CoreWeave (CRWV) Shares Plummet Following Core Scientific Acquisition Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Shares Plunge After Core Scientific Acquisition News: What Investors Need to Know

CoreWeave (CRWV), a leading provider of cloud computing services specializing in artificial intelligence (AI) workloads, experienced a significant stock price drop following the announcement of its acquisition of certain assets from the bankrupt cryptocurrency mining firm, Core Scientific. This unexpected move has left many investors questioning the strategic rationale and long-term implications for the company. The news sent shockwaves through the market, raising concerns about the financial burden and potential integration challenges.

Understanding the Acquisition:

CoreWeave's acquisition primarily focuses on Core Scientific's substantial computing infrastructure, including a vast array of high-performance GPUs (Graphics Processing Units). This acquisition is strategically significant for CoreWeave, potentially bolstering its capacity to meet the growing demands of AI and high-performance computing (HPC). However, the market reacted negatively, primarily due to concerns about:

- Financial Strain: Integrating Core Scientific's assets will require significant capital investment, potentially impacting CoreWeave's profitability in the short term. The cost of acquisition, along with the ongoing operational expenses associated with managing the expanded infrastructure, are key concerns for investors.

- Integration Challenges: Merging two distinct organizations, each with its own operational structures and technological landscapes, presents significant integration hurdles. Successfully streamlining operations and optimizing performance across the combined entity will be crucial for CoreWeave's future success.

- Debt Burden: Core Scientific's bankruptcy proceedings have resulted in considerable debt. Assuming even a portion of this debt could further strain CoreWeave's financial position.

- Market Sentiment: The negative market reaction reflects investor apprehension about the perceived risks associated with this acquisition. The cryptocurrency mining sector's volatility and the overall uncertainty surrounding the deal contributed to the share price decline.

H2: Analyzing the Market Reaction:

The immediate aftermath of the announcement saw CRWV shares experience a sharp and significant drop. This reflects investor concerns outlined above. Several analysts have issued revised price targets, reflecting a more cautious outlook on the company's short-term prospects. The market's reaction highlights the inherent risks involved in acquisitions, particularly when dealing with assets from a bankrupt entity.

H2: Long-Term Implications and Potential Upside:

Despite the initial negative market reaction, some analysts believe the long-term potential of the acquisition remains positive. The acquisition of Core Scientific's infrastructure could significantly enhance CoreWeave's market position in the rapidly growing AI and HPC sectors. The access to additional GPU capacity positions CoreWeave to capture a larger share of the market, potentially offsetting the short-term financial challenges. The success of this strategy hinges on effective integration and efficient management of the acquired assets.

H2: What's Next for CoreWeave (CRWV)?

The coming weeks and months will be critical for CoreWeave. The company will need to demonstrate its ability to effectively integrate Core Scientific's assets, manage the associated financial burden, and reassure investors about its long-term growth prospects. Transparency regarding the integration process and financial performance will be crucial in restoring investor confidence. Investors will be closely monitoring the company's financial reports and strategic communications for updates on the acquisition's progress.

H2: Conclusion:

The acquisition of certain assets from Core Scientific presents both significant opportunities and challenges for CoreWeave. While the immediate market reaction was negative, the long-term implications remain uncertain. Careful monitoring of the company's performance and strategic decisions will be essential for investors navigating this period of uncertainty. Only time will tell whether this bold move will ultimately prove beneficial for CoreWeave. This situation underscores the inherent volatility within the technology sector and the importance of thorough due diligence before making investment decisions. Stay informed and consult with a financial advisor before making any investment decisions related to CRWV or other publicly traded companies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Shares Plummet Following Core Scientific Acquisition Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Crypto Week Bitcoins Record High And What It Means

Jul 16, 2025

Us Crypto Week Bitcoins Record High And What It Means

Jul 16, 2025 -

Lloyd Howell Jr Retains Nflpa Leaderships Confidence Despite Recent Allegations

Jul 16, 2025

Lloyd Howell Jr Retains Nflpa Leaderships Confidence Despite Recent Allegations

Jul 16, 2025 -

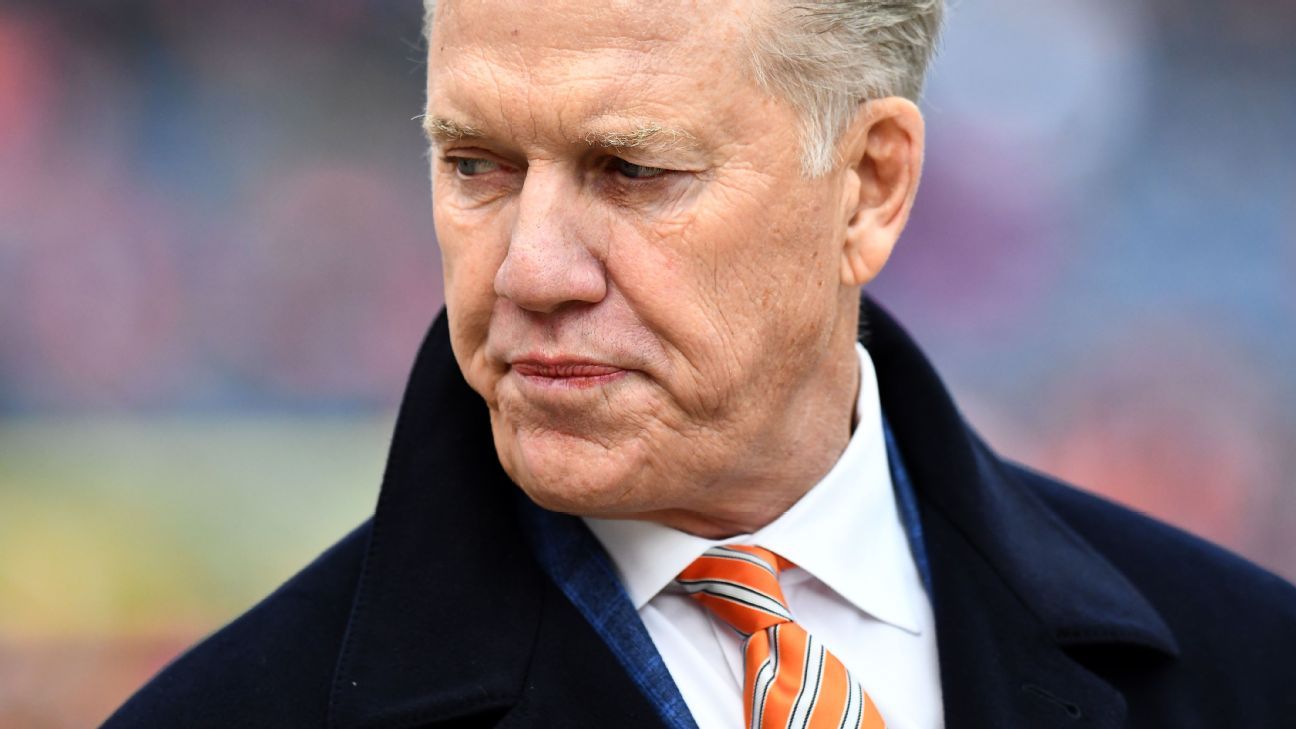

John Elways Former Agent Sheriff Investigates And Determines Cause Of Death

Jul 16, 2025

John Elways Former Agent Sheriff Investigates And Determines Cause Of Death

Jul 16, 2025 -

Alex Palou Dominates Iowa Solidifies Championship Position

Jul 16, 2025

Alex Palou Dominates Iowa Solidifies Championship Position

Jul 16, 2025 -

Broadway Barks 2025 Highlights Sunset Boulevards Special Appearance

Jul 16, 2025

Broadway Barks 2025 Highlights Sunset Boulevards Special Appearance

Jul 16, 2025

1 Million Deposit Investigating Dr Buckinghams B And B Activities

1 Million Deposit Investigating Dr Buckinghams B And B Activities