Carlyle's AlpInvest Raises $4.1 Billion For New Co-Investment Fund

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Carlyle's AlpInvest Raises $4.1 Billion for New Co-Investment Fund: A Giant Leap in Private Equity

Carlyle's AlpInvest Partners, a leading global private equity firm specializing in co-investments, has announced the successful closing of its latest fund, AlpInvest Partners X, with a staggering $4.1 billion in commitments. This marks a significant milestone for the firm and underscores the continued strong investor appetite for private equity co-investment strategies. The substantial capital raise positions AlpInvest for even greater success in the competitive landscape of private equity.

This monumental fundraising surpasses its predecessor, AlpInvest Partners IX, which closed on $3.1 billion in 2018. The increase reflects both the growth of the co-investment market and the sustained confidence investors have in AlpInvest’s proven track record.

What is a Co-Investment Strategy?

Before delving further into AlpInvest's success, let's clarify the core strategy. Co-investment in private equity involves investing alongside larger, established private equity firms in their target companies. This approach offers investors several key advantages:

- Reduced Management Fees: Co-investments generally have lower management fees compared to traditional private equity funds.

- Higher Potential Returns: While carrying the inherent risks associated with private equity, co-investments can offer the potential for superior returns.

- Diversification: A co-investment strategy allows for diversification across various asset classes and geographies.

- Access to Deal Flow: Investors gain access to a curated pipeline of high-quality investment opportunities typically unavailable to individual investors.

AlpInvest Partners has consistently demonstrated expertise in this arena, providing its investors with exposure to a diverse portfolio of promising companies across various sectors and regions.

AlpInvest Partners X: A Focus on Global Opportunities

AlpInvest Partners X will focus on a global range of opportunities, building upon the firm's established expertise and network. The fund intends to invest in later-stage private equity transactions, further solidifying its position in the market. This strategic focus on later-stage investments reflects a calculated approach to managing risk and maximizing returns.

The Implications of this Massive Raise

The successful closing of AlpInvest Partners X with $4.1 billion in commitments sends a powerful message to the private equity market. It signifies:

- Continued Investor Confidence in Private Equity: Despite economic uncertainties, investors remain confident in the long-term growth potential of private equity.

- The Growing Popularity of Co-Investment Strategies: Co-investment is increasingly seen as an attractive alternative to traditional private equity funds.

- AlpInvest's Strong Market Position: The firm's ability to raise such a significant amount of capital solidifies its leading position in the co-investment space.

This significant capital injection will allow AlpInvest to capitalize on attractive investment opportunities, further strengthening its portfolio and ultimately delivering strong returns to its investors. The fund’s success highlights the increasing importance of strategic partnerships and co-investment strategies in the evolving landscape of private equity.

The Future of AlpInvest and Co-Investment

The future looks bright for AlpInvest Partners. This substantial capital raise positions the firm for continued growth and leadership in the co-investment market. As investor interest in this strategy continues to rise, AlpInvest is well-positioned to remain at the forefront of this dynamic sector. We can expect to see further announcements and news regarding AlpInvest Partners X's investments in the coming months and years. This is a story to watch closely for those interested in private equity and global investment trends.

Keywords: AlpInvest, Carlyle, Co-Investment, Private Equity, Fund Raising, Investment, Finance, Global Investment, AlpInvest Partners X, $4.1 Billion, Private Equity Fund, Co-Investment Strategy

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Carlyle's AlpInvest Raises $4.1 Billion For New Co-Investment Fund. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

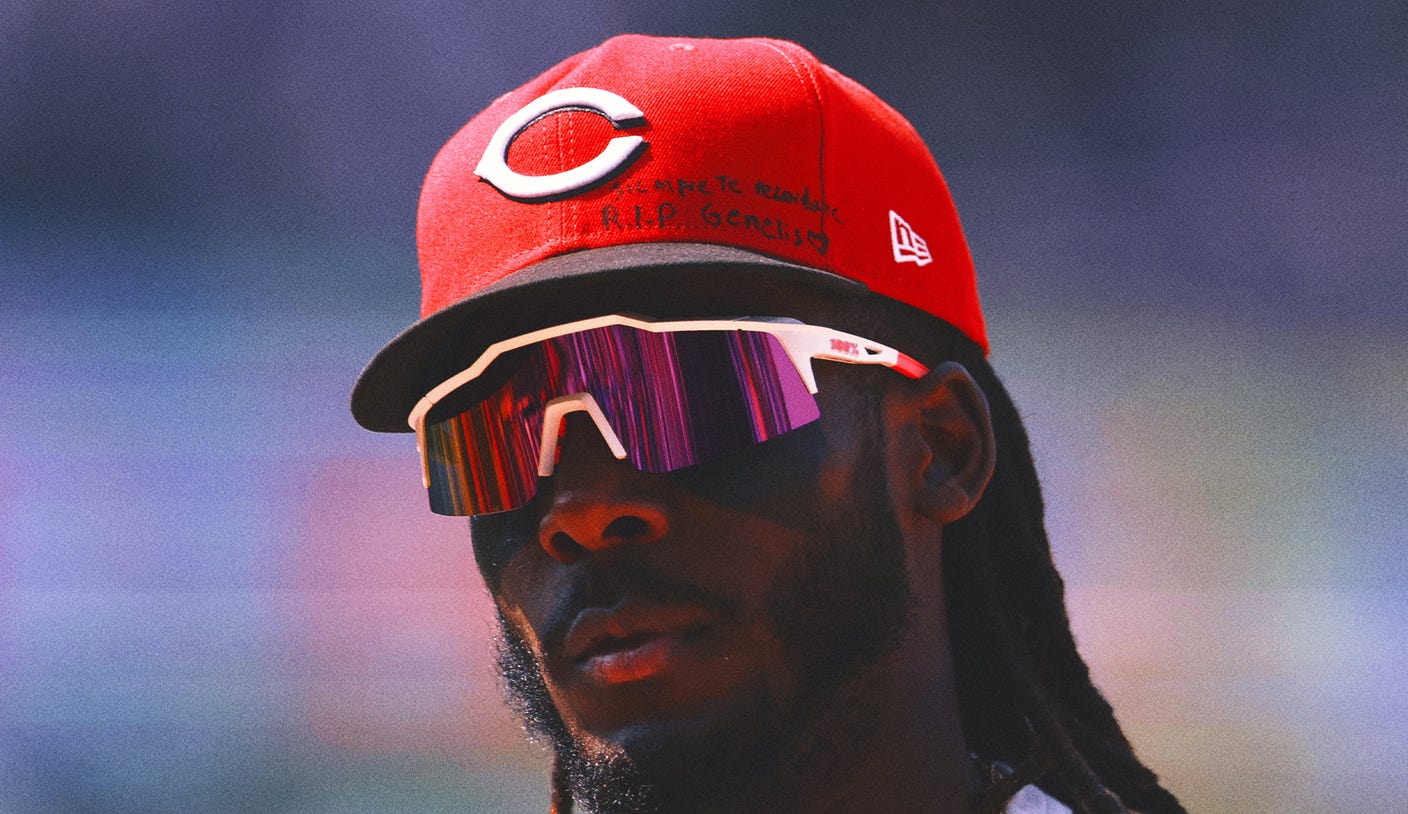

Cincinnati Reds Elly De La Cruz Home Run Following Sisters Passing

Jun 04, 2025

Cincinnati Reds Elly De La Cruz Home Run Following Sisters Passing

Jun 04, 2025 -

Injury Concerns Yankees To Place Luke Weaver On Il

Jun 04, 2025

Injury Concerns Yankees To Place Luke Weaver On Il

Jun 04, 2025 -

Cant Stop Watching Netflix Comedy Generates Significant Buzz

Jun 04, 2025

Cant Stop Watching Netflix Comedy Generates Significant Buzz

Jun 04, 2025 -

Verstappen Takes Blame Russell Crash Shouldnt Have Happened Spanish Gp Analysis

Jun 04, 2025

Verstappen Takes Blame Russell Crash Shouldnt Have Happened Spanish Gp Analysis

Jun 04, 2025 -

Espn Sources Bruno Fernandes Future Secured At Manchester United

Jun 04, 2025

Espn Sources Bruno Fernandes Future Secured At Manchester United

Jun 04, 2025