L Latest Spaghetti Models And Interactive Maps

Jul 16, 2025

Monitoring Invest 93 L Latest Spaghetti Models And Interactive Maps

Jul 16, 2025 -

Sources Cooper Flaggs Summer League Participation Concludes Prematurely

Jul 16, 2025

Sources Cooper Flaggs Summer League Participation Concludes Prematurely

Jul 16, 2025 -

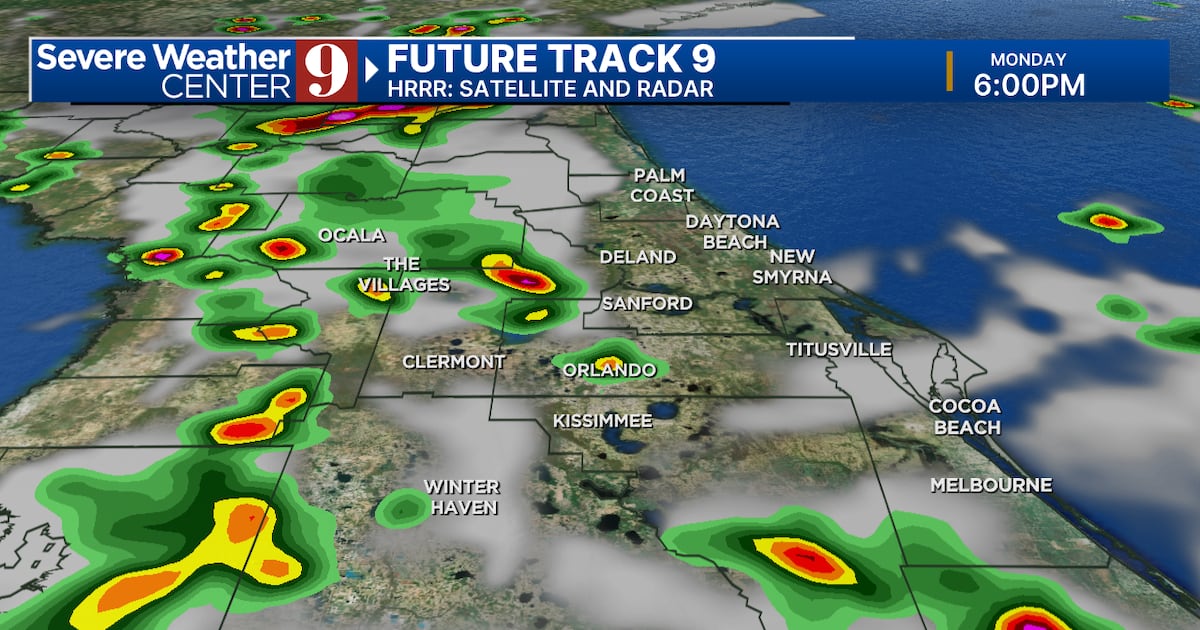

Central Florida Weather Heavy Rain And Thunderstorm Threat This Week

Jul 16, 2025

Central Florida Weather Heavy Rain And Thunderstorm Threat This Week

Jul 16, 2025 -

Van Gisbergen Continues Winning Run With Sonoma Triumph

Jul 16, 2025

Van Gisbergen Continues Winning Run With Sonoma Triumph

Jul 16, 2025 -

Severe Weather Impacts Central Florida Live Updates And Safety Information

Jul 16, 2025

Severe Weather Impacts Central Florida Live Updates And Safety Information

Jul 16, 2025