Broadcom Stock (AVGO): Q2 Earnings Report Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom Stock (AVGO): Q2 Earnings Report Expectations – A Bullish Outlook?

Broadcom (AVGO) is set to release its second-quarter earnings report soon, and investors are eagerly anticipating the results. The semiconductor giant has consistently delivered strong performance, but the current economic climate and industry headwinds create a complex picture. This article delves into the expectations surrounding AVGO's Q2 earnings, analyzing key factors that could influence the stock price and offering insights for investors.

What to Expect from Broadcom's Q2 2024 Earnings Report:

Analysts are generally optimistic about Broadcom's Q2 performance, forecasting revenue and earnings per share (EPS) that surpass the previous quarter. However, the level of growth is a key area of focus. Several factors contribute to this cautious optimism:

- Strong Demand in Key Sectors: Broadcom's diverse portfolio, catering to sectors like networking, wireless communications, and data centers, offers some resilience against economic downturns. Continued demand in these areas could drive strong revenue growth. Specifically, the growth within the hyperscale data center segment will be crucial in assessing future performance.

- Strategic Acquisitions: Broadcom's track record of strategic acquisitions, enhancing its product portfolio and market position, is a positive indicator for future growth. The impact of these acquisitions on Q2 earnings will be closely scrutinized.

- Supply Chain Issues: While supply chain disruptions have eased somewhat, lingering challenges could still impact production and potentially affect revenue. Investors will be keen to hear management's assessment of the current supply chain landscape.

- Inflationary Pressures: Rising inflation and increased material costs continue to be a challenge for businesses across the sector. Broadcom's ability to manage these pressures and maintain profitability will be a crucial factor.

- Competition: The semiconductor industry is fiercely competitive. Broadcom's ability to maintain its market share and fend off competition will play a significant role in its future success.

Key Metrics to Watch:

Beyond revenue and EPS, investors should pay close attention to the following key metrics:

- Gross margins: Any significant pressure on gross margins due to rising costs or increased competition could negatively impact profitability.

- Operating expenses: Effective cost management is crucial in a challenging economic environment.

- Guidance for Q3 and beyond: Management's outlook for the remainder of the year will be closely analyzed for signs of continued growth or potential headwinds.

Potential Impact on AVGO Stock Price:

A strong Q2 earnings report, exceeding expectations, could trigger a positive reaction from the market, potentially leading to an increase in AVGO's stock price. Conversely, a disappointing report could put downward pressure on the stock.

Investing in AVGO: A Long-Term Perspective:

Despite the short-term uncertainties, Broadcom's long-term prospects remain strong due to its position in key growth sectors. Its diverse portfolio, strategic acquisitions, and strong management team position it well for sustained growth. However, as with any investment, conducting thorough research and understanding the inherent risks is crucial.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Further Reading:

- – For official company announcements and financial filings.

- – For up-to-date news and analysis.

This comprehensive overview of Broadcom's Q2 earnings report expectations should provide investors with valuable insights and help them make informed decisions. Remember to stay updated with the latest news and analysis before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom Stock (AVGO): Q2 Earnings Report Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

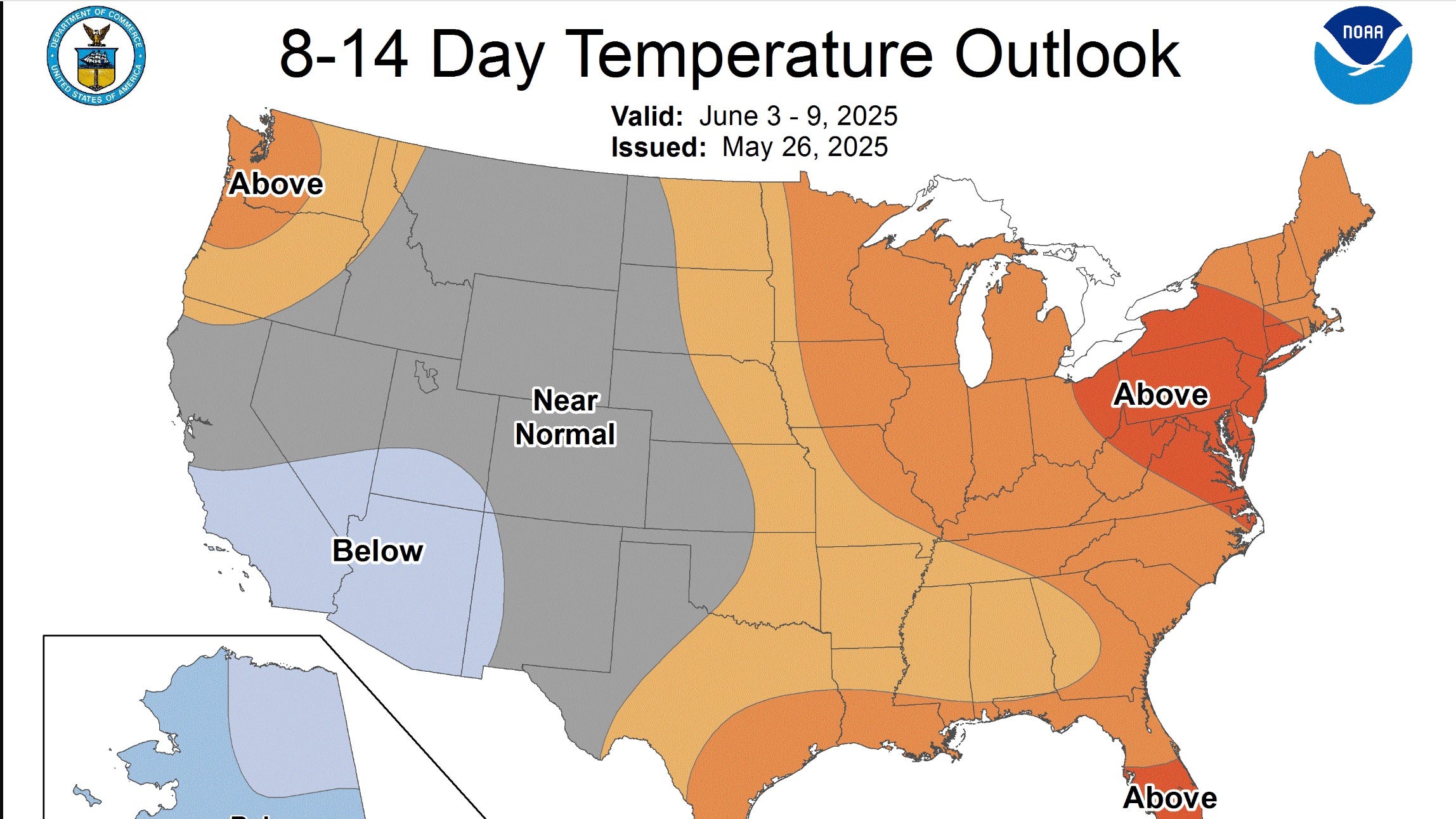

Willamette Valley Temperatures To Soar Into The 90s Oregon Heat Alert

Jun 05, 2025

Willamette Valley Temperatures To Soar Into The 90s Oregon Heat Alert

Jun 05, 2025 -

David Andrews Retirement A New England Legacy

Jun 05, 2025

David Andrews Retirement A New England Legacy

Jun 05, 2025 -

David Andrews Retirement A Patriot To The End

Jun 05, 2025

David Andrews Retirement A Patriot To The End

Jun 05, 2025 -

No Karen Read Trial Today Explanation Of The Delay

Jun 05, 2025

No Karen Read Trial Today Explanation Of The Delay

Jun 05, 2025 -

Yankees Announce Luke Weaver Injured List Placement

Jun 05, 2025

Yankees Announce Luke Weaver Injured List Placement

Jun 05, 2025