Bitcoin ETF Investments Surge Past $5 Billion: What's Driving The Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surge Past $5 Billion: What's Driving the Growth?

Record-breaking inflows into Bitcoin exchange-traded funds (ETFs) have surpassed $5 billion, marking a significant milestone for the cryptocurrency market and signaling a growing acceptance of Bitcoin as a mainstream asset. This surge in investment highlights a shift in investor sentiment, driven by a confluence of factors ranging from regulatory clarity to institutional adoption and the enduring appeal of Bitcoin's decentralized nature.

The recent approval of several Bitcoin ETFs in the United States has been a pivotal catalyst for this dramatic increase. This regulatory green light has opened the doors for a wider range of investors, including those traditionally wary of the complexities and volatility associated with directly holding Bitcoin. Now, access is simpler and arguably safer through the regulated framework of an ETF.

What Factors Are Fueling this Bitcoin ETF Boom?

Several key factors are contributing to the exponential growth in Bitcoin ETF investments:

-

Regulatory Approvals: The SEC's approval of spot Bitcoin ETFs is undoubtedly the primary driver. This legitimizes Bitcoin in the eyes of many institutional investors and provides a much-needed layer of regulatory oversight, mitigating some of the risks associated with direct Bitcoin ownership.

-

Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin ETFs. This institutional interest adds significant credibility and contributes to price stability, attracting more retail investors.

-

Growing Retail Investor Interest: The ease of access provided by ETFs has opened the doors for retail investors who may not have the technical expertise or risk tolerance to invest directly in Bitcoin. This wider accessibility fuels demand and contributes to the overall growth.

-

Inflation Hedge Narrative: Bitcoin's limited supply and decentralized nature continue to attract investors seeking an inflation hedge in an environment of persistent economic uncertainty. This narrative remains a powerful driver of long-term investment interest.

-

Technological Advancements: Ongoing developments in the Bitcoin network, including the Lightning Network for faster and cheaper transactions, contribute to its long-term viability and attractiveness as an investment.

The Future of Bitcoin ETF Investments

The outlook for Bitcoin ETF investments remains positive, though caution is always advised in the volatile world of cryptocurrency. Further regulatory approvals globally and increased institutional adoption are expected to fuel continued growth. However, potential regulatory hurdles and macroeconomic factors could influence future investment flows.

Potential Risks to Consider:

- Market Volatility: Bitcoin's price remains highly volatile, and investors should be prepared for significant price fluctuations.

- Regulatory Uncertainty: While recent approvals are positive, future regulatory changes could impact the Bitcoin ETF market.

- Security Risks: Although ETFs offer a layer of security compared to direct Bitcoin ownership, investors should carefully research the fund manager's security protocols.

This unprecedented surge in Bitcoin ETF investments signifies a critical turning point for the cryptocurrency market. The increased accessibility, regulatory clarity, and institutional confidence are all contributing to the mainstream adoption of Bitcoin as a viable asset class. While risks remain, the long-term potential for growth within the Bitcoin ETF space appears significant. Further developments in the regulatory landscape and the broader macroeconomic environment will be crucial in shaping the future trajectory of this investment trend. Stay tuned for further updates as the market evolves.

Learn more: (Example - replace with a relevant and authoritative link).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Surge Past $5 Billion: What's Driving The Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

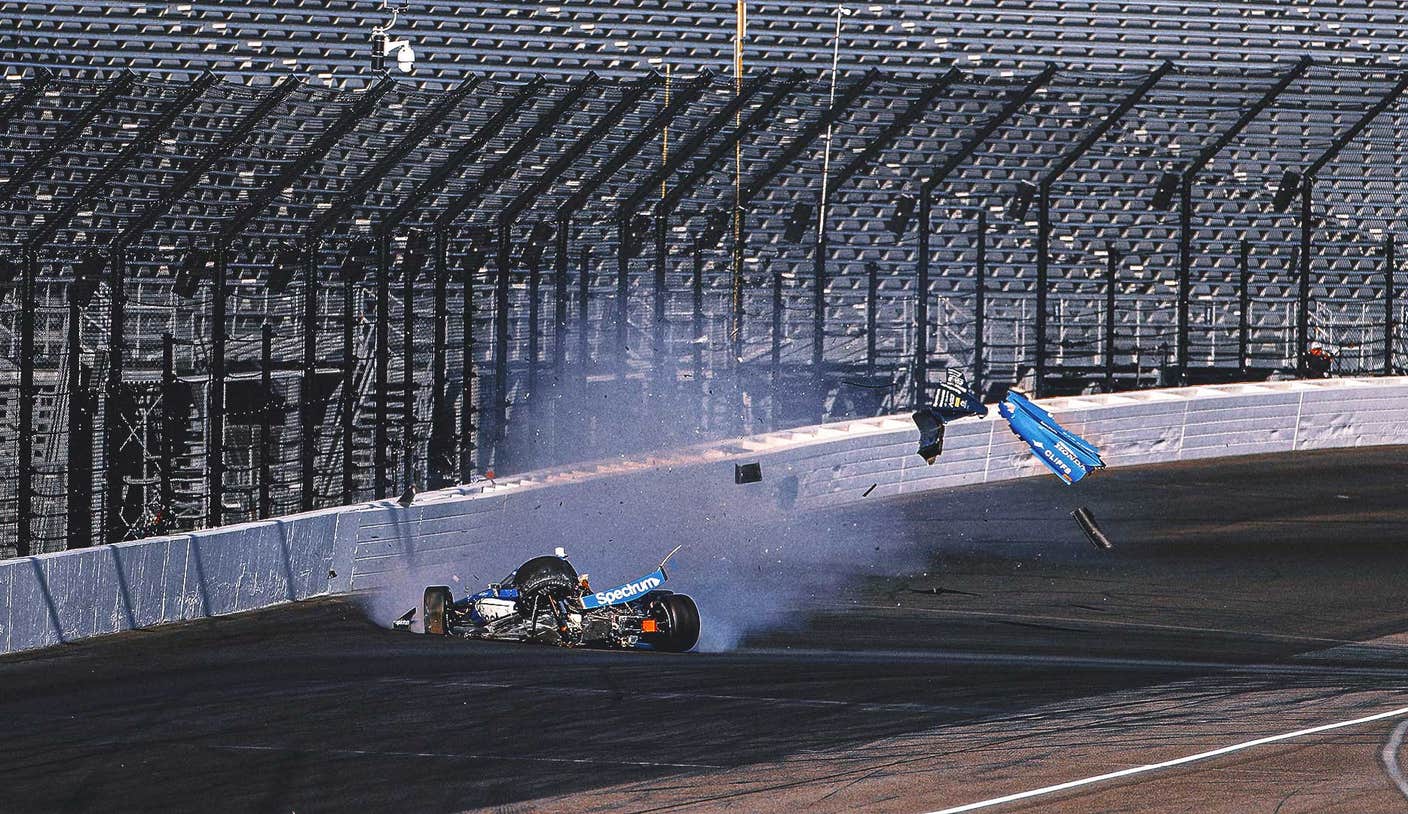

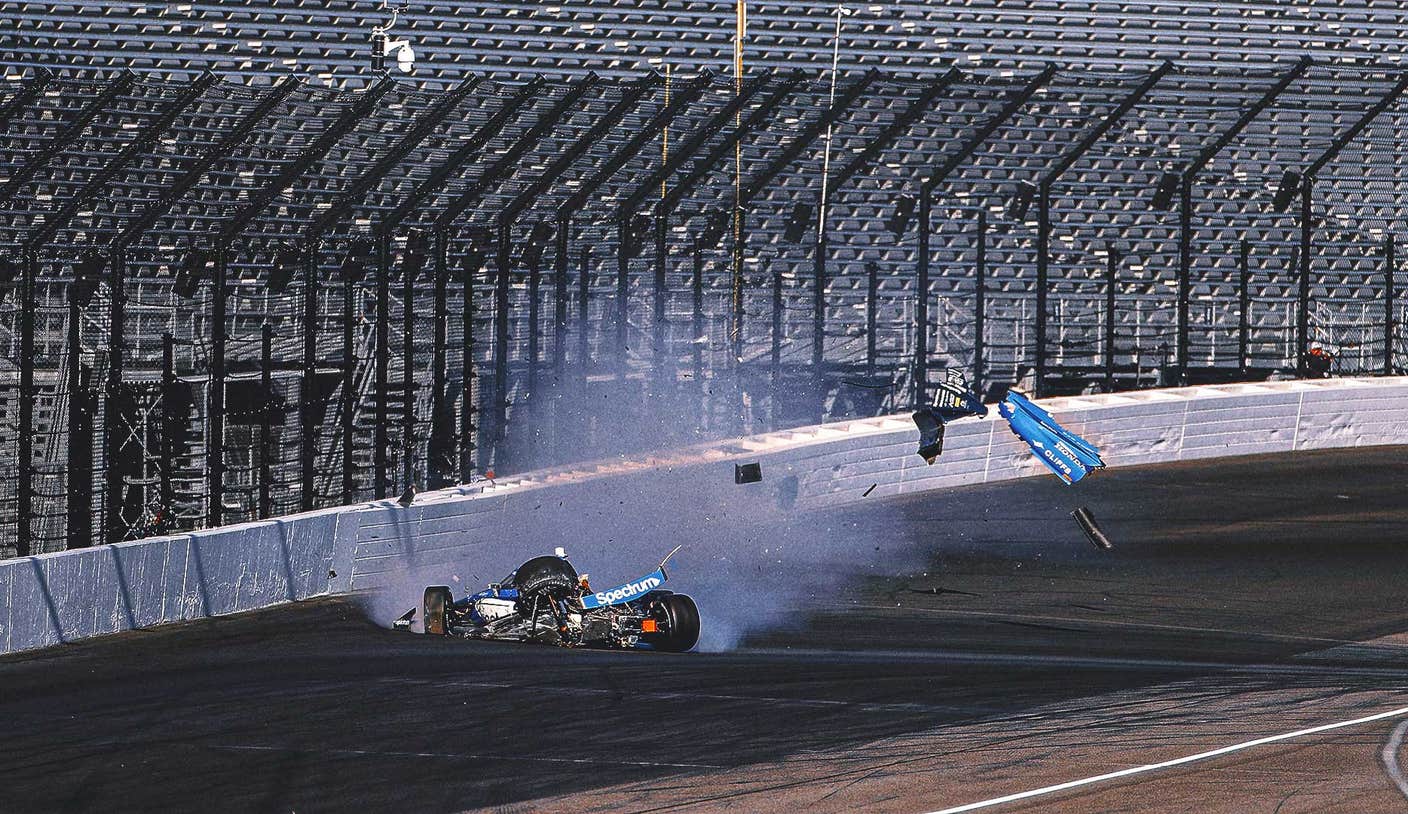

Multiple Crashes Disrupt Indy 500 Practice

May 20, 2025

Multiple Crashes Disrupt Indy 500 Practice

May 20, 2025 -

Indy 500 Practice Examining A Series Of Accidents

May 20, 2025

Indy 500 Practice Examining A Series Of Accidents

May 20, 2025 -

San Francisco Giants Secure Victory With Walk Off Walk Against Oakland As

May 20, 2025

San Francisco Giants Secure Victory With Walk Off Walk Against Oakland As

May 20, 2025 -

Updated 2025 Nba Title Odds Thunder And Knicks Vie For Championship Glory

May 20, 2025

Updated 2025 Nba Title Odds Thunder And Knicks Vie For Championship Glory

May 20, 2025 -

No Te Lo Pierdas Yahir Y Victor Garcia Cantan Otra Vez En Juego De Voces 2025

May 20, 2025

No Te Lo Pierdas Yahir Y Victor Garcia Cantan Otra Vez En Juego De Voces 2025

May 20, 2025