Capitalize On The Dip: 2 Promising S&P 500 Stocks To Consider Now

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Capitalize on the Dip: 2 Promising S&P 500 Stocks to Consider Now

The market's recent volatility has left many investors wondering where to turn. While uncertainty remains a constant companion in the world of finance, savvy investors see dips as opportunities. Instead of panicking, now might be the perfect time to capitalize on discounted prices and add strong performers to your portfolio. Today, we highlight two promising S&P 500 stocks that are showing resilience and potential for significant growth, even amidst current market fluctuations.

Understanding the Current Market Landscape

Before diving into specific stocks, it's crucial to understand the current economic climate. Inflation, interest rate hikes, and geopolitical tensions are all contributing factors to the market's recent downturn. However, history has repeatedly shown that market corrections are a normal part of the cycle, and often present excellent buying opportunities for long-term investors. [Link to reputable financial news source discussing current market trends]

Stock Pick #1: [Company Name A] (Ticker Symbol: [Ticker Symbol A])

[Company Name A] is a [briefly describe the company's industry and business model, e.g., leading technology company specializing in cloud-based solutions]. Despite the broader market downturn, [Company Name A] has demonstrated [mention positive recent performance indicators, e.g., strong earnings reports, positive revenue growth, innovative product launches].

- Reasons for optimism:

- Strong fundamentals: [Company Name A] boasts a solid balance sheet and consistent profitability.

- Growth potential: The company is well-positioned to benefit from [mention specific market trends driving growth, e.g., increasing demand for cloud services, expansion into new markets].

- Competitive advantage: [Mention key competitive advantages, e.g., proprietary technology, strong brand recognition].

[Include a concise chart or graph showing the stock's performance over the past year, highlighting the recent dip and potential for recovery.]

Stock Pick #2: [Company Name B] (Ticker Symbol: [Ticker Symbol B])

[Company Name B] operates in the [briefly describe the company's industry and business model, e.g., consumer staples sector, providing essential goods and services]. This sector is often considered more defensive during economic downturns, making [Company Name B] a potentially attractive option for risk-averse investors. Recent developments, such as [mention positive news, e.g., successful product launch, strategic partnership], suggest a promising outlook.

- Reasons for optimism:

- Defensive sector: The company's position in the [mention sector] provides a degree of protection against market volatility.

- Consistent dividends: [Company Name B] offers a [mention dividend yield percentage]% dividend yield, providing a steady income stream for investors.

- Long-term growth prospects: The company is actively investing in [mention initiatives driving long-term growth, e.g., research and development, expansion into new markets].

[Include a concise chart or graph showing the stock's performance over the past year, highlighting the recent dip and potential for recovery.]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Call to Action: Ready to explore these opportunities further? Do your own due diligence and consider adding these promising stocks to your watchlist. Remember to diversify your portfolio and invest according to your risk tolerance.

Keywords: S&P 500 stocks, stock market dip, investment opportunities, market correction, [Company Name A], [Ticker Symbol A], [Company Name B], [Ticker Symbol B], stock market investing, long-term investing, dividend stocks, growth stocks, defensive stocks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Capitalize On The Dip: 2 Promising S&P 500 Stocks To Consider Now. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Navigating The Future A Dire Warning From Google Deep Minds Ceo To Students

May 28, 2025

Navigating The Future A Dire Warning From Google Deep Minds Ceo To Students

May 28, 2025 -

French Open 2024 Jasmine Paolini Details Her First Round Worry

May 28, 2025

French Open 2024 Jasmine Paolini Details Her First Round Worry

May 28, 2025 -

Better For Spectators Roland Garros Explains Night Session Scheduling Strategy

May 28, 2025

Better For Spectators Roland Garros Explains Night Session Scheduling Strategy

May 28, 2025 -

Il Bayer Leverkusen E La Scommessa Ten Hag Un Analisi Tattica E Strategica

May 28, 2025

Il Bayer Leverkusen E La Scommessa Ten Hag Un Analisi Tattica E Strategica

May 28, 2025 -

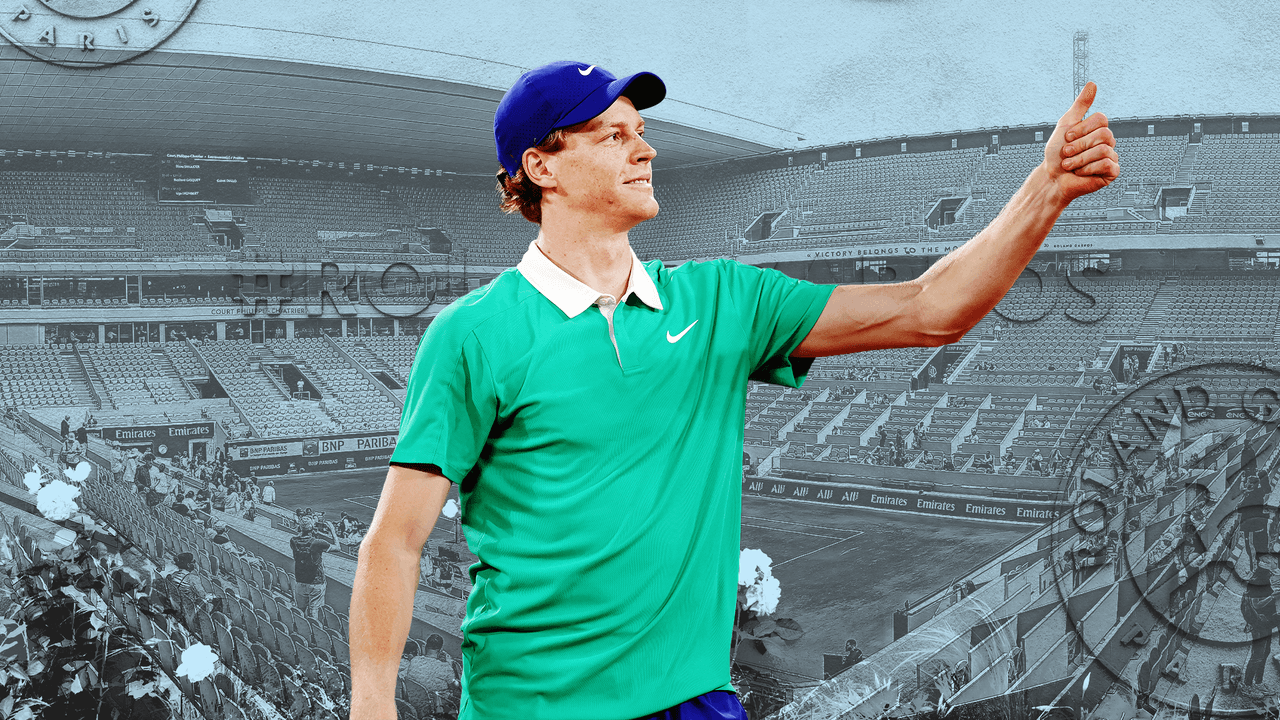

Roland Garros 2025 Streaming Di Tutte Le Partite Di Sinner Contro Gasquet E Altri

May 28, 2025

Roland Garros 2025 Streaming Di Tutte Le Partite Di Sinner Contro Gasquet E Altri

May 28, 2025