Buffett Dumps Bank Of America: Massive Investment In A 7,700% Growth Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett Dumps Bank of America: Massive Investment in a 7,700% Growth Stock Sends Shockwaves Through Wall Street

Warren Buffett's Berkshire Hathaway recently revealed a significant shift in its investment portfolio, sparking considerable debate and analysis among financial experts. The legendary investor has reduced his stake in Bank of America, a long-held position, while simultaneously increasing his investment in a lesser-known company boasting an astounding 7,700% growth. This bold move has sent shockwaves through Wall Street, prompting questions about Buffett's investment strategy and the future potential of the newly favored company.

The news of Berkshire Hathaway's decreased Bank of America holdings came as a surprise to many. While Bank of America remains a substantial part of the portfolio, the scaling back suggests a reevaluation of the investment's long-term prospects. This decision, coupled with the massive investment in the high-growth stock, signals a potential shift in Buffett's approach, moving towards companies with higher growth potential, even if they carry a greater level of risk.

<h3>What Drove Buffett's Decision?</h3>

Several factors could have contributed to Buffett's decision to trim his Bank of America holdings. The current economic climate, with rising interest rates and potential recessionary pressures, might have influenced his assessment of the bank's future performance. Furthermore, the competitive landscape in the banking sector remains intense, potentially impacting Bank of America's profitability.

While specific reasons remain undisclosed, analysts speculate that Buffett’s shift reflects his ongoing search for high-growth opportunities. He’s known for his long-term investment horizon, and this move suggests a belief that the newly favored company holds significantly greater potential for future returns.

<h3>The 7,700% Growth Stock: Unveiling the Mystery</h3>

While Berkshire Hathaway's filings don't explicitly name the company experiencing the 7,700% growth, [link to a reputable financial news source discussing the potential candidates]. Several companies fitting this description are currently being speculated upon by analysts. These companies typically operate in sectors experiencing rapid expansion, such as technology, renewable energy, or biotechnology. The remarkable growth signifies a significant market opportunity and the potential for substantial long-term returns.

Identifying the specific company is crucial for investors keen to understand the rationale behind Buffett's decision. Analyzing the company's financials, market position, and competitive advantages will be vital in assessing its future potential and whether it represents a viable investment opportunity.

<h3>Implications for Investors</h3>

Buffett's actions often serve as a benchmark for other investors. This recent portfolio shift underscores the importance of regularly reviewing and rebalancing investments based on changing market conditions and emerging opportunities. While mimicking Buffett's strategy isn't guaranteed to yield the same results, his moves provide valuable insights into identifying potentially high-growth sectors.

It's important to remember that investing always involves risk. Before making any investment decisions, conduct thorough research and consider seeking advice from a qualified financial advisor.

<h3>Key Takeaways:</h3>

- Buffett's portfolio shift highlights the dynamic nature of the investment landscape.

- The focus on a high-growth stock signals a potential shift in Buffett's investment strategy.

- Analyzing the specifics of the 7,700% growth company is crucial for understanding the full implications of this move.

- Investors should conduct thorough research and seek professional advice before making any investment decisions.

This bold move by Warren Buffett has undoubtedly created a significant talking point in the financial world, and the ongoing speculation promises to keep investors engaged in the coming weeks and months. Stay tuned for further updates as more information emerges.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett Dumps Bank Of America: Massive Investment In A 7,700% Growth Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

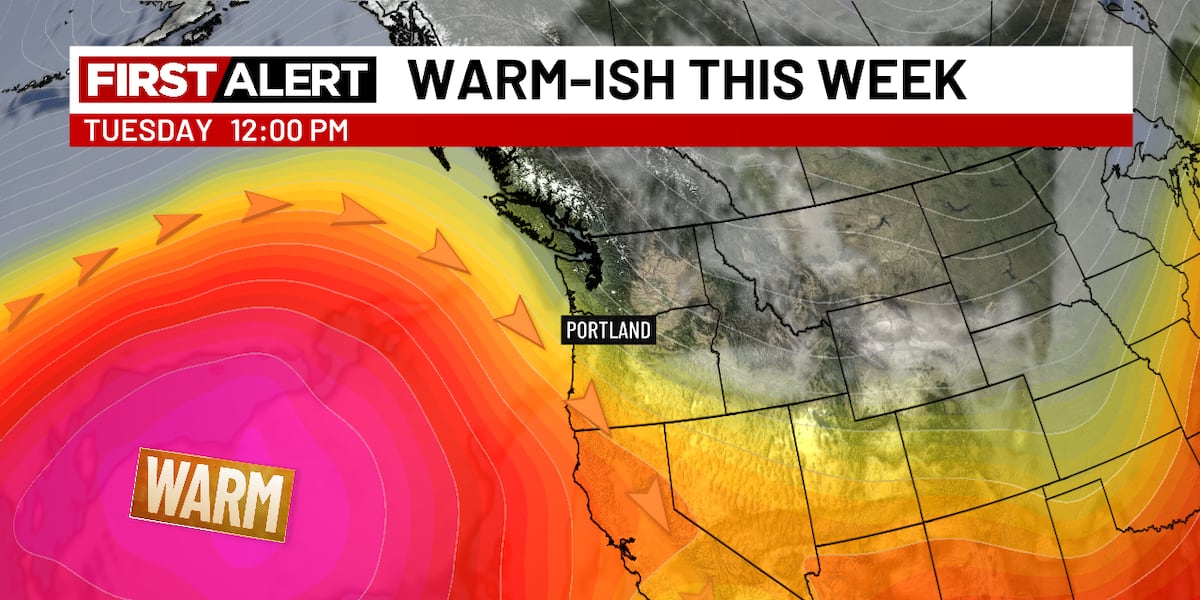

Early June Weather Warm Dry And Sunny Conditions Predicted

Jun 05, 2025

Early June Weather Warm Dry And Sunny Conditions Predicted

Jun 05, 2025 -

Rashod Bateman Surpasses Eric Decker Richest Nfl Contract For A Minnesota Gophers Wide Receiver

Jun 05, 2025

Rashod Bateman Surpasses Eric Decker Richest Nfl Contract For A Minnesota Gophers Wide Receiver

Jun 05, 2025 -

Will Broadcom Hit 250 Wall Streets Pre Earnings Analysis And Expectations

Jun 05, 2025

Will Broadcom Hit 250 Wall Streets Pre Earnings Analysis And Expectations

Jun 05, 2025 -

Van Hunt The Man Behind Halle Berrys Recent Romance

Jun 05, 2025

Van Hunt The Man Behind Halle Berrys Recent Romance

Jun 05, 2025 -

How To Watch The Germany Vs Portugal Nations League Semifinal Live Stream And Tv Info

Jun 05, 2025

How To Watch The Germany Vs Portugal Nations League Semifinal Live Stream And Tv Info

Jun 05, 2025