Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Directional Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Surge Past $5 Billion: A Bullish Signal or Temporary Frenzy?

The world of finance is abuzz with excitement as investments in Bitcoin exchange-traded funds (ETFs) have officially surpassed the $5 billion mark. This monumental leap represents a significant shift in the landscape of cryptocurrency investment, attracting both seasoned investors and newcomers alike. But what does this surge truly signify? Is it a bullish indicator pointing towards a sustained Bitcoin price rally, or merely a temporary influx of capital driven by short-term market trends? Let's delve into the data and analyze the directional bets shaping this momentous occasion.

The Explosive Growth of Bitcoin ETFs

The recent approval of several Bitcoin ETFs in the US has undeniably fueled this surge. Investors, previously hesitant due to regulatory uncertainty, now have a more accessible and regulated pathway into the Bitcoin market. This accessibility has opened the floodgates, allowing a wider range of investors – including institutional players – to participate. The ease of trading Bitcoin ETFs through traditional brokerage accounts is a key driver of this growth, eliminating the complexities associated with direct Bitcoin ownership.

Analyzing the Directional Bets:

The massive investment influx begs the question: what are investors expecting? Several factors contribute to the optimistic outlook:

- Increased Institutional Adoption: The involvement of large institutional investors signals a growing acceptance of Bitcoin as a legitimate asset class. This is a significant shift from the early days of Bitcoin, where the market was largely dominated by individual investors.

- Regulatory Clarity: The approval of ETFs in major markets like the US provides a crucial layer of regulatory legitimacy, reassuring investors concerned about the volatility and legal ambiguities surrounding cryptocurrencies.

- Inflation Hedge Narrative: Bitcoin continues to be viewed by many as a potential hedge against inflation. In times of economic uncertainty, investors often seek alternative assets to protect their purchasing power, making Bitcoin an attractive option.

However, caution is warranted. The current surge could also be attributed to several factors that might not signal long-term bullish sentiment:

- FOMO (Fear Of Missing Out): The rapid rise in ETF investments might be partly driven by fear of missing out on potential gains, leading to a speculative bubble.

- Short-Term Market Sentiment: Positive market sentiment and short-term price increases can easily attract speculative capital, leading to temporary surges that don't necessarily reflect long-term trends.

- Regulatory Uncertainty (Still Present): While some progress has been made, regulatory uncertainty surrounding cryptocurrencies remains a considerable risk factor.

What Lies Ahead?

Predicting the future of Bitcoin is inherently challenging. While the $5 billion milestone is undoubtedly impressive and suggests growing mainstream acceptance, it's crucial to remain aware of the potential risks. The sustained growth of Bitcoin ETF investments will depend heavily on factors such as broader market conditions, regulatory developments, and the ongoing evolution of the cryptocurrency ecosystem.

Further Reading:

- [Link to a reputable article on Bitcoin ETF approvals]

- [Link to a reputable article on institutional investment in Bitcoin]

- [Link to a reputable article on Bitcoin's role as an inflation hedge]

Conclusion:

The surpassing of the $5 billion mark in Bitcoin ETF investments is a significant development, reflecting growing institutional interest and regulatory clarity. However, it's essential to maintain a balanced perspective, acknowledging the potential for both short-term speculative behavior and long-term sustained growth. Only time will tell whether this surge marks a new era of Bitcoin adoption or a temporary market anomaly. The journey continues, and investors should remain informed and exercise due diligence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Directional Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solo Leveling Award Win Signals Further Success For The Series

May 21, 2025

Solo Leveling Award Win Signals Further Success For The Series

May 21, 2025 -

Bigger Stronger Better Marvin Harrison Jr Aims For Sophomore Success

May 21, 2025

Bigger Stronger Better Marvin Harrison Jr Aims For Sophomore Success

May 21, 2025 -

Trae Young Knicks Vs Thunder Fans A Stark Contrast In Reactions

May 21, 2025

Trae Young Knicks Vs Thunder Fans A Stark Contrast In Reactions

May 21, 2025 -

Nfl Green Bay Packers Revised Proposal For Tush Push Rule Explained

May 21, 2025

Nfl Green Bay Packers Revised Proposal For Tush Push Rule Explained

May 21, 2025 -

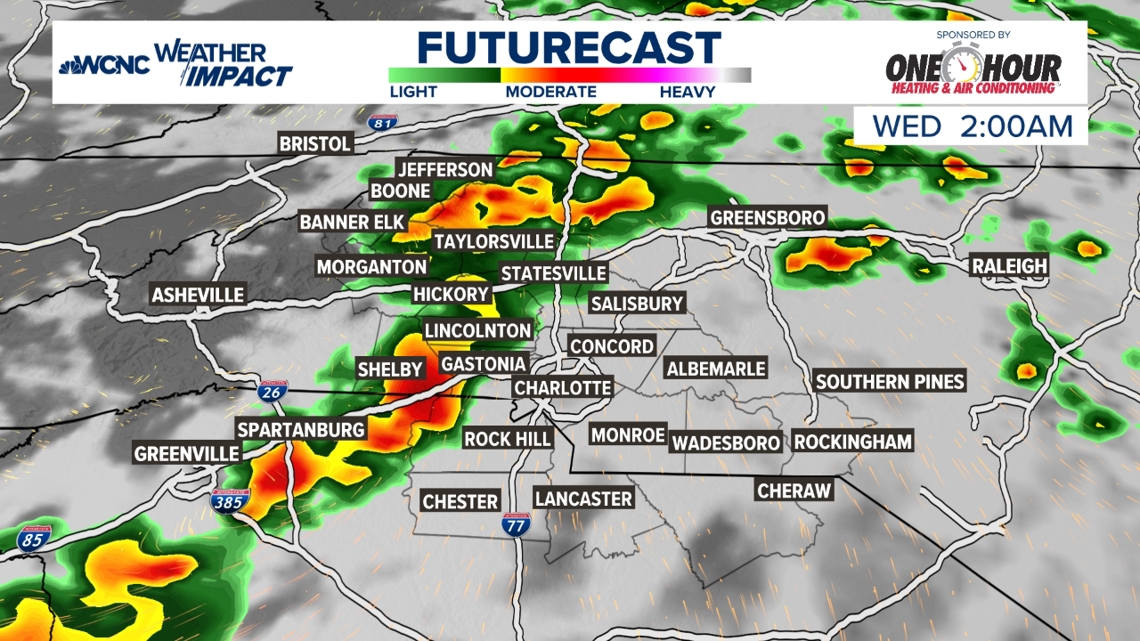

Few Strong Storms Expected Tuesday Night Limited Risk

May 21, 2025

Few Strong Storms Expected Tuesday Night Limited Risk

May 21, 2025