Buffett's Berkshire Hathaway: Major Bank Of America Sell-Off, Significant Consumer Brand Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Berkshire Hathaway Shakes Up Portfolio: Major Bank of America Sell-Off, Significant Consumer Brand Investment

Warren Buffett's Berkshire Hathaway surprised investors this week with a significant shift in its portfolio strategy. The Oracle of Omaha, known for his long-term investment approach, revealed a substantial reduction in its Bank of America stake alongside a noteworthy increase in holdings of several prominent consumer brands. This dual move has sparked considerable speculation and analysis within the financial world.

The news, disclosed in the company's latest 13F filing, immediately sent ripples through the market. Berkshire Hathaway significantly decreased its Bank of America holdings, shedding millions of shares. This move, following years of steady accumulation, marks a departure from Buffett's typically patient, buy-and-hold strategy for financial institutions. While the exact reasons remain unconfirmed, analysts point to several potential factors, including concerns about rising interest rates and potential economic headwinds impacting the banking sector. The sell-off undoubtedly raises questions about Berkshire's future outlook on the financial industry. Some experts believe this may be a tactical repositioning rather than a complete abandonment of the sector.

Shifting Focus: A Bet on Consumer Strength?

Conversely, Berkshire Hathaway's investment in consumer brands has significantly increased. The filing revealed substantial additions to holdings in companies like Coca-Cola and Kraft Heinz, suggesting a renewed focus on the enduring power of established consumer staples. This contrasts with the more volatile nature of the financial sector and speaks to Buffett's belief in the resilience of these brands during economic uncertainty.

This strategic shift highlights a key principle in Buffett's investment philosophy: adaptability. While he's often championed long-term holding periods, his actions demonstrate a willingness to adjust his portfolio based on changing market conditions and evolving economic forecasts. The move signals a potential reassessment of risk tolerance within Berkshire Hathaway's investment strategy.

What Does This Mean for Investors?

The implications of Berkshire Hathaway's portfolio reshuffle are far-reaching. For investors, this presents a valuable opportunity to reassess their own portfolios and consider the long-term implications of the recent market movements. The sell-off in Bank of America may be interpreted as a bearish signal by some, but others see it as a strategic maneuver by a seasoned investor adapting to changing market dynamics. The increase in consumer brand holdings, on the other hand, signals potential confidence in the resilience of these sectors during periods of economic uncertainty.

Key takeaways:

- Bank of America Sell-Off: A significant reduction in Berkshire Hathaway's Bank of America holdings raises questions about future investment strategies in the financial sector.

- Increased Consumer Brand Investment: A substantial increase in holdings in companies like Coca-Cola and Kraft Heinz indicates a shift towards consumer staples.

- Adaptability as a Key Strategy: Buffett's actions demonstrate a flexible approach to investment, adapting to changing market conditions.

- Investor Implications: The moves provide valuable insights for investors considering their own portfolio allocations and risk tolerance.

This development underscores the importance of staying informed about market trends and the investment strategies of major players like Berkshire Hathaway. By understanding these shifts, investors can make better-informed decisions to navigate the complexities of the financial world. For further analysis on Berkshire Hathaway's recent activities, consider reviewing their official filings and consulting with a qualified financial advisor. Staying updated on economic news and market analysis is crucial for informed investment strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Berkshire Hathaway: Major Bank Of America Sell-Off, Significant Consumer Brand Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

David Joseph Craig From North Royalton To Film Director

Jun 05, 2025

David Joseph Craig From North Royalton To Film Director

Jun 05, 2025 -

Yankees Reportedly Place Reliever Luke Weaver On Injured List

Jun 05, 2025

Yankees Reportedly Place Reliever Luke Weaver On Injured List

Jun 05, 2025 -

Stefon Diggs Remains A Patriot Team Addresses Video Controversy

Jun 05, 2025

Stefon Diggs Remains A Patriot Team Addresses Video Controversy

Jun 05, 2025 -

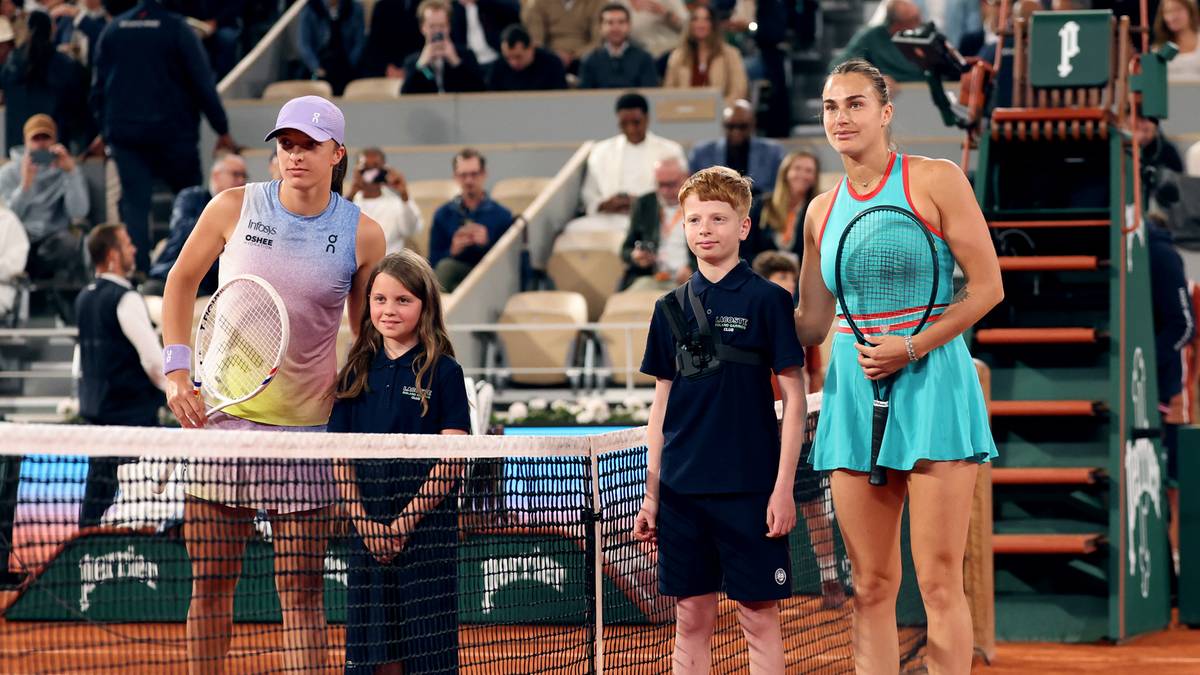

Iga Swiatek Aryna Sabalenka Wynik Na Zywo Z Roland Garros

Jun 05, 2025

Iga Swiatek Aryna Sabalenka Wynik Na Zywo Z Roland Garros

Jun 05, 2025 -

Why The Karen Read Trial Wasnt Held Today

Jun 05, 2025

Why The Karen Read Trial Wasnt Held Today

Jun 05, 2025