CoreWeave (CRWV) Stock Plunges After Core Scientific Merger News

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Stock Plunges After Core Scientific Merger News: What Went Wrong?

CoreWeave (CRWV), a prominent player in the rapidly expanding cloud computing market specializing in AI infrastructure, experienced a significant stock price drop following the announcement of its merger with bankrupt cryptocurrency mining firm, Core Scientific. This unexpected downturn has left investors questioning the long-term viability of the merger and the future trajectory of CRWV stock. This article delves into the reasons behind the plunge, analyzing the market reaction and exploring the potential implications for both CoreWeave and the broader AI infrastructure sector.

The Merger: A Risky Gamble?

The merger, initially presented as a strategic move to acquire Core Scientific's vast computing infrastructure, quickly faced skepticism from analysts and investors alike. While Core Scientific possesses significant computing power, its bankruptcy filing and history of financial instability raised serious concerns. Many questioned the wisdom of integrating such a troubled entity into a seemingly healthy and rapidly growing company like CoreWeave. The perceived risk associated with inheriting Core Scientific's debt and potential liabilities likely contributed significantly to the sell-off.

Market Reaction and Stock Price Decline:

The announcement triggered an immediate and sharp decline in CRWV's stock price. The market's negative response underscores the prevailing sentiment of uncertainty and apprehension surrounding the merger. Several factors likely contributed to this dramatic drop:

- Debt Burden: Core Scientific's substantial debt load is now a shared burden for CoreWeave, increasing the company's financial risk profile.

- Integration Challenges: The integration of two vastly different companies, one thriving and one struggling, presents considerable logistical and operational hurdles. Successful integration is crucial, and any missteps could further negatively impact the stock price.

- Dilution of Existing Shareholder Value: The terms of the merger could potentially dilute the value of existing CRWV shares, a major concern for current investors.

- Lack of Transparency: Some investors expressed concern over the lack of complete transparency regarding the merger's financial details and the potential long-term implications.

Analyzing the Long-Term Implications:

The long-term impact of this merger remains uncertain. While CoreWeave aims to leverage Core Scientific's infrastructure for its AI cloud computing services, the success hinges on several key factors:

- Successful Debt Restructuring: CoreWeave's ability to effectively manage and restructure Core Scientific's debt will significantly impact its financial health.

- Efficient Integration: Seamless integration of operations and technology is vital to avoid disruptions and maximize synergies.

- Market Demand: The continued growth and demand for AI computing services will be crucial for justifying the merger's strategic rationale.

What's Next for CoreWeave Investors?

Investors are now closely watching CoreWeave's actions and subsequent announcements. The company needs to provide clear communication regarding its integration strategy, debt management plans, and future financial projections to regain investor confidence. The success of the merger will ultimately determine whether the current stock price reflects a temporary setback or a more significant long-term challenge. Further analysis of the merger agreement and CoreWeave’s future financial performance will be critical in assessing the situation. This situation highlights the inherent risks involved in mergers and acquisitions, especially when involving financially distressed companies.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Stock Plunges After Core Scientific Merger News. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tense Euro 2025 Match France Edges Out Netherlands To Reach Quarterfinals

Jul 16, 2025

Tense Euro 2025 Match France Edges Out Netherlands To Reach Quarterfinals

Jul 16, 2025 -

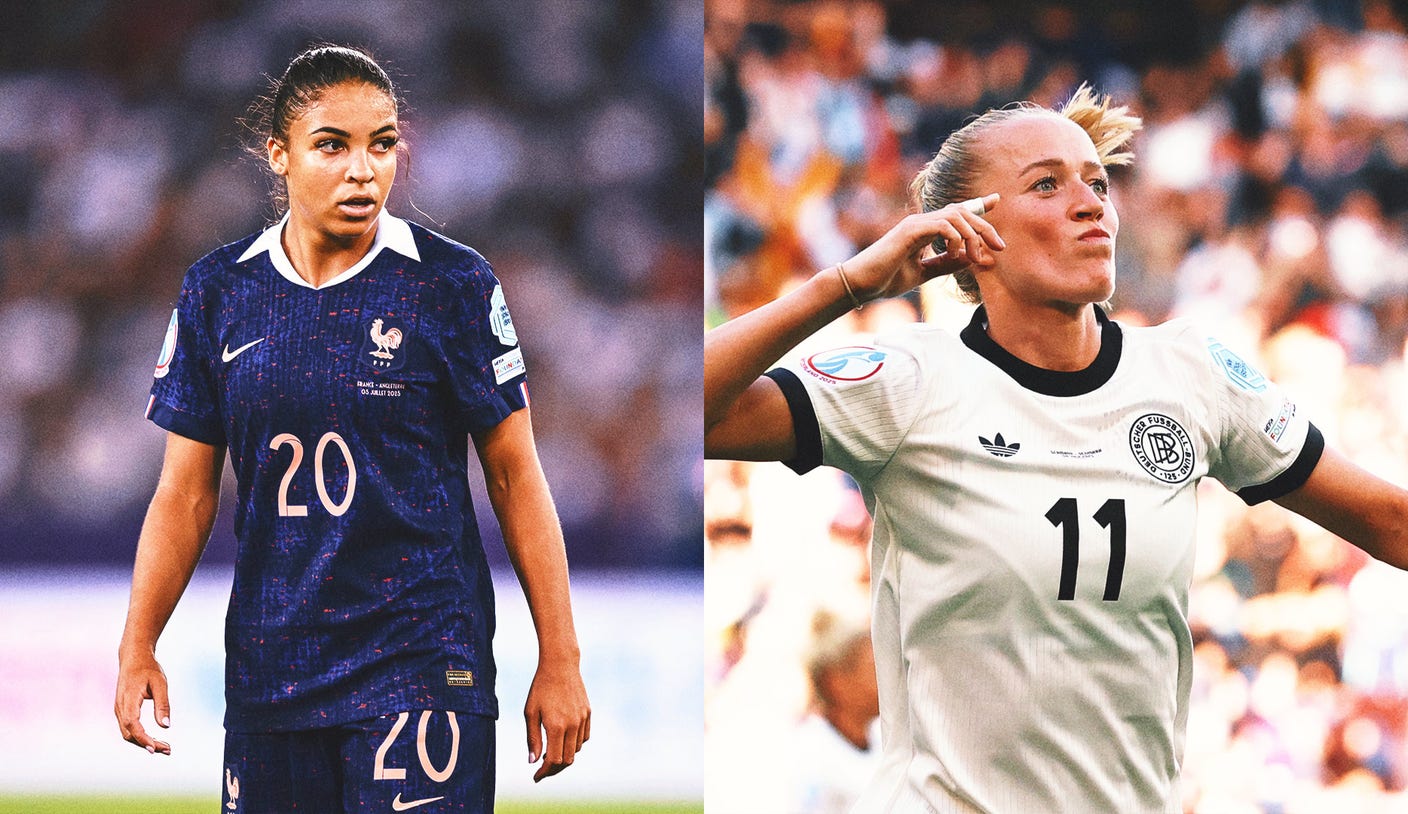

Uefa Womens Euro 2025 Analyzing The Crucial France Germany Quarterfinal

Jul 16, 2025

Uefa Womens Euro 2025 Analyzing The Crucial France Germany Quarterfinal

Jul 16, 2025 -

Mlb Draft 2024 Washington Nationals Draft Eli Willits No 1 Overall

Jul 16, 2025

Mlb Draft 2024 Washington Nationals Draft Eli Willits No 1 Overall

Jul 16, 2025 -

Bitcoin Hits Record High During Us Crypto Week A Comprehensive Overview

Jul 16, 2025

Bitcoin Hits Record High During Us Crypto Week A Comprehensive Overview

Jul 16, 2025 -

Immigrant Detention In Brooklyn Sparks Protest Demands For Release

Jul 16, 2025

Immigrant Detention In Brooklyn Sparks Protest Demands For Release

Jul 16, 2025