Broadcom Earnings Imminent: Why Wall Street Is Focused On The $250 Mark

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom Earnings Imminent: Why Wall Street is Focused on the $250 Mark

Investors are bracing for Broadcom's (AVGO) upcoming earnings report, with a significant focus on whether the chip giant can breach the crucial $250 price point. The semiconductor industry has experienced a rollercoaster ride recently, marked by fluctuating demand and economic uncertainty. Broadcom, a key player in the sector, is poised to offer vital insights into the current health of the market, and its performance will significantly influence investor sentiment.

The anticipation surrounding Broadcom's earnings is palpable. Wall Street analysts are closely scrutinizing the company's guidance for the coming quarters, particularly in light of recent macroeconomic headwinds. The $250 price point represents a psychological barrier for many investors, signifying a significant milestone in Broadcom's valuation and a potential indicator of future growth.

Why the $250 Mark Matters

Several factors contribute to the significance of the $250 price target for Broadcom's stock:

-

Strong Q3 Performance Expectations: Analysts generally anticipate a strong Q3 performance from Broadcom, driven by robust demand for its networking and infrastructure chips. However, concerns remain about potential softening in the consumer electronics market, which could impact certain segments of Broadcom's business.

-

Macroeconomic Uncertainty: Global economic headwinds, including inflation and potential recessionary pressures, are creating uncertainty within the tech sector. Broadcom's ability to navigate these challenges and maintain strong growth will be closely examined.

-

Competition and Market Share: The semiconductor industry is fiercely competitive. Broadcom's ability to maintain or expand its market share against rivals will play a crucial role in determining its future performance and stock price.

-

Data Center Demand: The data center market remains a key growth driver for Broadcom. The company's success in this area will be pivotal in determining whether it can surpass the $250 mark.

What to Expect from the Earnings Report

Broadcom's earnings report is expected to provide clarity on several key areas:

-

Revenue and Earnings Growth: Investors will be looking for evidence of sustained revenue and earnings growth, demonstrating the company's resilience in a challenging market.

-

Guidance for Q4 and Beyond: The company's guidance for the coming quarters will offer insights into its future outlook and growth trajectory. This will be particularly crucial for determining whether the $250 price point is achievable.

-

Capital Expenditures and R&D Spending: Broadcom's investment in research and development (R&D) and capital expenditures will indicate its commitment to innovation and future growth.

-

Management Commentary: Statements from Broadcom's management regarding the current market conditions and future outlook will be closely scrutinized by investors.

Broadcom's Position in the Semiconductor Industry

Broadcom is a leading designer, developer, and supplier of a wide range of high-performance semiconductor and infrastructure software solutions. The company's products are used in various applications, including data centers, smartphones, and networking infrastructure. [Link to Broadcom's Investor Relations page]. Understanding its market position is critical for interpreting the significance of this earnings report.

Investing in Broadcom: A Cautious Approach?

While the $250 price point represents a significant milestone, investors should approach any investment decision with caution, conducting thorough due diligence and considering their individual risk tolerance. The semiconductor industry is inherently cyclical, and macroeconomic factors can significantly impact company performance.

Conclusion:

Broadcom's upcoming earnings report is a crucial event for investors. The potential for the stock price to surpass the $250 mark depends on a number of factors, including the company's Q3 performance, guidance for the future, and the overall health of the semiconductor market. Stay tuned for updates as the results are released and analyzed by market experts. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom Earnings Imminent: Why Wall Street Is Focused On The $250 Mark. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ryan Goslings Potential Exploring The White Black Panther Role In The Mcu Following Ketema Reveal

Jun 05, 2025

Ryan Goslings Potential Exploring The White Black Panther Role In The Mcu Following Ketema Reveal

Jun 05, 2025 -

Hood Stock Surge Robinhood Shares Climb 6 46 June 3rd

Jun 05, 2025

Hood Stock Surge Robinhood Shares Climb 6 46 June 3rd

Jun 05, 2025 -

Injury Concerns For Yankees Luke Weavers Status

Jun 05, 2025

Injury Concerns For Yankees Luke Weavers Status

Jun 05, 2025 -

Tomorrows Broadcom Avgo Earnings A Detailed Outlook

Jun 05, 2025

Tomorrows Broadcom Avgo Earnings A Detailed Outlook

Jun 05, 2025 -

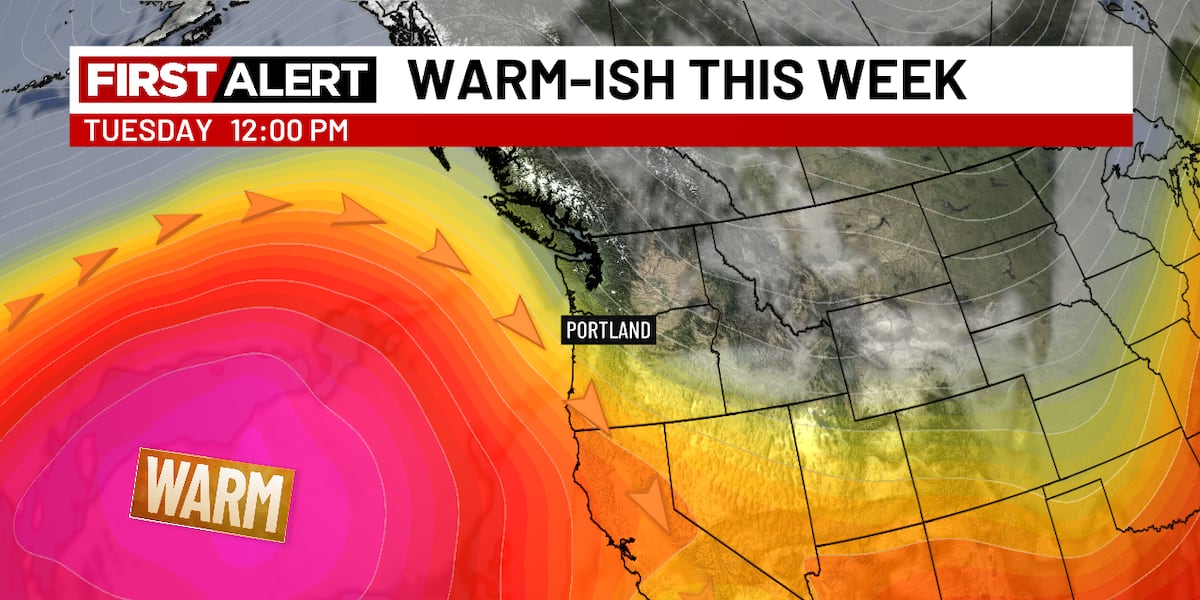

Dry And Sunny Skies To Dominate Early June

Jun 05, 2025

Dry And Sunny Skies To Dominate Early June

Jun 05, 2025