Boeing's 2025 Stock Performance: Analysis And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Boeing's 2025 Stock Performance: Analysis and Predictions

Boeing (BA), an aerospace giant synonymous with aviation innovation, has experienced a turbulent few years. From the 737 MAX grounding to supply chain disruptions and the impact of the global pandemic, the company's stock performance has been anything but predictable. But what does the future hold? This article delves into an analysis of Boeing's current situation and offers informed predictions for its stock performance in 2025.

Current State of Boeing:

Boeing's recent performance has been a mixed bag. While the 737 MAX is back in service, production remains carefully managed, and the company is focused on addressing lingering safety concerns and rebuilding customer confidence. The defense sector continues to be a strong performer, providing a degree of stability. However, ongoing inflation, rising interest rates, and geopolitical uncertainty continue to pose challenges. Supply chain issues, though easing, still impact production schedules and profitability.

Key Factors Influencing Boeing's 2025 Stock:

Several key factors will significantly influence Boeing's stock price in 2025:

- 737 MAX Production and Deliveries: Increased and sustained production of the 737 MAX is crucial for boosting revenue and regaining market share. Any further setbacks or production delays could negatively impact the stock.

- 787 Dreamliner Production: Resolving the 787 Dreamliner production issues and returning to a steady delivery rate is vital for long-term financial health.

- Defense Contracts: Securing significant defense contracts, both domestically and internationally, will provide crucial revenue streams and stability. Competition in this sector is fierce, making this a significant factor.

- Global Economic Conditions: A robust global economy is essential for strong demand for both commercial and defense aircraft. Recessions or significant economic slowdowns could negatively impact sales.

- Technological Advancements: Boeing's ability to innovate and develop next-generation aircraft and technologies will play a critical role in its future success and market competitiveness.

Predictions for Boeing's Stock in 2025:

Predicting stock prices is inherently risky, and any forecast should be considered speculative. However, based on the current analysis, several scenarios are plausible:

-

Optimistic Scenario: If Boeing successfully ramps up 737 MAX and 787 production, secures significant defense contracts, and the global economy remains relatively strong, we could see a significant increase in Boeing's stock price by 2025. This scenario might see a price increase exceeding 30% from current levels.

-

Neutral Scenario: If Boeing maintains its current production levels, faces moderate challenges in securing contracts, and the global economy experiences moderate growth, the stock price may remain relatively stable or experience modest growth (5-15%).

-

Pessimistic Scenario: Significant production delays, loss of major contracts, a global recession, or unexpected geopolitical events could result in a decline in Boeing's stock price. This scenario could see a price decrease of up to 20% or more.

Investing in Boeing:

Investing in the stock market always involves risk. Before investing in Boeing or any other company, conduct thorough due diligence, consider your personal risk tolerance, and consult with a financial advisor. Remember, past performance is not indicative of future results.

Conclusion:

Boeing's future stock performance hinges on several interconnected factors. While challenges remain, the company's long-term prospects are tied to its ability to execute its production plans, secure contracts, and navigate the complexities of the global aerospace market. Careful monitoring of these factors is crucial for investors considering a position in Boeing stock. Stay informed, stay vigilant, and make informed decisions.

(Disclaimer: This article is for informational purposes only and should not be considered financial advice.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Boeing's 2025 Stock Performance: Analysis And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

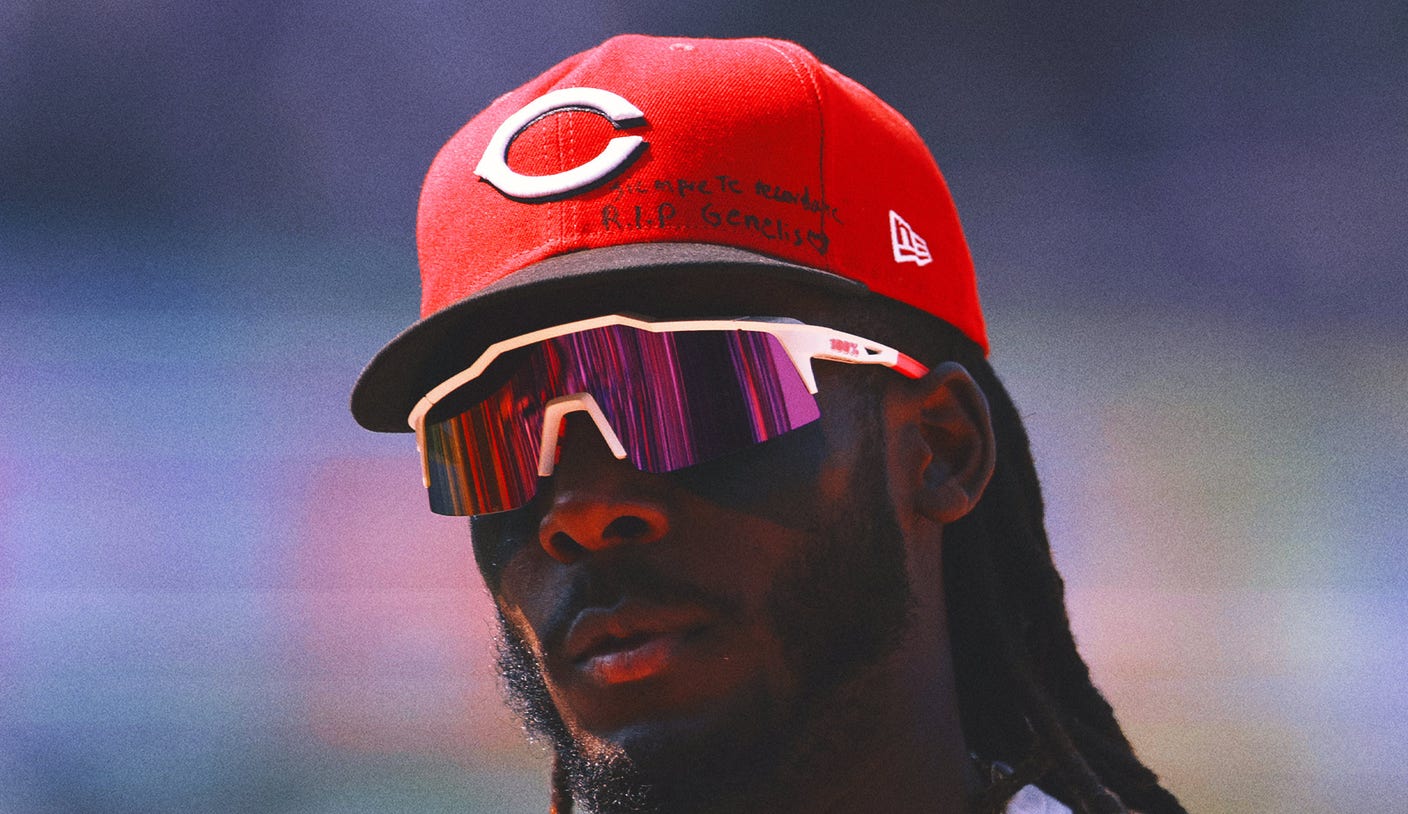

Reds Elly De La Cruz Honors Sister With Home Run Following Her Passing

Jun 03, 2025

Reds Elly De La Cruz Honors Sister With Home Run Following Her Passing

Jun 03, 2025 -

From Courts To Camaraderie Baptistes Growth Inspired By Tiafoe

Jun 03, 2025

From Courts To Camaraderie Baptistes Growth Inspired By Tiafoe

Jun 03, 2025 -

Update Gabe Davis Plans Visit With Pittsburgh Steelers

Jun 03, 2025

Update Gabe Davis Plans Visit With Pittsburgh Steelers

Jun 03, 2025 -

Netflixs She The People Founders Lawsuit Against Tyler Perry Heats Up

Jun 03, 2025

Netflixs She The People Founders Lawsuit Against Tyler Perry Heats Up

Jun 03, 2025 -

Deaths Reported Amid Psg Champions League Final Fan Celebrations In France

Jun 03, 2025

Deaths Reported Amid Psg Champions League Final Fan Celebrations In France

Jun 03, 2025