Can Snap Inc. Stock Rebound After A 90% Drop? 2025 Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Snap Inc. Stock Rebound After a 90% Drop? 2025 Outlook

Snap Inc. (SNAP), the parent company of the popular social media app Snapchat, has experienced a dramatic downturn, with its stock price plummeting by approximately 90% from its all-time high. This significant decline has left many investors wondering: can Snap stock rebound, and what does the future hold for the company by 2025? This article delves into the factors contributing to Snap's struggles, analyzes potential catalysts for a recovery, and offers a cautious outlook for 2025.

The Downward Spiral: What Went Wrong for Snap?

Several factors contributed to Snap's precipitous fall. The initial public offering (IPO) in 2017, while highly anticipated, ultimately disappointed investors. Subsequent challenges included:

- Increased Competition: The social media landscape is fiercely competitive. TikTok's explosive growth, particularly among younger demographics, significantly impacted Snapchat's user engagement and advertising revenue. Instagram, with its ever-expanding features, also poses a formidable threat.

- Advertising Revenue Slowdown: Economic uncertainty and a shift in digital advertising spending have negatively affected Snap's primary revenue stream. Advertisers are becoming more cautious, impacting the company's bottom line.

- Privacy Concerns: Growing concerns about data privacy and user data security have impacted the trust users place in social media platforms, affecting Snap's user growth and overall perception.

- Management Challenges: While Snap has made efforts to diversify its revenue streams, including exploring augmented reality (AR) technologies, the transition hasn't been seamless, and management decisions have faced scrutiny.

Potential Catalysts for a Snap Stock Rebound:

Despite the challenges, several factors could potentially trigger a Snap stock rebound:

- Innovation in AR Technology: Snap's investment in augmented reality could pay off. If the company can successfully integrate AR into its platform in a way that attracts users and advertisers, this could be a significant driver of growth. The potential of AR in e-commerce and advertising is vast.

- Improved User Engagement: Strategies aimed at boosting user engagement, including new features and content formats, could attract users back to the platform. This, in turn, could lead to increased advertising revenue.

- Economic Recovery: A stronger global economy would likely benefit Snap, as advertisers would be more inclined to increase their spending.

- Strategic Partnerships: Collaborations with other companies could help Snap expand its reach and diversify its revenue streams.

2025 Outlook: A Cautious Prediction

Predicting the future of any stock is inherently risky, and Snap is no exception. While a complete rebound to its all-time high by 2025 seems unlikely given the current landscape, a partial recovery is possible. However, this depends significantly on Snap's ability to execute its strategic initiatives successfully, navigate the competitive landscape, and adapt to changing market conditions. A sustained increase in advertising revenue and demonstrable progress in AR technology are crucial for a significant stock price appreciation.

Investor Considerations:

Investors considering Snap stock should conduct thorough due diligence and carefully assess the risks involved. The company's financial performance, competitive landscape, and future strategic direction should be closely monitored. Remember, past performance is not indicative of future results.

Disclaimer: This article provides information for educational purposes only and is not financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: Snap Inc., SNAP stock, Snapchat, stock market, social media, stock price, investment, augmented reality, AR technology, TikTok, Instagram, advertising revenue, 2025 outlook, stock rebound, financial analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Snap Inc. Stock Rebound After A 90% Drop? 2025 Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mpetshi Perricard Falls To Safiullins Deceptive Lob In Stuttgart 2025

Jun 10, 2025

Mpetshi Perricard Falls To Safiullins Deceptive Lob In Stuttgart 2025

Jun 10, 2025 -

Diablo Canyon Nuclear Plant Examining Pg And Es Fee For Continued Operation

Jun 10, 2025

Diablo Canyon Nuclear Plant Examining Pg And Es Fee For Continued Operation

Jun 10, 2025 -

Is A Tottenham Return On The Cards For Usmnt Manager Pochettino

Jun 10, 2025

Is A Tottenham Return On The Cards For Usmnt Manager Pochettino

Jun 10, 2025 -

Merab Dvalishvilis Ground Game Triumphs Ufc 316 Submission Win Over Sean O Malley

Jun 10, 2025

Merab Dvalishvilis Ground Game Triumphs Ufc 316 Submission Win Over Sean O Malley

Jun 10, 2025 -

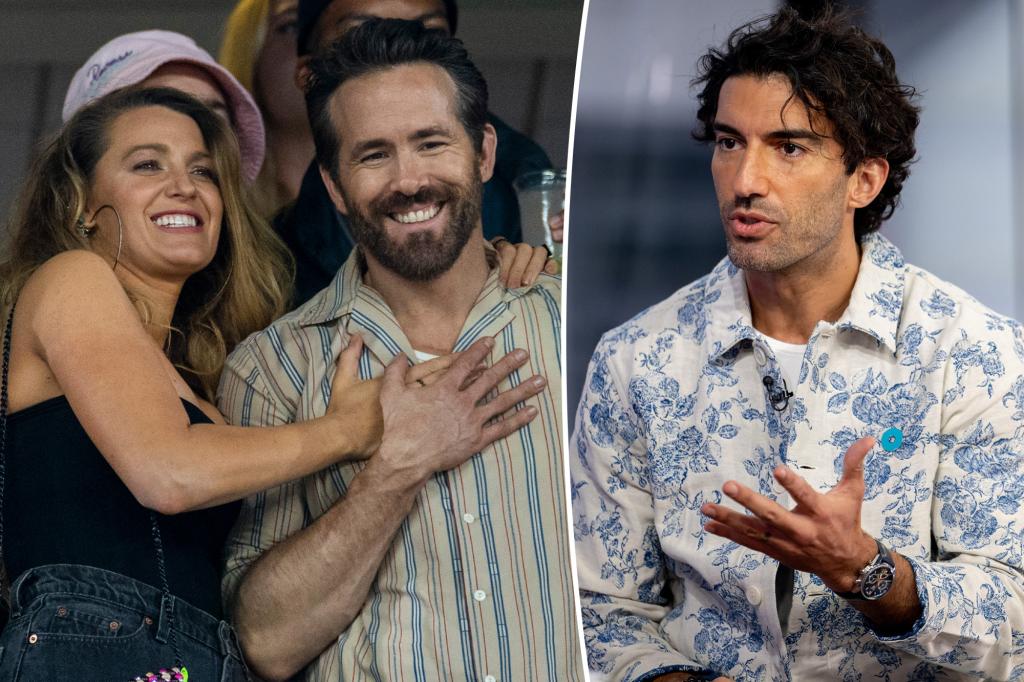

Ryan Reynolds And Blake Lively Victorious 400 M Lawsuit Against Them Dismissed

Jun 10, 2025

Ryan Reynolds And Blake Lively Victorious 400 M Lawsuit Against Them Dismissed

Jun 10, 2025