Cardano Price War: Retail Investors Vs. Whales

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cardano Price War: Retail Investors vs. Whales – A Battle for Dominance?

The cryptocurrency market is known for its volatility, but recent price fluctuations in Cardano (ADA) have sparked a fascinating, and arguably unsettling, debate: are retail investors battling it out with the so-called "whales" for control of ADA's price? This isn't just another market fluctuation; it's a potential paradigm shift in how we understand cryptocurrency market dynamics.

The recent price swings have left many asking: who’s really in charge? Is the price being manipulated, or is this simply a reflection of the inherent volatility within the crypto space? Let's delve into the complexities of this "price war" and explore the potential implications for ADA's future.

Understanding the Players:

-

Retail Investors: These are individual investors, often with smaller capital investments, who contribute significantly to overall trading volume. Their actions are often driven by sentiment, news cycles, and social media trends. They are considered less influential individually but collectively represent a considerable force.

-

Whales: These are large-scale investors holding massive amounts of ADA. Their trading activity can significantly impact price movements due to their sheer volume. Their actions can be less transparent, raising concerns about potential market manipulation. Identifying whales is difficult, but their influence is undeniable.

The Battleground: ADA Price Volatility

The recent price volatility in ADA highlights the potential conflict between these two groups. When whales sell large amounts of ADA, the price can plummet, potentially causing losses for retail investors. Conversely, large-scale buying by whales can drive the price up, benefiting both themselves and retail investors who bought at lower prices. This creates a dynamic tension, reminiscent of a price war.

Evidence Suggesting a Power Struggle:

While definitive proof of coordinated actions is difficult to obtain, several factors suggest a possible struggle between retail investors and whales:

- Sharp Price Swings: The sudden and dramatic price drops and surges observed in ADA's price are not always easily explained by typical market forces.

- Social Media Sentiment: Increased chatter on platforms like Twitter and Reddit about price manipulation often coincides with significant price movements.

- Lack of Transparency: The opaque nature of large cryptocurrency transactions makes it challenging to pinpoint the precise actors behind major price shifts.

The Implications for the Future of ADA:

The ongoing "price war" raises several critical questions about the future of Cardano:

- Long-Term Sustainability: Will the continuous tension between retail investors and whales create a volatile and unpredictable market that discourages long-term investment?

- Regulatory Scrutiny: Could this potential manipulation attract increased regulatory scrutiny from governments worldwide?

- Decentralization Concerns: If whales exert excessive influence, does this undermine the fundamental principles of decentralization that underpin cryptocurrencies like Cardano?

What Should Investors Do?

Navigating this turbulent landscape requires caution and informed decision-making:

- Diversification: Spread your investments across various cryptocurrencies and asset classes to mitigate risk.

- Fundamental Analysis: Focus on the underlying technology and development of Cardano, rather than solely relying on short-term price movements.

- Risk Management: Implement proper risk management strategies, including setting stop-loss orders.

- Stay Informed: Keep abreast of market developments and news related to Cardano and the broader cryptocurrency industry.

The Cardano price war is a complex issue with no easy answers. Understanding the dynamics at play, however, empowers investors to make more informed decisions and navigate the inherent volatility of the cryptocurrency market. This situation underscores the need for transparency and responsible investment practices within the crypto ecosystem. Only time will tell if this "price war" will ultimately benefit or hinder Cardano's long-term growth.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cardano Price War: Retail Investors Vs. Whales. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

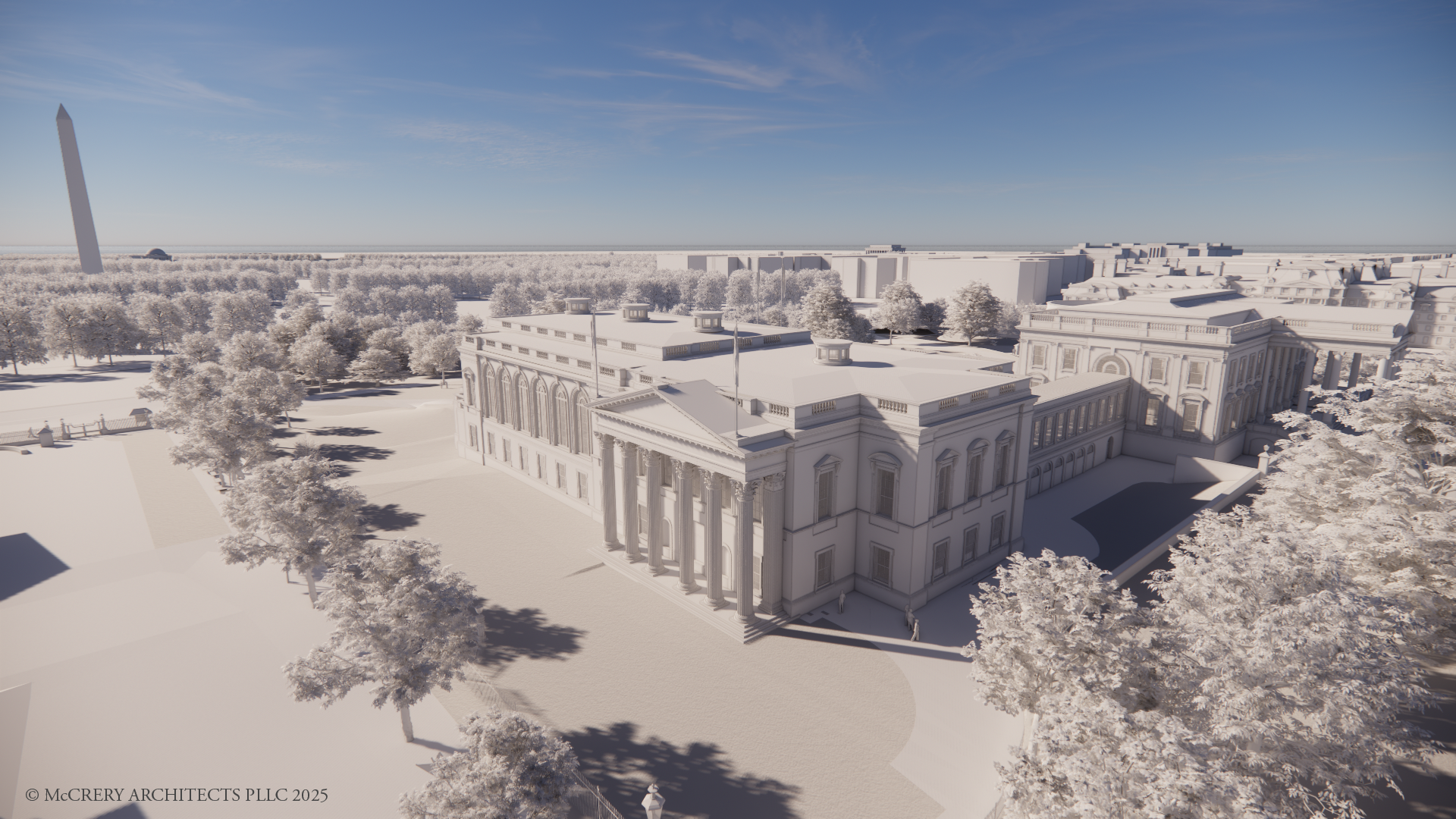

White House Ballroom Renovation Construction To Begin

Aug 04, 2025

White House Ballroom Renovation Construction To Begin

Aug 04, 2025 -

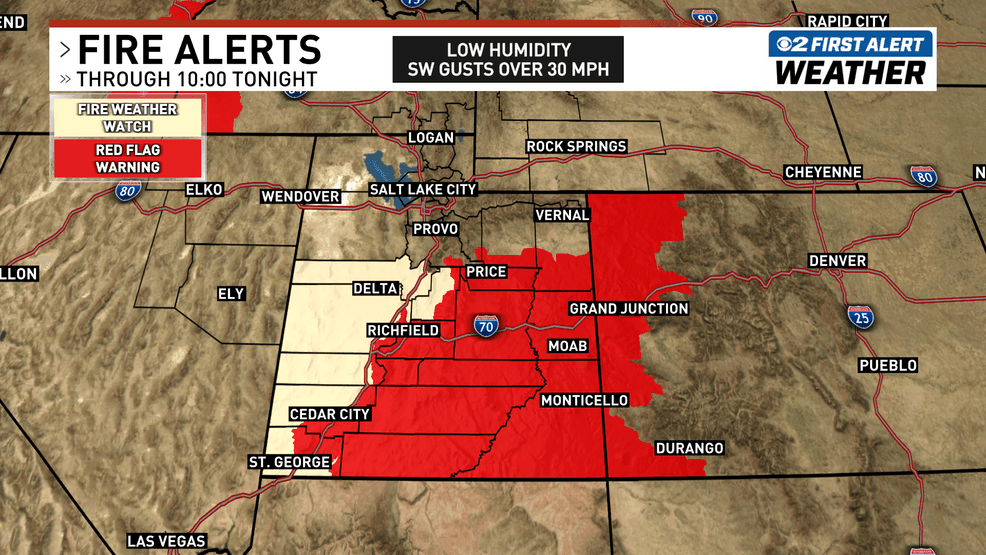

South Facing Utah At High Risk For Wildfires Amidst Thunderstorm Potential

Aug 04, 2025

South Facing Utah At High Risk For Wildfires Amidst Thunderstorm Potential

Aug 04, 2025 -

Brazil Wins Copa America Femenina Martas Heroics Seal Victory

Aug 04, 2025

Brazil Wins Copa America Femenina Martas Heroics Seal Victory

Aug 04, 2025 -

Amazon Mgms James Bond Steven Knight Takes The Helm

Aug 04, 2025

Amazon Mgms James Bond Steven Knight Takes The Helm

Aug 04, 2025 -

Alien Movie Timeline Explained Locating Alien Earth

Aug 04, 2025

Alien Movie Timeline Explained Locating Alien Earth

Aug 04, 2025

Latest Posts

-

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025

Leg Injury Forces Messi Out Of Inter Miamis League Cup Competition

Aug 04, 2025 -

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025

Bristol Motor Speedways Mlb Speedway Classic Suspended To Continue Sunday

Aug 04, 2025 -

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025

North Highlands Crash Woman Cyclist Injured Need For Bicycle Accident Attorney

Aug 04, 2025 -

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025

From Big Screen To Small Ridley Scotts Alien Gets A Tv Adaptation

Aug 04, 2025 -

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025

Jerry Jones Downplays Micah Parsons Trade Request Dont Lose Sleep

Aug 04, 2025