Broadcom (AVGO) Q2 Earnings: Impact On Stock Price And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom (AVGO) Q2 Earnings: Impact on Stock Price and Future Outlook

Broadcom (AVGO), a leading designer, developer, and global supplier of a wide range of semiconductor and infrastructure software solutions, recently released its Q2 2024 earnings report, sending ripples through the tech industry and impacting its stock price significantly. This report delves into the key takeaways from the earnings announcement, analyzes its impact on AVGO's stock price, and explores the future outlook for the company.

Q2 Earnings: A Mixed Bag

Broadcom reported better-than-expected revenue for the second quarter, exceeding analyst estimates. However, the company's outlook for Q3 was slightly more cautious than some investors had hoped, leading to a mixed reaction in the market. The revenue beat was primarily driven by strong performance in its infrastructure software segment, a testament to the growing demand for cloud computing and data center solutions. This positive performance offset some softness in other areas, resulting in a complex picture for investors to interpret.

Key Highlights from the Earnings Report:

- Revenue Beat: Broadcom surpassed analyst expectations for Q2 revenue, signaling strong demand for its products.

- Software Strength: The infrastructure software segment showed particularly strong growth, highlighting Broadcom's successful diversification strategy.

- Cautious Q3 Guidance: While Q2 results were positive, the company’s guidance for Q3 was more conservative, potentially impacting investor confidence.

- Margins Under Pressure: Increased competition and supply chain challenges put some pressure on profit margins.

- Strong Free Cash Flow: Despite the margin pressure, Broadcom continued to generate robust free cash flow, supporting its capital allocation strategy.

Impact on AVGO Stock Price:

The initial market reaction to the earnings report was somewhat volatile. While the revenue beat initially boosted the stock price, the cautious Q3 guidance led to a subsequent pullback. This highlights the importance of both current performance and future expectations in shaping investor sentiment and stock valuation. The long-term impact on the stock price will depend on how Broadcom navigates the challenges and opportunities ahead. Analyzing the trading volume and price movements following the earnings release provides a clearer picture of investor reaction. [Link to a reputable financial news source charting AVGO's stock price].

Future Outlook: Navigating Uncertainties

Broadcom’s future success will hinge on several factors, including:

- Maintaining Momentum in Software: Continued growth in the infrastructure software segment will be crucial for sustained revenue growth.

- Addressing Supply Chain Challenges: Effectively managing supply chain disruptions will be vital for meeting demand and maintaining profitability.

- Competitive Landscape: Navigating intense competition in the semiconductor industry will require strategic innovation and adaptability.

- Regulatory Environment: The regulatory landscape, particularly concerning potential antitrust concerns, could also play a significant role in shaping Broadcom's future.

Conclusion: A Cautiously Optimistic View

While the Q2 earnings report presented a mixed picture for Broadcom, the company's overall performance remains relatively strong. The cautious Q3 guidance underscores the uncertainties in the current market environment. However, Broadcom's position as a leading player in key technology sectors, combined with its strong free cash flow, suggests a cautiously optimistic outlook for the long term. Investors should closely monitor the company's progress in navigating the challenges and capitalizing on the opportunities ahead. Further analysis of industry trends and competitor activities will be crucial for assessing the long-term prospects of AVGO. This is a dynamic situation, and staying informed is essential for any investor considering Broadcom stock.

Disclaimer: This article provides general information and should not be considered investment advice. Consult a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom (AVGO) Q2 Earnings: Impact On Stock Price And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

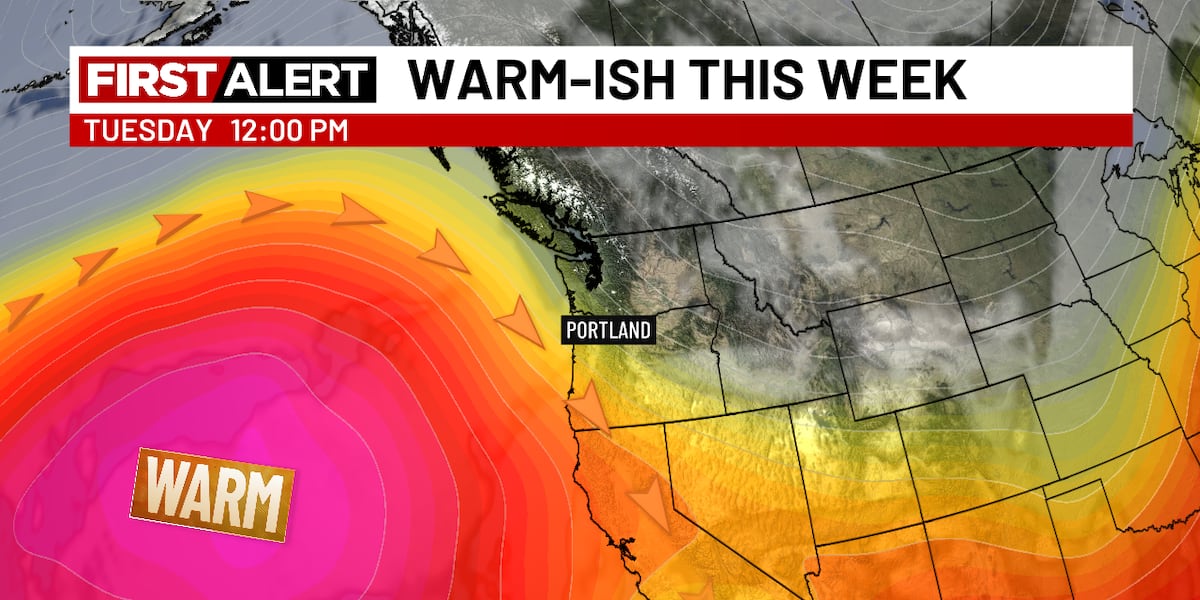

Dry Sunny And Warm Junes Weather Forecast

Jun 05, 2025

Dry Sunny And Warm Junes Weather Forecast

Jun 05, 2025 -

Who Is Carl Nassib A Look At The Groundbreaking Nfl Player

Jun 05, 2025

Who Is Carl Nassib A Look At The Groundbreaking Nfl Player

Jun 05, 2025 -

Top 10 Sports Headlines Of May Memorable Moments And Unforgettable Games

Jun 05, 2025

Top 10 Sports Headlines Of May Memorable Moments And Unforgettable Games

Jun 05, 2025 -

Financial Crisis Threatens Australias Largest Energy Storage Project Supplier

Jun 05, 2025

Financial Crisis Threatens Australias Largest Energy Storage Project Supplier

Jun 05, 2025 -

Luke Weavers Injury Yankees To Add Closer To Il

Jun 05, 2025

Luke Weavers Injury Yankees To Add Closer To Il

Jun 05, 2025