Can Snap Stock Recover From Its 90% Fall In 2025?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Snap Stock Recover From its 90% Fall in 2025? A Deep Dive into the Future of SNAP

Snap Inc. (SNAP), the parent company of the popular social media app Snapchat, has experienced significant volatility in its stock price. While a 90% fall by 2025 is a hypothetical extreme scenario, the possibility of substantial further decline warrants serious consideration. This article delves into the potential factors contributing to such a drastic drop and explores the chances of a recovery.

The Hypothetical 90% Drop: Unpacking the Potential Causes

A 90% decline in Snap's stock price by 2025 would signify a catastrophic loss of investor confidence. Several factors could contribute to such a scenario:

-

Increased Competition: The social media landscape is fiercely competitive. TikTok's explosive growth, Instagram's persistent dominance, and the emergence of new platforms constantly challenge Snapchat's user base and market share. Failure to innovate and adapt could lead to significant user attrition and revenue loss.

-

Advertising Revenue Slump: Snap heavily relies on advertising revenue. A significant downturn in the global advertising market, perhaps triggered by a recession or changes in digital advertising strategies, could severely impact Snap's financial performance.

-

Privacy Concerns and Regulatory Scrutiny: Growing concerns about data privacy and increasing regulatory scrutiny regarding user data collection and usage could negatively affect Snap's user base and its ability to monetize its platform effectively. Heavy fines or limitations on data collection could cripple the company.

-

Failed Innovation and Product Development: Snap's future hinges on its ability to innovate and introduce engaging new features. Failure to keep up with evolving user preferences and technological advancements could lead to user decline and a subsequent drop in stock value.

-

Macroeconomic Factors: Global economic instability, inflation, and geopolitical events can significantly impact investor sentiment and lead to a broader market downturn affecting even seemingly robust companies like Snap.

Can Snap Recover? A Look at Potential Scenarios

While a 90% drop represents a severe downturn, a complete recovery isn't impossible. However, it would depend on several key factors:

-

Successful Pivoting and Innovation: If Snap can successfully adapt to the changing digital landscape, introducing innovative features and effectively competing against rivals, it could regain lost ground. This includes focusing on areas like augmented reality (AR) technology, where it has a potential advantage.

-

Strategic Acquisitions and Partnerships: Strategic acquisitions of smaller companies with complementary technologies or forming beneficial partnerships could broaden Snap's reach and capabilities.

-

Improved Monetization Strategies: Refining its advertising strategies to better target audiences and increase revenue per user would be crucial for financial stability. Exploring new revenue streams beyond advertising could also prove beneficial.

-

Restoring Investor Confidence: Transparency, clear communication, and demonstrable progress in addressing the challenges mentioned above are crucial for restoring investor trust and attracting new investment.

Conclusion: A Long Road to Recovery

A 90% drop in Snap's stock price by 2025 is a highly pessimistic, but not entirely unrealistic, scenario. The company faces significant challenges, but also possesses potential strengths. Its recovery would depend on its capacity for innovation, adaptation, and strategic decision-making. Investors should carefully monitor Snap's performance, focusing on key metrics like user growth, advertising revenue, and product development, before making any investment decisions. The road to recovery, if it happens, would be long and arduous. The coming years will be critical in determining the future trajectory of SNAP stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and past performance is not indicative of future results. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Snap Stock Recover From Its 90% Fall In 2025?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rome Wasnt Built In A Day Mc Carthys Plea For Calm Amidst Harambee Stars Progress

Jun 11, 2025

Rome Wasnt Built In A Day Mc Carthys Plea For Calm Amidst Harambee Stars Progress

Jun 11, 2025 -

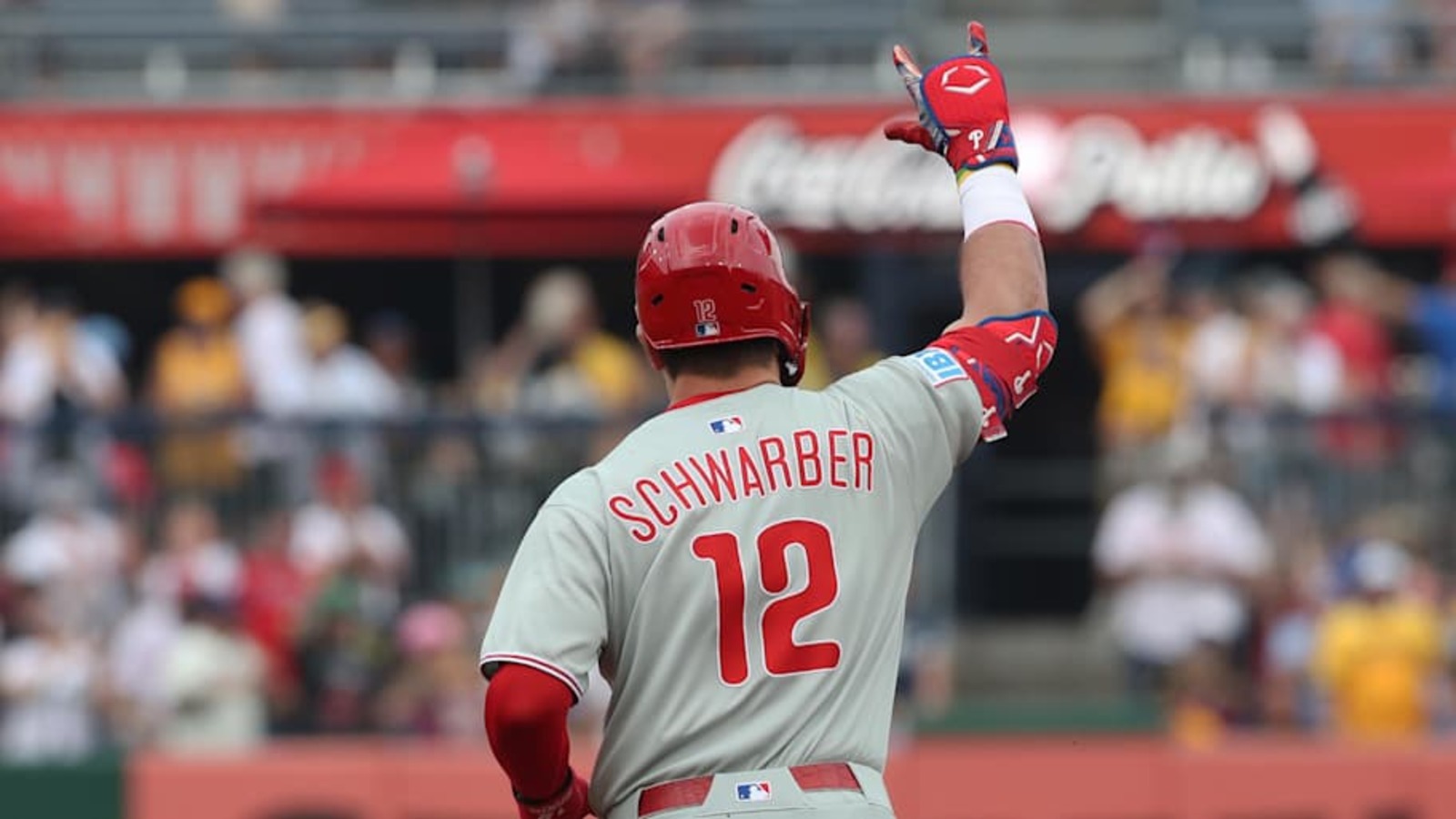

Phillies All Star Projection Only One Hitter Makes The Cut

Jun 11, 2025

Phillies All Star Projection Only One Hitter Makes The Cut

Jun 11, 2025 -

Bills Sean Mc Dermott Impressed By James Cooks Minicamp Participation

Jun 11, 2025

Bills Sean Mc Dermott Impressed By James Cooks Minicamp Participation

Jun 11, 2025 -

Wander Francos Gun Possession Arrest Latest Updates From The Dominican Republic

Jun 11, 2025

Wander Francos Gun Possession Arrest Latest Updates From The Dominican Republic

Jun 11, 2025 -

Saudi Arabia Faces Near Impossible World Cup Qualifier Against Australia

Jun 11, 2025

Saudi Arabia Faces Near Impossible World Cup Qualifier Against Australia

Jun 11, 2025