Broadcom's Earnings Looms: Will The Stock Hit $250? Wall Street's Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom Earnings Looms: Will the Stock Hit $250? Wall Street's Outlook Remains Divided

Broadcom (AVGO) is on the cusp of releasing its latest earnings report, and Wall Street is buzzing with anticipation. The semiconductor giant's performance will significantly impact its stock price, with some analysts predicting a potential surge to $250 per share. But will this ambitious target be met? The outlook, as we'll explore, is far from unanimous.

The upcoming earnings announcement is crucial for several reasons. Broadcom, a key player in the semiconductor industry, supplies vital components for various sectors, including data centers, smartphones, and networking infrastructure. Any significant shifts in these markets directly impact its revenue and profitability. Analysts will be closely scrutinizing the company's guidance for the coming quarters, particularly in light of the ongoing global economic uncertainty and the persistent chip shortage, albeit easing.

What to Expect from Broadcom's Earnings Report:

Several key factors will shape the market's reaction to Broadcom's earnings:

- Revenue Growth: Analysts will be looking for robust revenue growth, driven by strong demand across its diverse product portfolio. Any slowdown in key sectors could send shockwaves through the market.

- Profit Margins: Maintaining healthy profit margins in a challenging environment will be a significant indicator of Broadcom's operational efficiency and pricing power.

- Guidance: The company's outlook for future quarters will be crucial. Positive guidance, signaling continued strong growth, would likely boost investor confidence. Conversely, a cautious outlook could trigger a sell-off.

- Impact of the Macroeconomic Environment: The ongoing geopolitical tensions and inflationary pressures are undeniable factors. Broadcom's ability to navigate these challenges will be closely examined.

Wall Street's Divided Outlook:

While some analysts are bullish on Broadcom's prospects, projecting a potential stock price surge to $250, others remain more cautious. The differing viewpoints highlight the inherent uncertainty in predicting the performance of a technology company operating in a rapidly evolving market.

- Bullish Arguments: Proponents of the $250 target point to Broadcom's strong market position, diversified customer base, and its ability to innovate and adapt to changing market demands. They also highlight the continued growth in key markets like 5G and cloud computing.

- Bearish Arguments: Conversely, some analysts express concerns about potential supply chain disruptions, increased competition, and the overall macroeconomic climate. These concerns could temper growth expectations and limit the stock's upside potential.

Investing in Broadcom: A Risky Proposition?

Investing in Broadcom, or any individual stock for that matter, carries inherent risk. While the potential for significant returns is certainly there, investors should carefully consider the risks before making any investment decisions. Conduct thorough research, diversify your portfolio, and consult with a financial advisor to make informed choices that align with your risk tolerance.

Conclusion:

Broadcom's upcoming earnings report is a critical event that will significantly shape the company's future trajectory. While the potential for a stock price surge to $250 exists, the reality is far more nuanced. The market's reaction will depend on a confluence of factors, including revenue growth, profit margins, future guidance, and the broader macroeconomic environment. Investors should approach this with a balanced perspective, considering both the bullish and bearish arguments before making any investment decisions. Stay tuned for updates following the official earnings release. Remember to always consult a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom's Earnings Looms: Will The Stock Hit $250? Wall Street's Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Underdog Texas Tech Shatters Oklahomas Wcws Dominance

Jun 05, 2025

Underdog Texas Tech Shatters Oklahomas Wcws Dominance

Jun 05, 2025 -

Seyfrieds Fringe Forward Rabanne A Look At The I Dont Understand You Premiere

Jun 05, 2025

Seyfrieds Fringe Forward Rabanne A Look At The I Dont Understand You Premiere

Jun 05, 2025 -

Germany Vs Portugal Nations League Semifinal Match Preview And Viewing Options

Jun 05, 2025

Germany Vs Portugal Nations League Semifinal Match Preview And Viewing Options

Jun 05, 2025 -

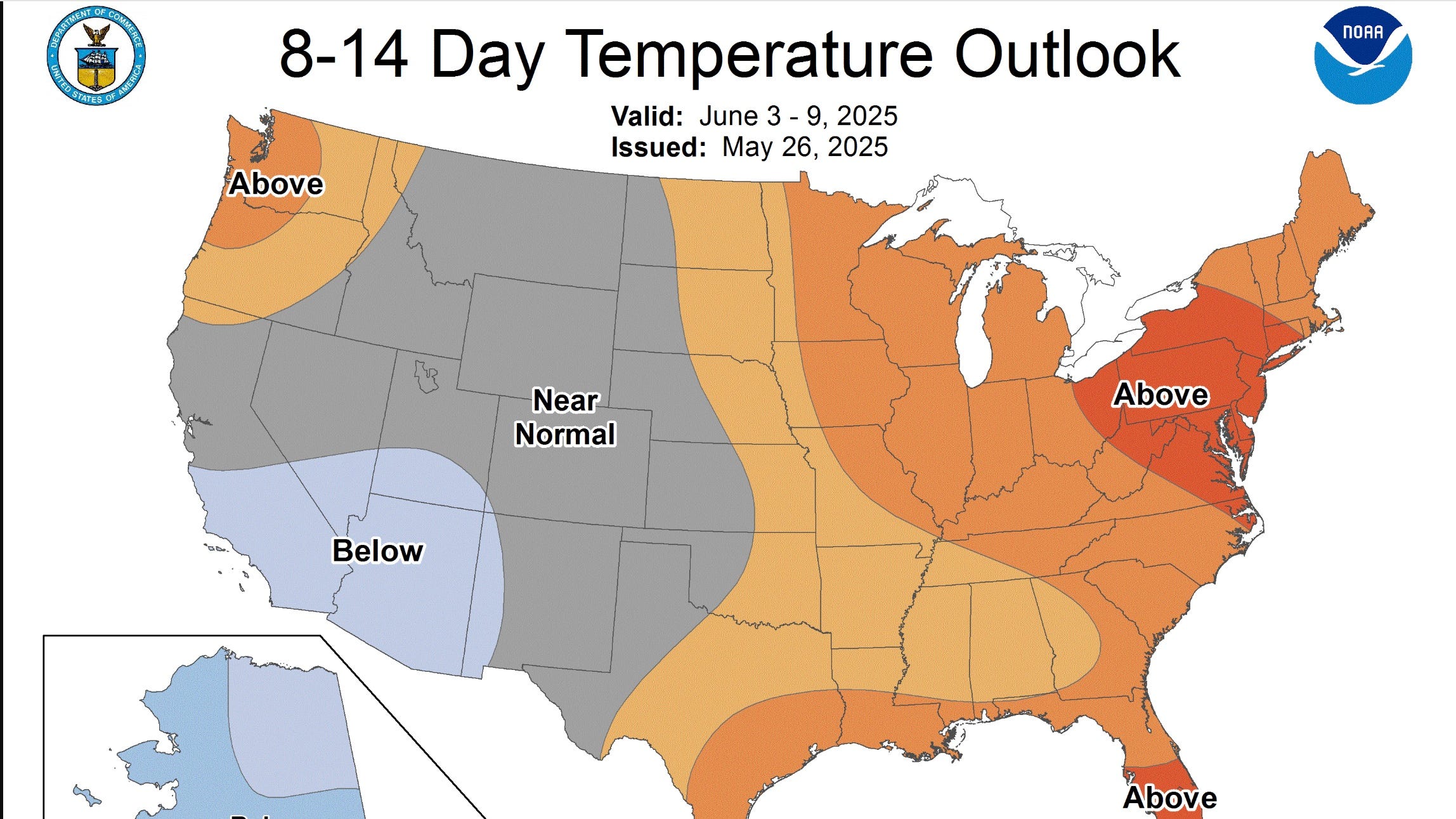

Oregons Willamette Valley Record Breaking Heatwave With Temperatures In The 80s And 90s

Jun 05, 2025

Oregons Willamette Valley Record Breaking Heatwave With Temperatures In The 80s And 90s

Jun 05, 2025 -

France Vs Spain Nations League Semifinal Watch Live Tv Listings And Streaming Options

Jun 05, 2025

France Vs Spain Nations League Semifinal Watch Live Tv Listings And Streaming Options

Jun 05, 2025

Latest Posts

-

Karen Read Retrial Explanation For Cancelled Testimony

Jun 06, 2025

Karen Read Retrial Explanation For Cancelled Testimony

Jun 06, 2025 -

Bruins Assistant Coach Joe Sacco Reportedly Moving To New Organization

Jun 06, 2025

Bruins Assistant Coach Joe Sacco Reportedly Moving To New Organization

Jun 06, 2025 -

Pre Earnings Options Trading Maximizing Returns On Broadcom Stock

Jun 06, 2025

Pre Earnings Options Trading Maximizing Returns On Broadcom Stock

Jun 06, 2025 -

Dan Muses Future With The Rangers Assistant Coaching Staff Insights

Jun 06, 2025

Dan Muses Future With The Rangers Assistant Coaching Staff Insights

Jun 06, 2025 -

No Karen Read Trial Today Heres Why Proceedings Were Suspended

Jun 06, 2025

No Karen Read Trial Today Heres Why Proceedings Were Suspended

Jun 06, 2025