Can Snap Stock Rebound After A 90% Drop? 2025 Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Snap Stock Rebound After a 90% Drop? 2025 Outlook

Snap Inc. (SNAP), the parent company of the popular photo-sharing app Snapchat, has experienced a dramatic downturn in its stock price, plummeting by approximately 90% from its all-time high. This significant decline has left investors questioning the platform's future and the potential for a rebound. Can Snap stock recover, and what does the 2025 outlook hold? Let's delve into the factors influencing Snap's performance and explore the possibilities.

The Fall from Grace: Understanding Snap's Stock Decline

Several factors contributed to Snap's steep decline. The initial public offering (IPO) in 2017, while highly anticipated, was followed by a period of inconsistent growth. Increased competition from established social media giants like Meta (Facebook) and TikTok, coupled with challenges in monetizing its user base, significantly impacted investor confidence. Furthermore, macroeconomic headwinds, including inflation and a slowing global economy, have further dampened investor sentiment towards growth stocks like Snap. The company's struggles to effectively navigate the evolving digital advertising landscape also played a crucial role in its stock's underperformance.

Analyzing the Current Situation: Headwinds and Tailwinds

While the challenges are undeniable, several factors could potentially contribute to a Snap stock rebound. The company's continued focus on augmented reality (AR) technology represents a significant long-term opportunity. AR is poised for explosive growth, and Snap's early adoption and innovative features in this space could provide a competitive edge. Furthermore, Snapchat's massive user base, particularly among younger demographics, represents a valuable asset for advertisers. If Snap can successfully improve its ad targeting and monetization strategies, it could significantly boost its revenue and profitability.

Key Factors to Watch in 2024 and Beyond

- Advertising Revenue Growth: Snap's ability to generate consistent advertising revenue growth is paramount for its stock price recovery. Success will hinge on its capacity to innovate and attract advertisers in a competitive landscape.

- AR Technology Advancement: Continued investment and innovation in AR technology are vital for Snap's long-term success and potential for differentiation. Groundbreaking AR features could attract new users and solidify its position in the market.

- Improved User Engagement: Maintaining and enhancing user engagement is crucial. New features, improvements to the user experience, and effective content moderation strategies are essential for attracting and retaining users.

- Cost Management and Profitability: Improving efficiency and reducing costs will be critical for demonstrating profitability to investors. A clear path to profitability will instill greater confidence in Snap's long-term viability.

The 2025 Outlook: A Cautious Optimism

Predicting the future of any stock is inherently speculative, but considering the factors above, the 2025 outlook for Snap stock presents a cautious optimism. A significant rebound in 2025 hinges on the company's success in overcoming its current challenges and capitalizing on its growth opportunities. A focus on profitability, innovative AR technology, and improved advertising revenue generation will be key drivers of any potential recovery.

Conclusion: Investment Considerations

Investing in Snap stock remains inherently risky. The company faces significant challenges, and its future performance is not guaranteed. However, the potential for long-term growth in the AR space and a large user base present an opportunity for investors with a higher risk tolerance and a long-term perspective. Before investing, it's crucial to conduct thorough research and consider consulting with a financial advisor. Remember, past performance is not indicative of future results. This analysis is for informational purposes only and should not be considered financial advice.

(Note: This article includes relevant keywords such as "Snap stock," "Snapchat," "AR technology," "stock price," "IPO," "2025 outlook," etc., naturally woven into the text for SEO purposes.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Snap Stock Rebound After A 90% Drop? 2025 Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Earthquake Off California Coast Raises Serious Tsunami Concerns

Jun 10, 2025

Earthquake Off California Coast Raises Serious Tsunami Concerns

Jun 10, 2025 -

Tsunami Threat To California Assessing Potential Casualties And Damage

Jun 10, 2025

Tsunami Threat To California Assessing Potential Casualties And Damage

Jun 10, 2025 -

Report Cooper Flagg Duke Star Gets Private Workout From Dallas Mavericks

Jun 10, 2025

Report Cooper Flagg Duke Star Gets Private Workout From Dallas Mavericks

Jun 10, 2025 -

Ex Bengals Linebacker Making A Case For Denver

Jun 10, 2025

Ex Bengals Linebacker Making A Case For Denver

Jun 10, 2025 -

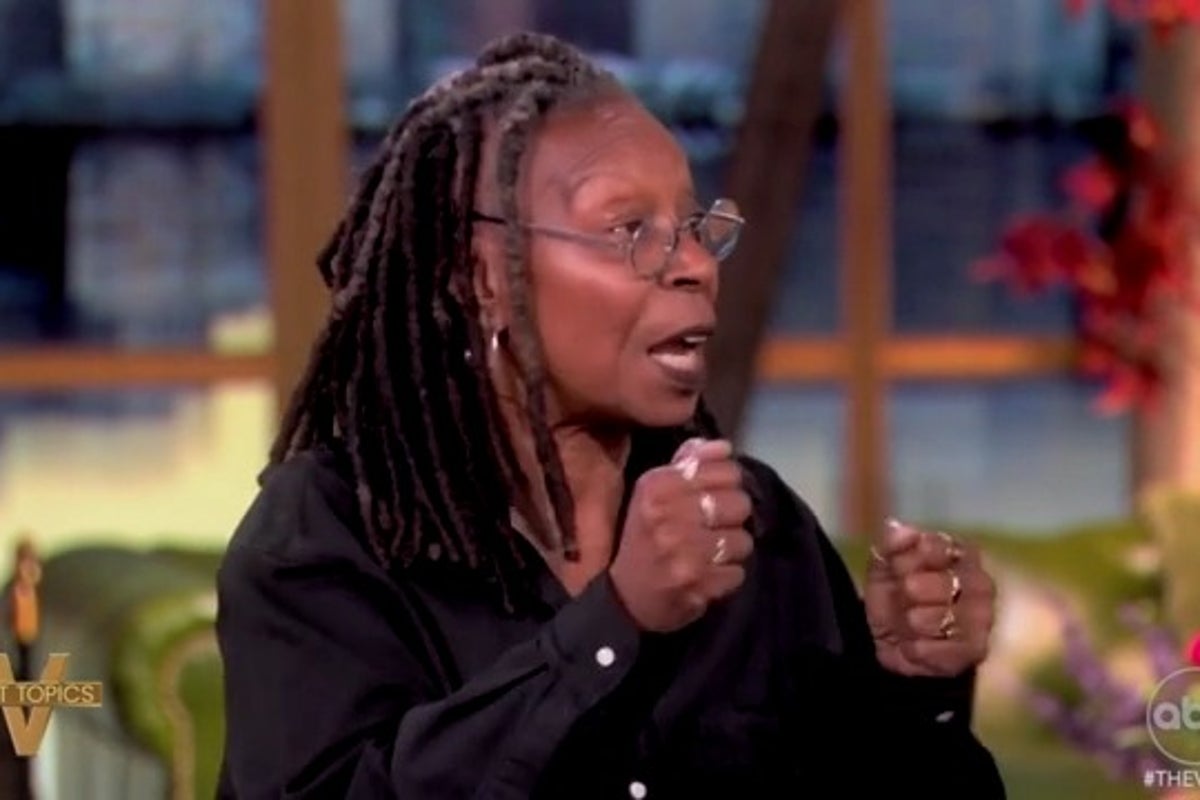

Whoopi Goldbergs Skepticism Of Elon Musk And Donald Trumps Breakup Sparks The View Controversy

Jun 10, 2025

Whoopi Goldbergs Skepticism Of Elon Musk And Donald Trumps Breakup Sparks The View Controversy

Jun 10, 2025