CoreWeave (CRWV): Analyzing The Recent Stock Drop And Future Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV): Deciphering the Recent Stock Drop and Exploring Future Potential

CoreWeave (CRWV), a leading provider of cloud computing infrastructure specializing in artificial intelligence (AI) and high-performance computing (HPC), has experienced a significant stock drop recently. This article delves into the potential reasons behind this downturn, analyzes the company's current standing, and explores its future prospects within the rapidly evolving landscape of AI and cloud computing.

The Recent Dip: Understanding the Market Volatility

CoreWeave's initial public offering (IPO) in August 2023 generated considerable excitement, but the stock price hasn't mirrored initial enthusiasm. Several factors likely contributed to the recent decline:

- Overall Market Sentiment: The broader tech sector has faced headwinds, with rising interest rates and concerns about economic growth impacting investor confidence. This macroeconomic climate negatively affects even high-growth companies like CoreWeave.

- Profitability Concerns: While CoreWeave is experiencing rapid revenue growth, it's currently operating at a loss. Investors often scrutinize profitability in publicly traded companies, especially during periods of economic uncertainty. This lack of immediate profitability may contribute to investor hesitancy.

- Increased Competition: The cloud computing market is fiercely competitive, with established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) constantly innovating. CoreWeave needs to demonstrate a clear competitive advantage to maintain market share and attract investors.

- Valuation Concerns: Some analysts argue CoreWeave's initial valuation was overly optimistic, leading to a correction as the market re-evaluates its true worth. This is a common phenomenon following high-profile IPOs.

CoreWeave's Strengths and Competitive Advantages

Despite the recent stock drop, CoreWeave possesses several key strengths:

- Focus on AI and HPC: The company's specialization in AI and HPC positions it ideally for the booming demand in these sectors. As AI applications continue to proliferate, the need for powerful, scalable computing resources will only increase.

- Strong Partnerships: CoreWeave has forged strategic partnerships with major technology players, enhancing its reach and credibility. These partnerships provide access to wider markets and resources.

- Innovative Technology: The company utilizes advanced technologies, including NVIDIA GPUs, to provide cutting-edge computing solutions. This technological prowess allows them to offer superior performance and efficiency.

- Experienced Leadership Team: CoreWeave boasts a leadership team with extensive experience in the cloud computing and technology industries. This expertise is crucial for navigating the complexities of the market and driving future growth.

Future Potential and Investment Considerations

The long-term potential for CoreWeave remains significant, given the explosive growth of the AI and HPC markets. However, investors should consider the following:

- Path to Profitability: CoreWeave's ability to achieve profitability will be a crucial factor in determining its future stock performance. Investors should closely monitor the company's financial reports and strategic initiatives aimed at improving margins.

- Competitive Landscape: The ongoing competition from established cloud providers poses a significant challenge. CoreWeave's success hinges on its ability to differentiate its services and maintain a competitive edge.

- Technological Advancements: Rapid technological advancements in the cloud computing industry necessitate continuous innovation. CoreWeave's ability to adapt and stay ahead of the curve will be essential for long-term growth.

Conclusion:

The recent decline in CoreWeave's stock price reflects a combination of market-wide factors and company-specific concerns. While challenges exist, the company's strong focus on the burgeoning AI and HPC markets, coupled with its innovative technology and experienced leadership team, presents substantial long-term growth potential. Investors should conduct thorough due diligence and carefully weigh the risks and rewards before making any investment decisions. The future success of CoreWeave ultimately depends on its ability to execute its business strategy effectively and navigate the dynamic landscape of the cloud computing industry. Keep an eye on CoreWeave's upcoming financial reports and industry announcements for further insights into its performance and future direction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV): Analyzing The Recent Stock Drop And Future Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Congressman Goldman Questions Ice Agreement To Hold Immigrants At Mdc Brooklyn

Jul 16, 2025

Congressman Goldman Questions Ice Agreement To Hold Immigrants At Mdc Brooklyn

Jul 16, 2025 -

9 Billion Merger Deal Core Weave Crwv Stock Suffers Sharp Decline

Jul 16, 2025

9 Billion Merger Deal Core Weave Crwv Stock Suffers Sharp Decline

Jul 16, 2025 -

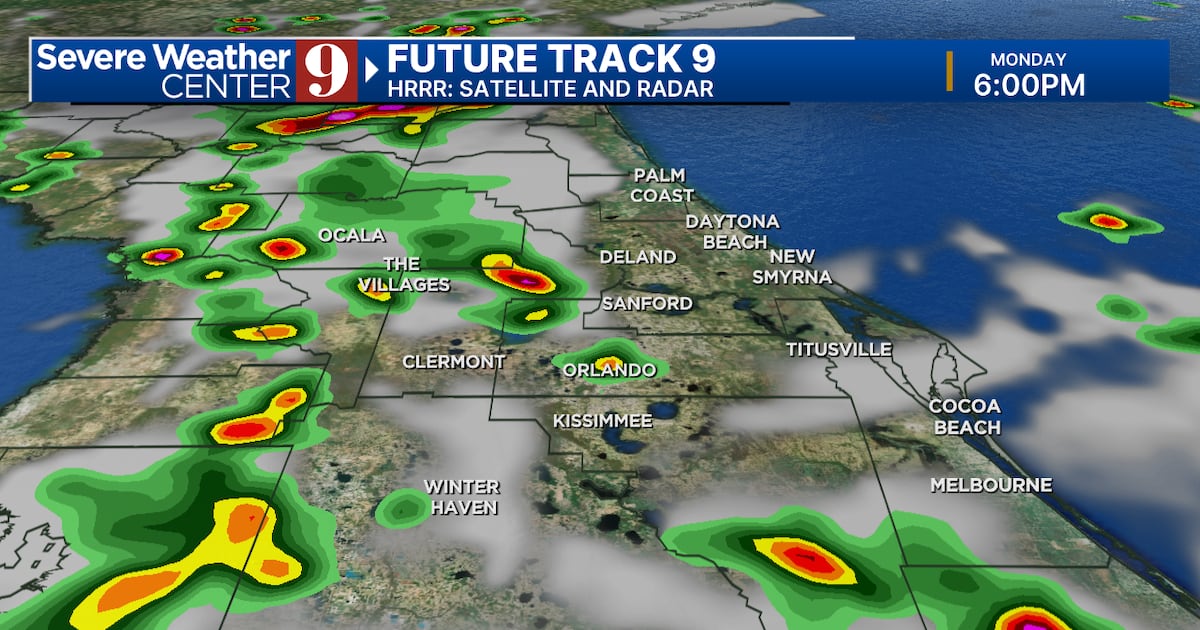

Central Florida Heavy Rain And Storms Expected Through Wednesday

Jul 16, 2025

Central Florida Heavy Rain And Storms Expected Through Wednesday

Jul 16, 2025 -

Chelseas Palmer Leads Upset Club World Cup Triumph Over Psg

Jul 16, 2025

Chelseas Palmer Leads Upset Club World Cup Triumph Over Psg

Jul 16, 2025 -

Tahoe Celebrity Golf Tournament Results Pavelski Takes Home The Trophy

Jul 16, 2025

Tahoe Celebrity Golf Tournament Results Pavelski Takes Home The Trophy

Jul 16, 2025

1 Million Deposit Investigating Dr Buckinghams B And B Activities

1 Million Deposit Investigating Dr Buckinghams B And B Activities