Buffett's Recent Stock Sales: A Shift In Investment Strategy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Recent Stock Sales: A Shift in Investment Strategy?

Warren Buffett's Berkshire Hathaway has recently made headlines for significant stock sales, sparking debate among investors about a potential shift in the legendary investor's long-term strategy. The moves, notably the reduction of holdings in companies like Bank of America and Chevron, have raised eyebrows and fueled speculation about what lies ahead for the Oracle of Omaha. This article delves into the details, analyzing the sales and exploring possible implications for investors.

The Sales That Sparked the Conversation:

Berkshire Hathaway's recent activity in the stock market has been anything but quiet. The significant divestment from previously favored holdings isn't just a minor adjustment; it represents a notable change in portfolio composition. While Buffett has always been known for his buy-and-hold approach, these sales suggest a potential recalibration of his investment philosophy, or at least a response to evolving market conditions.

-

Bank of America: The reduction of Berkshire's stake in Bank of America represents a significant move, given the long-standing relationship between Buffett and the financial institution. This sale, coupled with others, is prompting many to question the future of Berkshire's involvement in the banking sector.

-

Chevron: Similarly, the trimming of Berkshire's Chevron holdings adds to the narrative of strategic adjustments. This move, coming amidst fluctuating energy prices and geopolitical uncertainties, highlights the challenges even seasoned investors face in navigating the current market landscape.

-

Other Notable Sales: Beyond Bank of America and Chevron, other sales have contributed to the overall impression of a changing strategy. Analyzing these individual transactions, alongside macroeconomic factors, provides a more comprehensive understanding of Buffett's current thinking.

Possible Explanations: A Shifting Market Landscape?

Several factors could be contributing to these recent sales:

-

Market Valuation: It's possible that Buffett sees certain stocks, even those he's held for years, as overvalued in the current market. His legendary ability to identify undervalued assets might be leading him to take profits where he sees opportunities dwindling.

-

Sectoral Shifts: The changing economic climate and technological advancements may be prompting Buffett to re-evaluate his portfolio's sectoral balance. He may be reallocating capital to areas he believes are poised for stronger future growth.

-

Cash is King: Maintaining significant cash reserves has always been a key part of Buffett's strategy. These sales could simply reflect a desire to increase liquidity for future investment opportunities, which might be more lucrative in the coming years.

-

Succession Planning: With age comes succession planning. While Buffett remains actively involved, the future leadership of Berkshire Hathaway might also play a role in these decisions. A more gradual shift in investment style might be underway.

What Does This Mean for Investors?

The implications of Buffett's recent moves are far-reaching. While it doesn't necessarily signal an immediate market downturn, it does highlight the dynamic nature of even the most successful investment strategies. For average investors, the key takeaway is the importance of:

-

Diversification: Maintain a diverse portfolio to mitigate risk, mirroring Buffett's own principle of spreading investments across various sectors.

-

Long-Term Perspective: Despite these recent sales, Buffett's long-term approach remains a cornerstone of his success. Investors should maintain patience and a long-term focus.

-

Due Diligence: Continuously research and analyze investments, adapting your strategy as market conditions evolve.

Conclusion:

Buffett's recent stock sales are a significant event worthy of careful analysis. While not necessarily a complete departure from his established principles, they certainly suggest a period of adjustment and perhaps a subtle shift in strategy. Only time will tell the full impact of these decisions, but they serve as a valuable reminder of the unpredictable nature of the market and the importance of adapting to change. Further analysis is needed to fully understand the implications of these decisions, but one thing remains certain: the Oracle of Omaha continues to shape the conversation in the world of finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Recent Stock Sales: A Shift In Investment Strategy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Spelling Bee Strands Puzzle Solution For June 3rd

Jun 04, 2025

Nyt Spelling Bee Strands Puzzle Solution For June 3rd

Jun 04, 2025 -

India A Squad Bolstered Senior Batsmen Added For England Warm Up Match

Jun 04, 2025

India A Squad Bolstered Senior Batsmen Added For England Warm Up Match

Jun 04, 2025 -

Rockies Suffer Historic Sweep Near Mlb Record For Losses

Jun 04, 2025

Rockies Suffer Historic Sweep Near Mlb Record For Losses

Jun 04, 2025 -

Tiger Woods And Scottie Scheffler Exclusive Club Of Memorial Repeat Champions

Jun 04, 2025

Tiger Woods And Scottie Scheffler Exclusive Club Of Memorial Repeat Champions

Jun 04, 2025 -

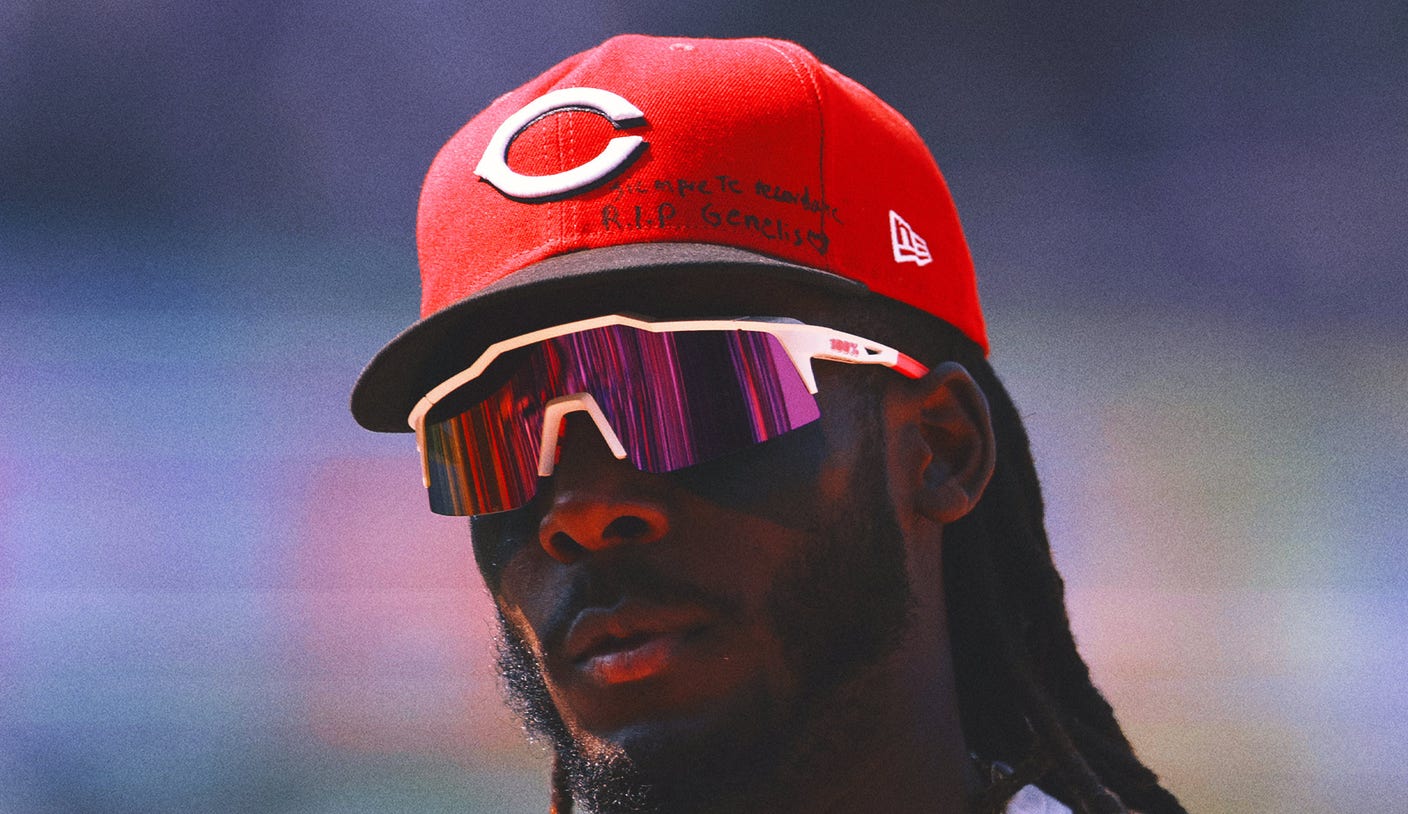

De La Cruzs Powerful Home Run A Heartfelt Remembrance Of His Sister

Jun 04, 2025

De La Cruzs Powerful Home Run A Heartfelt Remembrance Of His Sister

Jun 04, 2025