Broadcom Earnings Preview: Why $250 Is Crucial For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom Earnings Preview: Why $250 Is Crucial for Investors

Broadcom (AVGO), a semiconductor giant, is poised to release its Q3 2023 earnings report, and the market is buzzing. Analysts and investors are keenly focused on a single, crucial figure: $250. But why is this number so significant? This article delves into the key factors driving investor interest and explains why exceeding or falling short of this benchmark could dramatically impact Broadcom's stock price.

The Significance of the $250 Target

The $250 price point isn't arbitrary. It represents a confluence of several crucial factors impacting investor sentiment and Broadcom's overall valuation:

-

Meeting Analyst Expectations: Many analysts have set a consensus earnings per share (EPS) estimate near or slightly above $10. Coupled with the current market conditions and Broadcom's projected revenue, this translates to a share price target hovering around $250. Falling short could signal weaker-than-expected performance and potentially trigger a sell-off.

-

Maintaining Growth Trajectory: Broadcom has consistently demonstrated strong growth in recent quarters, fueled by demand for its semiconductor solutions in key markets like data centers, 5G infrastructure, and artificial intelligence. Maintaining this upward trajectory is crucial for investor confidence, and $250 serves as a key indicator of continued momentum.

-

Investor Sentiment and Market Confidence: The semiconductor sector has experienced volatility recently. Broadcom's performance relative to the $250 target will significantly influence overall investor sentiment towards the company and the sector as a whole. A strong showing could boost investor confidence, while a weaker result could contribute to broader market uncertainty.

-

Future Growth Projections: The $250 price point isn't just about the current quarter. It also reflects expectations for future growth and Broadcom's ability to capitalize on long-term trends in the technology industry. Exceeding the target suggests strong future prospects, while falling short may raise concerns about potential headwinds.

Factors Affecting Broadcom's Q3 Performance

Several factors could influence Broadcom's Q3 performance and its ability to reach the $250 target:

-

Supply Chain Dynamics: Ongoing challenges in the global semiconductor supply chain could impact Broadcom's production and delivery timelines.

-

Demand in Key Markets: The strength of demand in key markets, particularly data centers and 5G, will be crucial in determining Broadcom's overall revenue and profitability.

-

Competition: Intense competition in the semiconductor industry could impact Broadcom's market share and pricing power.

-

Macroeconomic Conditions: Global economic uncertainty and potential recessionary pressures could influence demand for Broadcom's products.

What to Watch For

When analyzing Broadcom's Q3 earnings report, investors should pay close attention to:

-

Revenue growth: The rate of revenue growth will provide a key indication of Broadcom's overall performance.

-

Earnings per share (EPS): The actual EPS reported will be compared against analyst expectations and will play a significant role in determining the stock price reaction.

-

Guidance for Q4: Broadcom's guidance for the upcoming quarter will offer valuable insights into its future prospects and potentially influence investor sentiment.

-

Management commentary: Statements made by Broadcom's management during the earnings call will offer valuable context and insights into the company's current situation and future plans.

Conclusion: The $250 Threshold Matters

The $250 price point represents a significant threshold for Broadcom. Whether the company exceeds or falls short of this benchmark will significantly impact investor sentiment, the stock's price, and the overall perception of the semiconductor sector. Therefore, investors should carefully monitor the earnings report and accompanying commentary for crucial insights into Broadcom's future prospects. Stay informed and stay invested! Learn more about investing in technology stocks by [linking to a reputable financial news source or educational website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom Earnings Preview: Why $250 Is Crucial For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Cuts For Stefon Diggs Patriots Weather The Storm Of Recent Video

Jun 04, 2025

No Cuts For Stefon Diggs Patriots Weather The Storm Of Recent Video

Jun 04, 2025 -

French Open Live Musetti Vs Tiafoe Quarter Final Showdown Swiatek Sets Up Sabalenka Clash

Jun 04, 2025

French Open Live Musetti Vs Tiafoe Quarter Final Showdown Swiatek Sets Up Sabalenka Clash

Jun 04, 2025 -

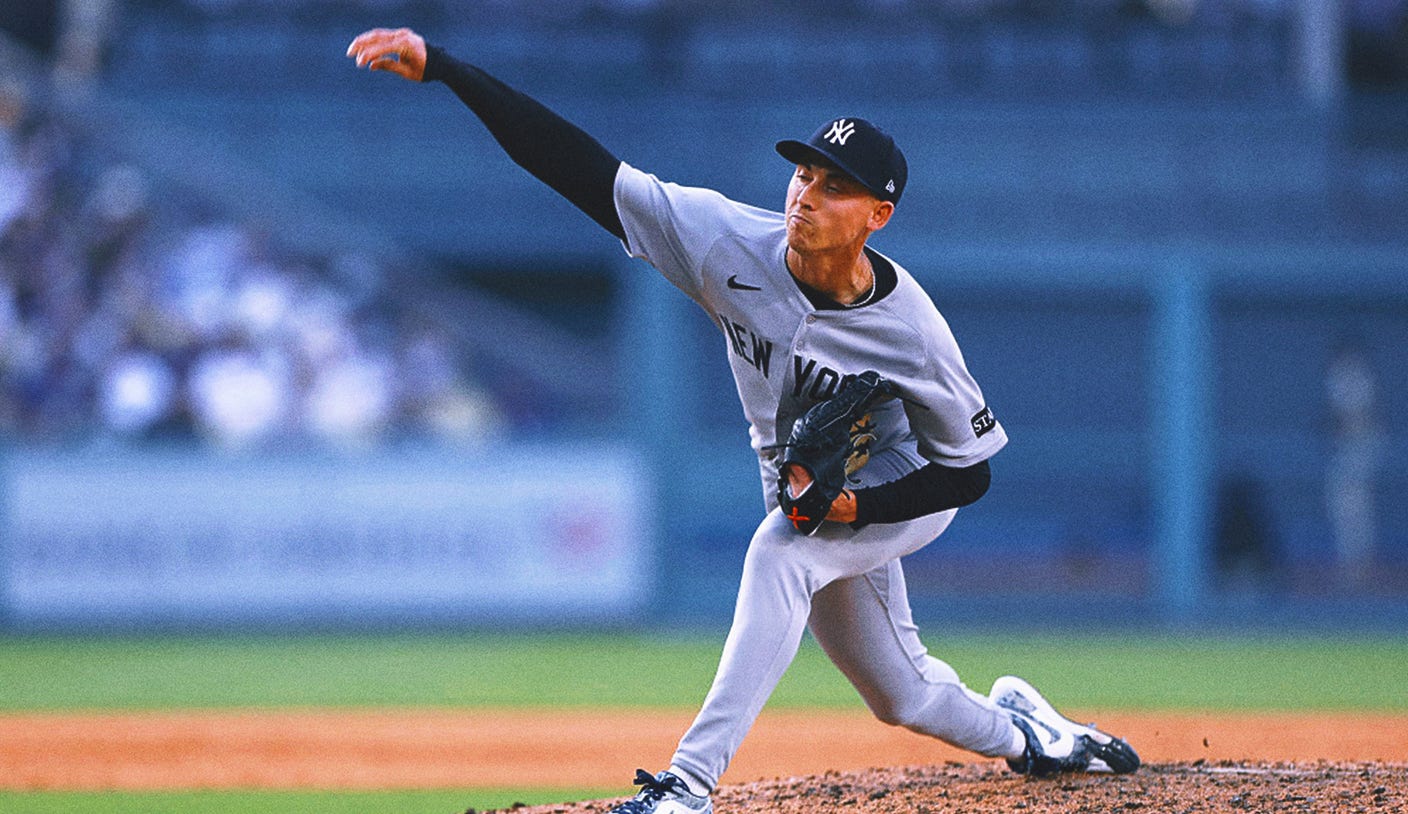

Official Announcement Expected Luke Weavers Yankees Injury

Jun 04, 2025

Official Announcement Expected Luke Weavers Yankees Injury

Jun 04, 2025 -

Buffetts Billions A 39 Bank Of America Stake Sale And A 7 700 Winner

Jun 04, 2025

Buffetts Billions A 39 Bank Of America Stake Sale And A 7 700 Winner

Jun 04, 2025 -

Some Players Bike To Cricket Match After Traffic Delays England West Indies Game

Jun 04, 2025

Some Players Bike To Cricket Match After Traffic Delays England West Indies Game

Jun 04, 2025