Broadcom's $250 Price Target: Why Wall Street Is Watching Ahead Of Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom's $250 Price Target: Why Wall Street Is Watching Ahead of Earnings

Broadcom (AVGO) is on the cusp of releasing its earnings report, and Wall Street is buzzing. A significant $250 price target from several analysts has investors and traders alike glued to their screens, anticipating the semiconductor giant's performance. This heightened interest isn't just about the potential for profit; it reflects Broadcom's crucial role in the tech landscape and the broader economic implications of its success.

The anticipation surrounding Broadcom's earnings isn't unfounded. The company is a major player in various crucial sectors, including networking, wireless communication, and data center infrastructure. Its chips are integral to countless devices and systems worldwide, making its financial health a significant indicator of the overall tech sector's strength.

Why the $250 Price Target?

Several factors contribute to the optimistic $250 price target for Broadcom stock. These include:

- Strong Demand for Semiconductors: The global demand for semiconductors remains robust, despite concerns about a potential slowdown. Broadcom's diverse product portfolio positions it to capitalize on this demand across multiple market segments.

- Data Center Growth: The continued expansion of data centers fuels the need for high-performance networking solutions, a key area where Broadcom excels. This burgeoning market offers significant growth potential for the company.

- 5G Infrastructure Investment: The ongoing rollout of 5G networks globally necessitates advanced semiconductor components, further bolstering Broadcom's prospects. Their involvement in this crucial infrastructure upgrade provides a substantial revenue stream.

- Strategic Acquisitions: Broadcom has a history of strategic acquisitions that have expanded its product portfolio and market reach. These acquisitions demonstrate a proactive approach to growth and market dominance.

- Strong Management Team: Broadcom's leadership has consistently demonstrated a strong track record of delivering results, further inspiring investor confidence.

Risks and Considerations

While the outlook appears positive, it's crucial to acknowledge potential risks:

- Global Economic Uncertainty: The global economy faces various uncertainties, including inflation and geopolitical instability. These factors could impact demand for semiconductors and Broadcom's overall performance.

- Supply Chain Disruptions: Persistent supply chain challenges could affect Broadcom's ability to meet demand, impacting production and revenue.

- Competition: Broadcom operates in a competitive market, facing pressure from other major semiconductor players. Maintaining its market share requires continuous innovation and strategic adaptation.

What to Watch for in the Earnings Report

Investors will be closely scrutinizing several key metrics in Broadcom's upcoming earnings report, including:

- Revenue Growth: The overall revenue growth will be a key indicator of the company's performance and its ability to meet market expectations.

- Profit Margins: Maintaining healthy profit margins will be crucial in demonstrating the company's efficiency and profitability.

- Guidance for Future Quarters: The company's outlook for future quarters will provide insights into its projected growth trajectory and investor confidence.

- Capital Expenditures: Investments in research and development and expansion will reveal the company's commitment to long-term growth.

Conclusion: Awaiting the Results

The $250 price target for Broadcom reflects the significant expectations surrounding the company's upcoming earnings report. While several factors point towards a positive outcome, investors should carefully consider the potential risks associated with the current global economic climate and the competitive semiconductor landscape. The upcoming earnings release will be crucial in determining whether Broadcom can live up to the high expectations set by Wall Street. Stay tuned for further updates as the situation unfolds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom's $250 Price Target: Why Wall Street Is Watching Ahead Of Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing The Contenders Which Fringe Nfl Teams Have The Highest Probability Of A Postseason Berth

Jun 05, 2025

Analyzing The Contenders Which Fringe Nfl Teams Have The Highest Probability Of A Postseason Berth

Jun 05, 2025 -

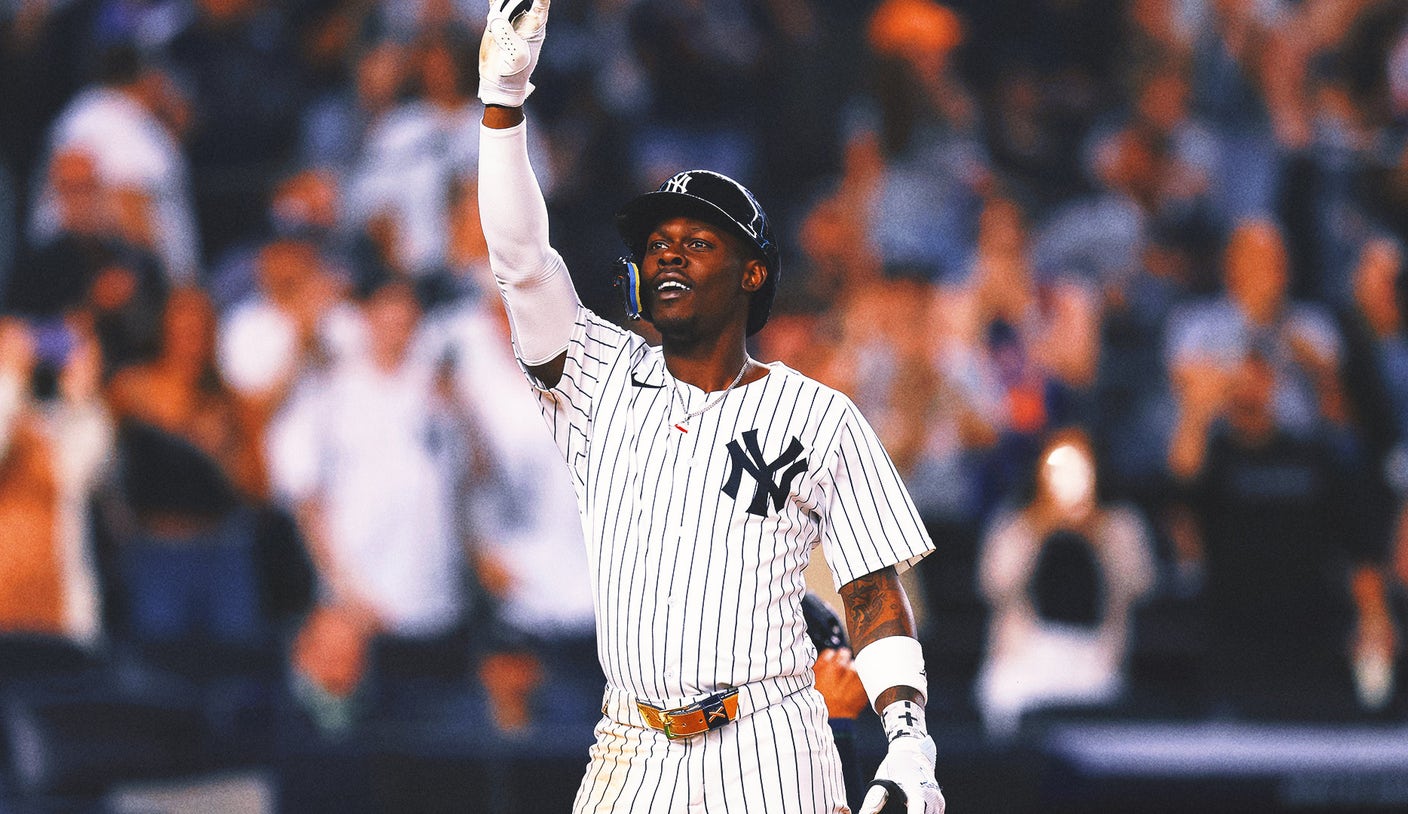

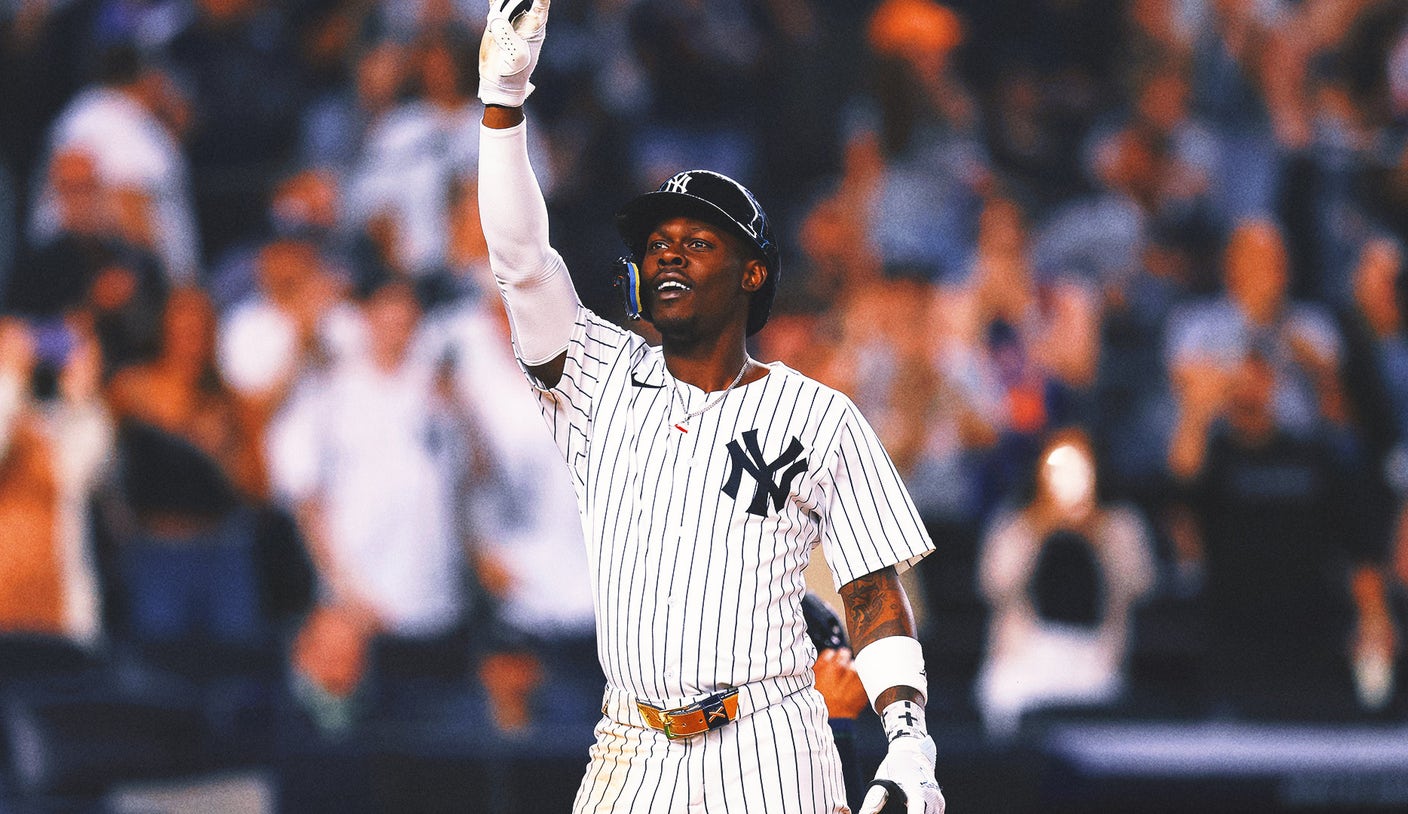

Jazz Is Back Chisholm Jr Leads Yankees To Victory

Jun 05, 2025

Jazz Is Back Chisholm Jr Leads Yankees To Victory

Jun 05, 2025 -

Injury Comeback Mike Trout Homers For The Angels

Jun 05, 2025

Injury Comeback Mike Trout Homers For The Angels

Jun 05, 2025 -

Recent Developments Dan Muse And The Texas Rangers Assistant Coaching Team

Jun 05, 2025

Recent Developments Dan Muse And The Texas Rangers Assistant Coaching Team

Jun 05, 2025 -

Carl Nassibs Legacy Exploring The Life Of The Nfls First Openly Gay Player

Jun 05, 2025

Carl Nassibs Legacy Exploring The Life Of The Nfls First Openly Gay Player

Jun 05, 2025

Latest Posts

-

Uswnt Vs Jamaica 4 0 Win Caps Unbeaten International Friendly Series

Jun 06, 2025

Uswnt Vs Jamaica 4 0 Win Caps Unbeaten International Friendly Series

Jun 06, 2025 -

Why Karen Reads Retrial Testimony Was Cancelled On Thursday

Jun 06, 2025

Why Karen Reads Retrial Testimony Was Cancelled On Thursday

Jun 06, 2025 -

7 Billion Ai Deal Sends Applied Digital Stock Up 48

Jun 06, 2025

7 Billion Ai Deal Sends Applied Digital Stock Up 48

Jun 06, 2025 -

Chisholm Jr Back And Better Yankees Secure Win Thanks To Injury Return Solo Home Run

Jun 06, 2025

Chisholm Jr Back And Better Yankees Secure Win Thanks To Injury Return Solo Home Run

Jun 06, 2025 -

Ketema Casting Fuels Rumors Ryan Gosling Eyed For White Black Panther Mcu Role

Jun 06, 2025

Ketema Casting Fuels Rumors Ryan Gosling Eyed For White Black Panther Mcu Role

Jun 06, 2025