Buffett Sells 39% Of Berkshire's Bank Of America Stake: Big Bet On This Consumer Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett Sells 39% of Berkshire's Bank of America Stake: Big Bet on This Consumer Stock

Warren Buffett's Berkshire Hathaway has significantly reduced its stake in Bank of America, sparking speculation about the Oracle of Omaha's next big move. The move, which saw Berkshire sell nearly 39% of its holdings, has sent ripples through the financial world and raised questions about Buffett's investment strategy. But the real story might lie not in what he's selling, but in what he's implicitly buying – a renewed bet on the resilient consumer.

The sale, reported on [insert date of filing/news report], involved the disposal of millions of shares, a considerable reduction in Berkshire's overall position in the banking giant. While the exact reasons remain undisclosed – a hallmark of Buffett's famously opaque investment approach – analysts are pointing to several potential factors. This includes the recent rise in interest rates, impacting bank profitability, and the possibility of reallocating capital towards sectors perceived as offering greater growth potential.

Why the Bank of America Sell-Off? Deciphering Buffett's Strategy

Several theories attempt to explain this significant divestment. One prominent theory suggests that Buffett might be taking profits after a substantial period of growth in Bank of America's stock price. Another perspective focuses on the current macroeconomic climate. With increasing concerns about a potential recession and tightening credit conditions, a reduction in exposure to the banking sector might be a prudent risk management strategy.

-

Profit-Taking: Bank of America stock has performed well in recent years, offering substantial returns for Berkshire Hathaway. A partial sell-off allows Buffett to secure these gains and reinvest them elsewhere.

-

Risk Mitigation: The current economic uncertainty necessitates a careful approach to portfolio management. Reducing exposure to a potentially volatile sector like banking could be a defensive measure.

-

Shifting Investment Focus: Buffett’s moves often signal broader market trends. This sell-off could indicate a shift towards sectors better positioned to weather an economic downturn.

The Implicit Bet: Strength in the Consumer Sector

While the Bank of America sale is significant, many analysts believe the real story lies in what it implies about Buffett's future investments. The sale could free up substantial capital for investment in other sectors, particularly those demonstrating strong resilience in challenging economic times. This points to a possible increased focus on consumer-staple companies, which tend to show more stable performance even during recessions.

What are consumer-staple companies? These are businesses that provide essential goods and services, such as food, beverages, household products, and personal care items. Their demand remains relatively consistent regardless of economic fluctuations.

Examples include:

- Grocery chains: Companies like Kroger and Walmart's grocery segment continue to see consistent demand.

- Consumer goods manufacturers: Procter & Gamble and Coca-Cola produce products with inelastic demand.

- Pharmaceutical companies: The need for healthcare remains consistent regardless of economic conditions.

This renewed focus on consumer stocks could be a significant indicator of Buffett’s outlook on the economy. His investment decisions often serve as a powerful barometer for market sentiment.

Conclusion: A Strategic Adjustment, Not a Panic Sell

The sale of Berkshire's Bank of America stake shouldn't be viewed as a sign of panic or a negative reflection on the bank itself. Instead, it likely represents a strategic adjustment to Berkshire's portfolio, reflecting a changing economic landscape and perhaps a renewed focus on consumer-oriented companies poised for consistent growth, regardless of market volatility. Only time will tell the full extent of Buffett's investment strategy, but this move certainly provides valuable insight into his thinking. What are your thoughts on this significant shift in Berkshire Hathaway's holdings? Share your predictions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett Sells 39% Of Berkshire's Bank Of America Stake: Big Bet On This Consumer Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

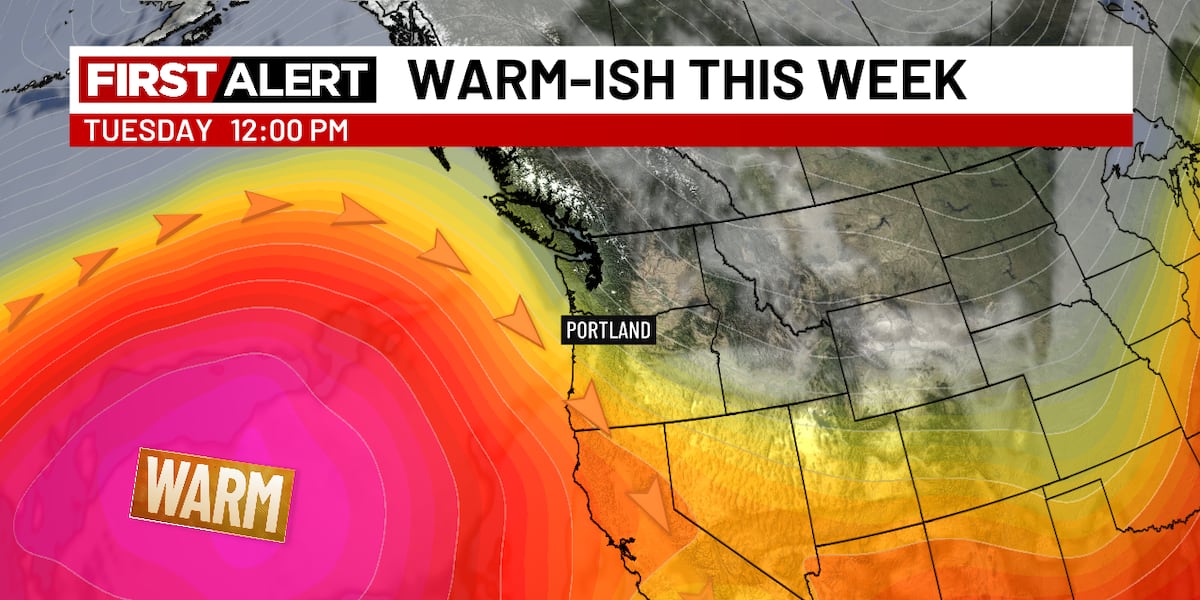

Fair Weather Ahead Warm Sunny And Dry June Outlook

Jun 05, 2025

Fair Weather Ahead Warm Sunny And Dry June Outlook

Jun 05, 2025 -

Applied Digital Skyrockets Core Weave Ai Lease Agreement Drives 48 Surge

Jun 05, 2025

Applied Digital Skyrockets Core Weave Ai Lease Agreement Drives 48 Surge

Jun 05, 2025 -

Darnolds Starting Position Confirmed Seahawks Macdonald Speaks Out

Jun 05, 2025

Darnolds Starting Position Confirmed Seahawks Macdonald Speaks Out

Jun 05, 2025 -

No Cuts For Diggs Patriots Weather Video Storm

Jun 05, 2025

No Cuts For Diggs Patriots Weather Video Storm

Jun 05, 2025 -

Nba Trade Rumors Potential Deals For Top Draft Pick Cooper Flagg

Jun 05, 2025

Nba Trade Rumors Potential Deals For Top Draft Pick Cooper Flagg

Jun 05, 2025