Broadcom (AVGO) Earnings: Trader Sentiment And Stock Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom (AVGO) Earnings: Trader Sentiment and Stock Outlook After Strong Q3 Results

Broadcom (AVGO) recently reported stellar third-quarter earnings, exceeding analyst expectations and sending ripples through the tech sector. But what does this mean for investors? Let's delve into the trader sentiment surrounding AVGO and explore the stock's outlook in the coming months.

Q3 Earnings: A Beat and Raise

Broadcom smashed Q3 expectations, reporting earnings per share (EPS) significantly above forecasts and raising its guidance for the fourth quarter. This strong performance was driven by robust demand across its key segments, including semiconductor solutions for data centers, wireless communications, and broadband infrastructure. The company's diversification across various tech sectors proved to be a key strength, mitigating the impact of potential slowdowns in specific markets. This positive news fueled a surge in AVGO's stock price immediately following the earnings release.

Positive Trader Sentiment, But Cautious Optimism

The market's reaction to Broadcom's Q3 results reflects a generally positive trader sentiment. Many analysts have upgraded their price targets for AVGO, citing the company's strong execution and promising outlook. However, a note of caution remains. While the near-term outlook appears bright, macroeconomic headwinds, including potential inflation and recessionary concerns, continue to cast a shadow over the broader tech sector. This cautious optimism is reflected in the relatively moderate stock price increase following the earnings announcement, rather than a dramatic surge.

Key Factors Shaping the AVGO Stock Outlook:

- Demand for Semiconductors: The continued strong demand for semiconductors across various industries is crucial for Broadcom's future performance. Any slowdown in this demand could negatively impact the stock's trajectory.

- Global Economic Conditions: The overall global economic climate will play a significant role. A potential recession could dampen demand for technology products, impacting Broadcom's revenue.

- Competition: Intense competition within the semiconductor industry remains a key risk factor. Broadcom's ability to innovate and maintain its market share will be vital for its future success.

- Supply Chain Resilience: Maintaining a resilient supply chain in the face of geopolitical uncertainties is critical. Disruptions could lead to production delays and impact profitability.

- Acquisition Strategy: Broadcom's history of strategic acquisitions could further fuel growth. Successful acquisitions will enhance its product portfolio and market position.

H2 2023 and Beyond: What to Expect

While the Q3 results were undoubtedly positive, investors should approach the AVGO stock outlook with a balanced perspective. While the near-term prospects appear strong, monitoring the macroeconomic environment and keeping an eye on the competitive landscape is crucial. The company's ability to navigate these challenges will ultimately determine its long-term success. Many analysts believe that AVGO remains a strong buy for long-term investors, given its diversified portfolio and strong management team.

Should You Invest in AVGO?

The decision to invest in Broadcom ultimately depends on your individual risk tolerance and investment goals. It's crucial to conduct thorough due diligence before making any investment decisions. Consulting with a financial advisor is always recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom (AVGO) Earnings: Trader Sentiment And Stock Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Historic Victory Rockies Win First Series In Over Two Years

Jun 05, 2025

Historic Victory Rockies Win First Series In Over Two Years

Jun 05, 2025 -

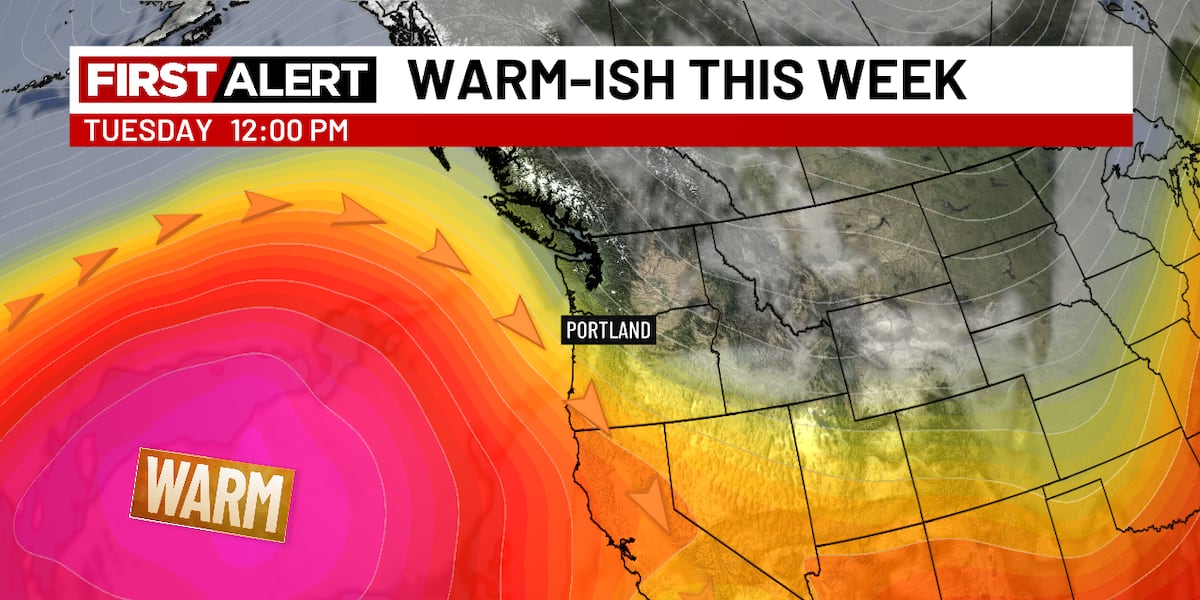

Dry And Sunny Skies To Dominate Early June

Jun 05, 2025

Dry And Sunny Skies To Dominate Early June

Jun 05, 2025 -

Another Portland Energy Firm Threatened With Shutdown What Went Wrong

Jun 05, 2025

Another Portland Energy Firm Threatened With Shutdown What Went Wrong

Jun 05, 2025 -

Massive Ai Lease Agreement Propels Applied Digital Stock 48 Higher

Jun 05, 2025

Massive Ai Lease Agreement Propels Applied Digital Stock 48 Higher

Jun 05, 2025 -

Former Nfl Stars Jersey Finds A Home At The Smithsonian

Jun 05, 2025

Former Nfl Stars Jersey Finds A Home At The Smithsonian

Jun 05, 2025