Car Finance Scandal: Redress Needed For Mis-sold Loans, Says The Guardian

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Car Finance Scandal: Urgent Call for Redress as Mis-sold Loans Plague Consumers

The Guardian's exposé on widespread mis-selling in the car finance industry has ignited a firestorm, leaving countless consumers demanding redress for predatory lending practices. The article highlights a systemic failure within the sector, urging immediate action to protect vulnerable borrowers and hold negligent lenders accountable. This isn't just another financial scandal; it's a crisis affecting millions, leaving them saddled with unaffordable debt and damaged credit scores.

The Scale of the Problem: Beyond the Headlines

The Guardian's investigation isn't the first to uncover malpractice in the car finance market. Numerous reports over the years have highlighted issues such as:

- Inflated interest rates: Borrowers are often trapped in high-interest loans, far exceeding market rates, making repayments unsustainable.

- Misleading advertising: Advertisements often downplay the true cost of borrowing, leading consumers into agreements they don't fully understand.

- Aggressive sales tactics: High-pressure sales environments, coupled with inadequate financial assessments, contribute to irresponsible lending.

- Lack of transparency: Complex loan agreements, riddled with jargon, make it difficult for borrowers to understand the terms and conditions.

This isn't simply a matter of a few rogue companies; the Guardian suggests a systemic problem demanding a comprehensive regulatory overhaul. The Financial Conduct Authority (FCA) has been criticized for its perceived slow response, prompting calls for a more robust and proactive approach to consumer protection.

Who is Affected? The Human Cost of Mis-selling

The victims of this car finance scandal are diverse, spanning various socioeconomic backgrounds. However, vulnerable individuals – those with poor credit scores, limited financial literacy, or facing financial hardship – are disproportionately affected. The consequences can be devastating:

- Debt spiraling: Unmanageable repayments lead to mounting debt, impacting credit ratings and potentially leading to repossession.

- Financial hardship: Struggling to meet loan repayments can cause significant stress and impact other aspects of life, including housing and healthcare.

- Damaged credit rating: Defaulting on loans leaves a lasting negative mark on credit history, making it difficult to access future credit.

What Can Be Done? The Path to Redress

The Guardian's call for redress is not just a plea; it's a necessary step to rectify the injustice suffered by countless borrowers. Several avenues are being explored to help affected individuals:

- Filing complaints with the FCA: The FCA is the primary regulatory body responsible for addressing complaints about mis-selling. Consumers should thoroughly document their experiences and file formal complaints. [Link to FCA website]

- Seeking legal advice: Individuals may consider seeking legal counsel to explore options for reclaiming mis-sold loans. A solicitor specializing in consumer rights can assess the merits of their case.

- Supporting consumer advocacy groups: Organizations dedicated to consumer rights can provide valuable support and guidance to those affected. [Link to relevant consumer advocacy group]

The Future of Car Finance: Preventing Future Scandals

This scandal highlights the urgent need for greater transparency and regulation in the car finance industry. Strengthened consumer protection laws, stricter enforcement of existing regulations, and improved financial literacy initiatives are crucial steps to prevent similar incidents from occurring in the future. The industry needs a fundamental shift in culture, prioritizing ethical lending practices over profit maximization. Only through collective action – from regulators, lenders, and consumers themselves – can we build a fairer and more responsible car finance market.

Call to Action: Share this article to raise awareness of this crucial issue and help those affected find the support they need. If you've been affected by mis-selling in the car finance industry, please share your story in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Car Finance Scandal: Redress Needed For Mis-sold Loans, Says The Guardian. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bicycle Accident Attorney Needed Woman Seriously Injured In North Highlands

Aug 05, 2025

Bicycle Accident Attorney Needed Woman Seriously Injured In North Highlands

Aug 05, 2025 -

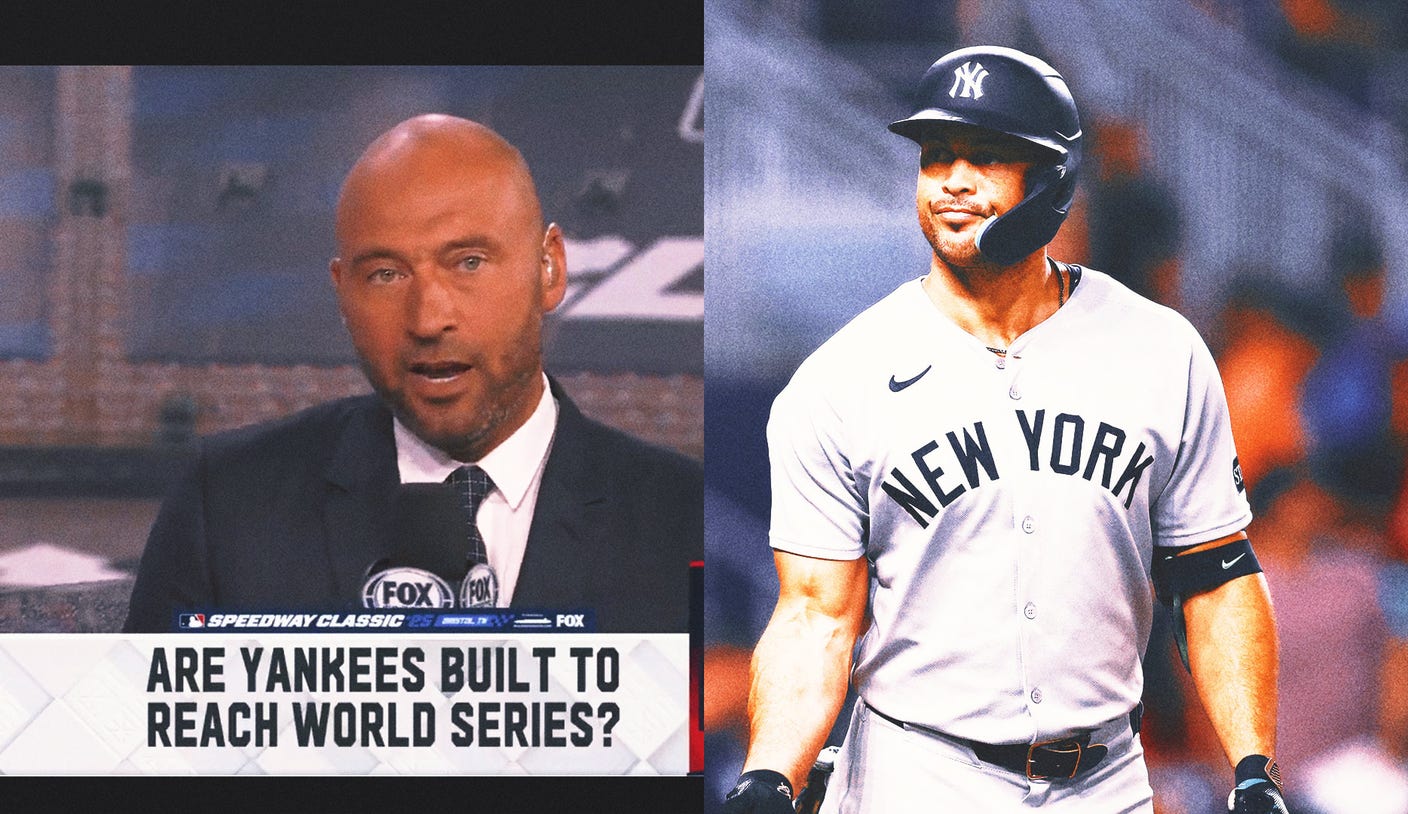

Yankees Struggles Jeter Points To Excessive Errors

Aug 05, 2025

Yankees Struggles Jeter Points To Excessive Errors

Aug 05, 2025 -

North Carolina Motorcycle Crash Your Guide To Finding The Right Legal Representation

Aug 05, 2025

North Carolina Motorcycle Crash Your Guide To Finding The Right Legal Representation

Aug 05, 2025 -

Witkoffs Moscow Mission Us Envoys Wednesday Talks

Aug 05, 2025

Witkoffs Moscow Mission Us Envoys Wednesday Talks

Aug 05, 2025 -

Lionel Messis Leg Injury Impact On Inter Miamis League Cup Campaign

Aug 05, 2025

Lionel Messis Leg Injury Impact On Inter Miamis League Cup Campaign

Aug 05, 2025

Latest Posts

-

No Charges Filed Denzel Perryman Released After Arrest

Aug 06, 2025

No Charges Filed Denzel Perryman Released After Arrest

Aug 06, 2025 -

Analyst Nick Wright Slams Jerry Jones Approach To Micah Parsons Contract Negotiations

Aug 06, 2025

Analyst Nick Wright Slams Jerry Jones Approach To Micah Parsons Contract Negotiations

Aug 06, 2025 -

Cancer Battle Doesnt Stop Guardians Pitcher Nic Enrights First Save

Aug 06, 2025

Cancer Battle Doesnt Stop Guardians Pitcher Nic Enrights First Save

Aug 06, 2025 -

Denzel Perryman Released From Custody Charges Dropped

Aug 06, 2025

Denzel Perryman Released From Custody Charges Dropped

Aug 06, 2025 -

Guardians Reliever Nic Enrights First Save Amidst Lymphoma Battle

Aug 06, 2025

Guardians Reliever Nic Enrights First Save Amidst Lymphoma Battle

Aug 06, 2025