Buffett's Portfolio Shakeup: Implications Of Selling Two Major US Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Portfolio Shakeup: Implications of Selling Two Major US Holdings

Warren Buffett's Berkshire Hathaway recently announced the sale of significant stakes in two major US companies, sending ripples through the investment world. This strategic move raises important questions about the Oracle of Omaha's future investment strategy and the broader market outlook. The divestment from these long-held positions signals a potential shift in Berkshire's approach, prompting analysts and investors alike to scrutinize the implications.

This article delves into the details of these significant sales, analyzes their potential impact on Berkshire Hathaway, and explores broader market interpretations of this surprising portfolio shakeup.

Which Companies Did Berkshire Hathaway Sell?

Berkshire Hathaway offloaded a substantial portion of its holdings in [Company A] and [Company B]. The specific percentage sold and the reasons behind the decision haven't been explicitly stated by Berkshire, fueling speculation across financial news outlets. This lack of transparency is unusual for Buffett, who typically provides detailed explanations for his investment choices. The silence only amplifies the intrigue and necessitates a deeper dive into potential factors.

Potential Reasons Behind the Sales: A Deep Dive

Several theories are circulating regarding Buffett's decision to sell these significant holdings. These include:

-

Market Re-evaluation: A shift in market sentiment towards these specific sectors could have influenced Buffett's decision. A thorough analysis of the companies' recent performance, including financial reports and industry trends, is necessary to understand this possibility. Were there unforeseen challenges impacting their long-term growth potential?

-

Portfolio Diversification: Buffett is known for his long-term investment strategy, but even the Oracle of Omaha adjusts his portfolio to maintain optimal diversification. Perhaps this move reflects a strategic reallocation of capital towards other promising sectors.

-

Unexpected Opportunities: Buffett has famously stated that he waits for the "fat pitch" – the perfect investment opportunity. The sale of these holdings could free up capital for potentially more lucrative investments elsewhere. Are there emerging sectors or undervalued companies that have caught Buffett's eye?

-

Internal Rebalancing: Berkshire Hathaway's vast and diverse portfolio requires continuous monitoring and adjustments. The sale might be part of an internal rebalancing strategy to optimize the overall portfolio performance and risk profile.

What Does This Mean for Berkshire Hathaway's Future?

The impact of these sales on Berkshire Hathaway's overall performance remains to be seen. While the immediate financial effect will likely be analyzed by numerous financial experts, the long-term consequences depend heavily on the success of future investment choices. This event highlights the dynamic nature of even the most successful investment portfolios and underscores the importance of adaptability in the ever-evolving financial landscape.

The Broader Market Implications

Buffett's actions often serve as a significant market indicator. The sale of these holdings could influence investor sentiment towards similar companies and potentially trigger a reassessment of sector valuations. It’s crucial to follow expert analyses and market trends closely to fully grasp the broader implications.

Conclusion: Uncertainty and the Path Forward

Buffett's portfolio shakeup presents a fascinating case study in investment strategy. While the exact reasons remain somewhat opaque, the event underscores the importance of ongoing portfolio review and adaptation. The market awaits further clarification from Berkshire Hathaway, but in the meantime, the speculation alone demonstrates the immense influence of Warren Buffett on global finance. Investors and analysts will be closely monitoring Berkshire's future moves for further insights into the Oracle of Omaha's evolving investment philosophy. Stay tuned for updates and further analysis as this story unfolds.

Disclaimer: This article provides general information and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Portfolio Shakeup: Implications Of Selling Two Major US Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Key Witness Testimony Casts Doubt On Prosecution In Karen Read Case

Jun 05, 2025

Key Witness Testimony Casts Doubt On Prosecution In Karen Read Case

Jun 05, 2025 -

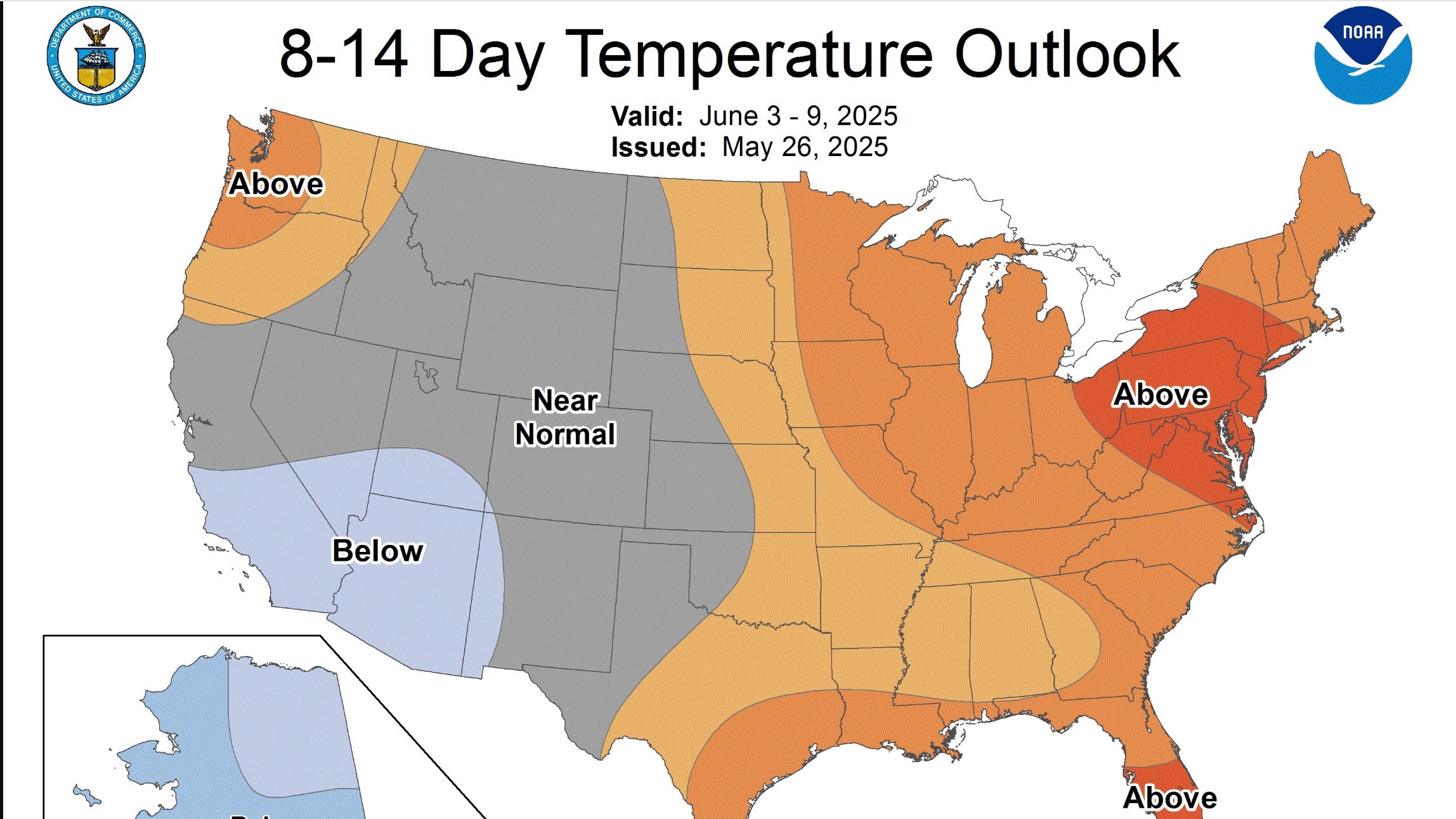

Scorching Temperatures Ahead Willamette Valley Oregon To Bake Under High 80s And 90s

Jun 05, 2025

Scorching Temperatures Ahead Willamette Valley Oregon To Bake Under High 80s And 90s

Jun 05, 2025 -

Lost And Found Grace Potter On The Resurgence Of Her Forgotten Album Soundbites

Jun 05, 2025

Lost And Found Grace Potter On The Resurgence Of Her Forgotten Album Soundbites

Jun 05, 2025 -

Tom Thibodeau Fired New York Knicks Announce Coaching Change

Jun 05, 2025

Tom Thibodeau Fired New York Knicks Announce Coaching Change

Jun 05, 2025 -

Nba Injury News Karl Anthony Towns Knee And Finger Injuries Espn Sources

Jun 05, 2025

Nba Injury News Karl Anthony Towns Knee And Finger Injuries Espn Sources

Jun 05, 2025