Can Boeing Stock Sustain Its 2025 Performance?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Boeing Stock Sustain its 2025 Performance? Navigating Headwinds and Tailwinds

Boeing (BA) enjoyed a significant rebound in 2025, exceeding many analysts' expectations. But the question on every investor's mind is: can this momentum continue? The aerospace giant faces a complex landscape of challenges and opportunities, making predicting its future performance a tricky endeavor. This article delves into the factors that could either propel Boeing to further success or hinder its progress.

The 2025 Success Story: A Brief Recap

Boeing's resurgence in 2025 was largely attributed to several key factors: increased 737 MAX deliveries after the grounding was lifted, strong demand for its defense products, and a recovery in commercial air travel following the pandemic. This led to a significant boost in revenue and a positive impact on the Boeing stock price. However, this success wasn't without its hurdles. Supply chain disruptions, inflation, and geopolitical instability all played a role in shaping the company's performance.

Headwinds on the Horizon: Challenges Facing Boeing in the Future

Several factors could potentially dampen Boeing's future performance. These include:

- Inflation and Rising Interest Rates: Increased costs for materials and labor, coupled with higher borrowing costs, can significantly impact profitability. This necessitates careful cost management and efficient operational strategies.

- Supply Chain Disruptions: While the situation improved in 2025, the global supply chain remains fragile. Any unforeseen disruptions could lead to production delays and negatively impact Boeing's delivery schedule.

- Geopolitical Instability: Global conflicts and political uncertainties can significantly affect demand for both commercial and defense aircraft, creating significant volatility in the market.

- Competition: Boeing faces stiff competition from Airbus, especially in the commercial aircraft market. Maintaining a competitive edge requires continuous innovation and efficient production.

- Regulatory Scrutiny: Following past incidents, Boeing remains under significant regulatory scrutiny. Meeting stringent safety and compliance standards is crucial for maintaining public trust and avoiding further setbacks.

Tailwinds to Consider: Factors Favoring Continued Growth

Despite the challenges, several factors could support Boeing's continued growth:

- Strong Backlog of Orders: Boeing has a substantial backlog of orders for both commercial and defense aircraft, providing a solid foundation for future revenue generation.

- Growing Demand for Air Travel: The global air travel industry is expected to continue its recovery and growth, driving demand for new aircraft.

- Investment in Innovation: Boeing's ongoing investments in research and development, particularly in sustainable aviation technologies, could position the company for long-term success.

- Defense Spending: Increased defense spending globally presents significant opportunities for Boeing's defense division.

Analyzing Boeing Stock: What to Watch For

Investors should closely monitor the following key indicators:

- Delivery Rates: Sustained and increased delivery rates of both the 737 MAX and other aircraft models are crucial for sustained growth.

- Profit Margins: Maintaining healthy profit margins amidst rising costs is a critical factor in assessing Boeing's financial health.

- Supply Chain Improvements: Progress in mitigating supply chain risks is vital for consistent production.

- New Program Success: The success of new aircraft programs and defense contracts will play a crucial role in shaping future performance.

Conclusion: A Cautiously Optimistic Outlook

While Boeing's 2025 performance was impressive, sustaining that momentum requires navigating a complex and challenging landscape. A cautiously optimistic outlook seems appropriate. Investors should carefully consider the headwinds and tailwinds discussed above before making any investment decisions. Conduct thorough due diligence and consider consulting with a financial advisor before investing in Boeing stock. The future of Boeing, and its stock price, remains a story unfolding, and careful observation is key.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Boeing Stock Sustain Its 2025 Performance?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Equipementier Trop Visible Hailey Baptiste Doit Changer De Bandeau

Jun 02, 2025

Equipementier Trop Visible Hailey Baptiste Doit Changer De Bandeau

Jun 02, 2025 -

Review Justin Moores Latest Concert A Resounding Success

Jun 02, 2025

Review Justin Moores Latest Concert A Resounding Success

Jun 02, 2025 -

Key Endorsement Bolsters Mamdanis Nyc Mayoral Bid For Asian American Support

Jun 02, 2025

Key Endorsement Bolsters Mamdanis Nyc Mayoral Bid For Asian American Support

Jun 02, 2025 -

Mike Trouts Return Bats 5th Powers Angels To Victory

Jun 02, 2025

Mike Trouts Return Bats 5th Powers Angels To Victory

Jun 02, 2025 -

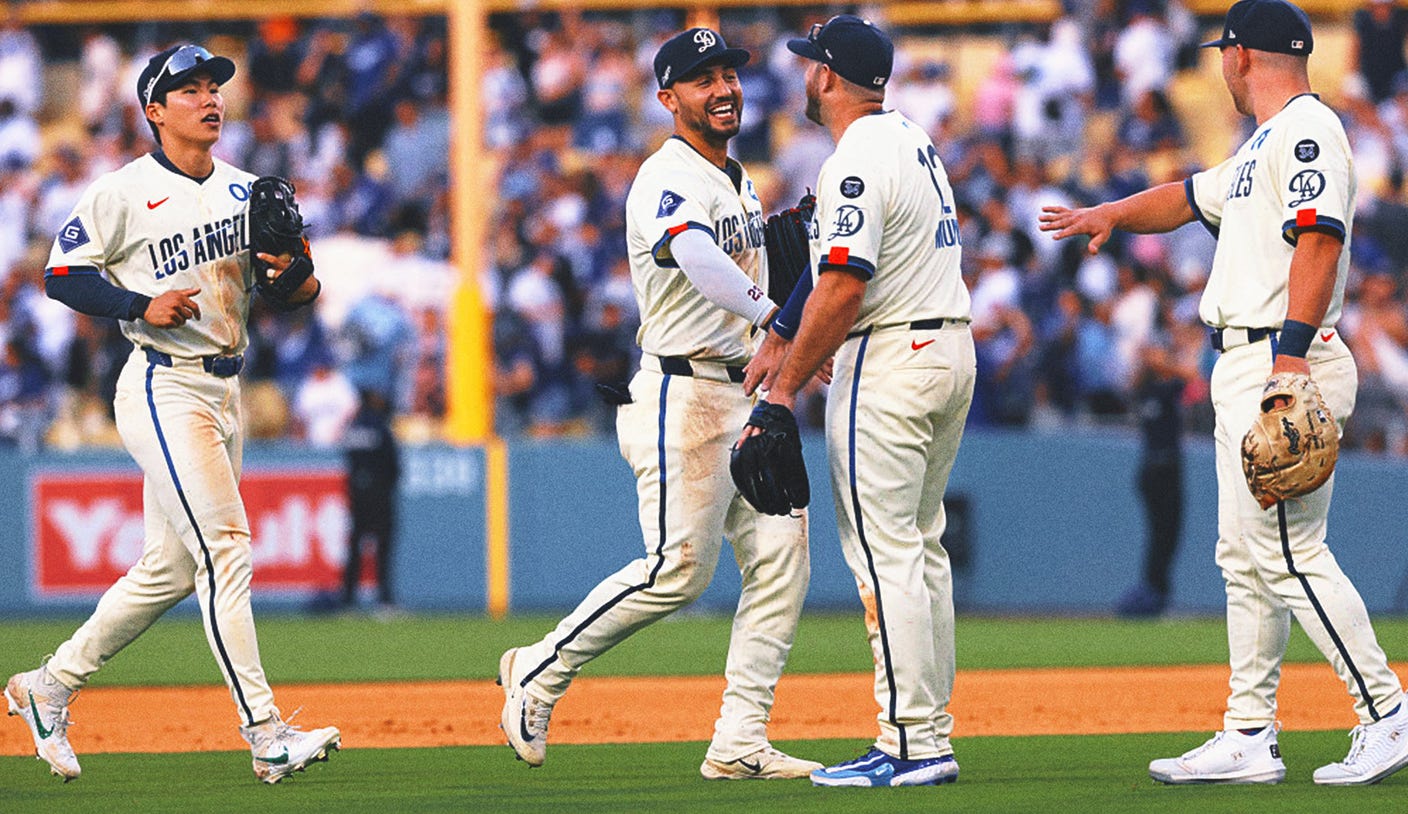

Dodgers Obliterate Mets Record Setting Offensive Explosion In New York

Jun 02, 2025

Dodgers Obliterate Mets Record Setting Offensive Explosion In New York

Jun 02, 2025