Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Bold Bets Driving Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: Analyzing the Bold Bets Driving Growth

The world of finance is buzzing. Bitcoin exchange-traded funds (ETFs) have officially crossed the $5 billion investment mark, a monumental leap signifying a significant shift in investor sentiment towards the leading cryptocurrency. This surge isn't just a fleeting trend; it's a bold statement reflecting growing institutional acceptance and a calculated bet on Bitcoin's future. But what's driving this explosive growth, and what does it mean for the future of Bitcoin and the broader financial landscape?

The Institutional Embrace of Bitcoin ETFs

The recent surge in Bitcoin ETF investments is largely attributed to the increasing institutional adoption of cryptocurrencies. Previously hesitant, major financial players are now recognizing Bitcoin's potential as a valuable asset class. This shift is fueled by several factors:

-

Regulatory Clarity (or the Lack Thereof): While regulatory frameworks surrounding crypto remain complex and evolving, the approval of several Bitcoin ETFs in key markets like the US has provided a degree of legitimacy and paved the way for broader institutional participation. The ongoing debate surrounding further regulatory developments continues to shape investor confidence.

-

Diversification Strategies: Many institutional investors view Bitcoin as a hedge against inflation and a valuable diversifier within their existing portfolios. Its low correlation with traditional assets makes it an attractive option for managing risk.

-

Technological Advancements: The ongoing development of the Bitcoin network, including advancements in layer-2 scaling solutions and improved security protocols, further bolsters investor confidence in its long-term viability.

Beyond the Hype: Understanding the Risks

While the $5 billion milestone is undeniably impressive, it's crucial to acknowledge the inherent risks associated with Bitcoin ETF investments. The cryptocurrency market is notoriously volatile, and significant price swings are commonplace. Investors must carefully consider:

-

Market Volatility: Bitcoin's price is subject to rapid and unpredictable fluctuations influenced by factors ranging from regulatory announcements to macroeconomic events.

-

Security Risks: While Bitcoin's underlying technology is robust, exchanges and custodial services remain vulnerable to hacking and security breaches.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies continues to evolve, and future regulatory changes could significantly impact the value of Bitcoin ETFs.

The Future of Bitcoin ETF Investments: A Look Ahead

The $5 billion milestone represents a significant turning point, but it's only the beginning. The continued growth of Bitcoin ETF investments will likely depend on several factors, including:

-

Further Regulatory Approvals: Expansion of ETF offerings into new jurisdictions and the approval of spot Bitcoin ETFs in major markets will likely fuel further investment.

-

Institutional Adoption Continues: As more institutional investors gain comfort with Bitcoin, investment flows will likely increase.

-

Technological Innovations: Continued advancements in Bitcoin's underlying technology will likely enhance its appeal to both institutional and retail investors.

Looking ahead, the journey of Bitcoin ETFs is far from over. The $5 billion mark signifies a crucial step towards mainstream adoption, but the future trajectory will depend on navigating regulatory hurdles, managing inherent market volatility, and adapting to technological advancements. Investors should carefully weigh the risks and rewards before participating in this exciting, yet volatile, asset class. For more in-depth analysis on the cryptocurrency market, explore resources like [link to reputable financial news source] and [link to a credible crypto analysis website]. Stay informed and invest wisely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Bold Bets Driving Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Proposal Immediate Truce Talks Between Russia And Ukraine

May 20, 2025

Trumps Proposal Immediate Truce Talks Between Russia And Ukraine

May 20, 2025 -

Indy 500 Shwartzmans Historic Pole Position Defies Expectations

May 20, 2025

Indy 500 Shwartzmans Historic Pole Position Defies Expectations

May 20, 2025 -

Thunders Triumph Over Nuggets A Return To Western Conference Finals After Eight Year Absence

May 20, 2025

Thunders Triumph Over Nuggets A Return To Western Conference Finals After Eight Year Absence

May 20, 2025 -

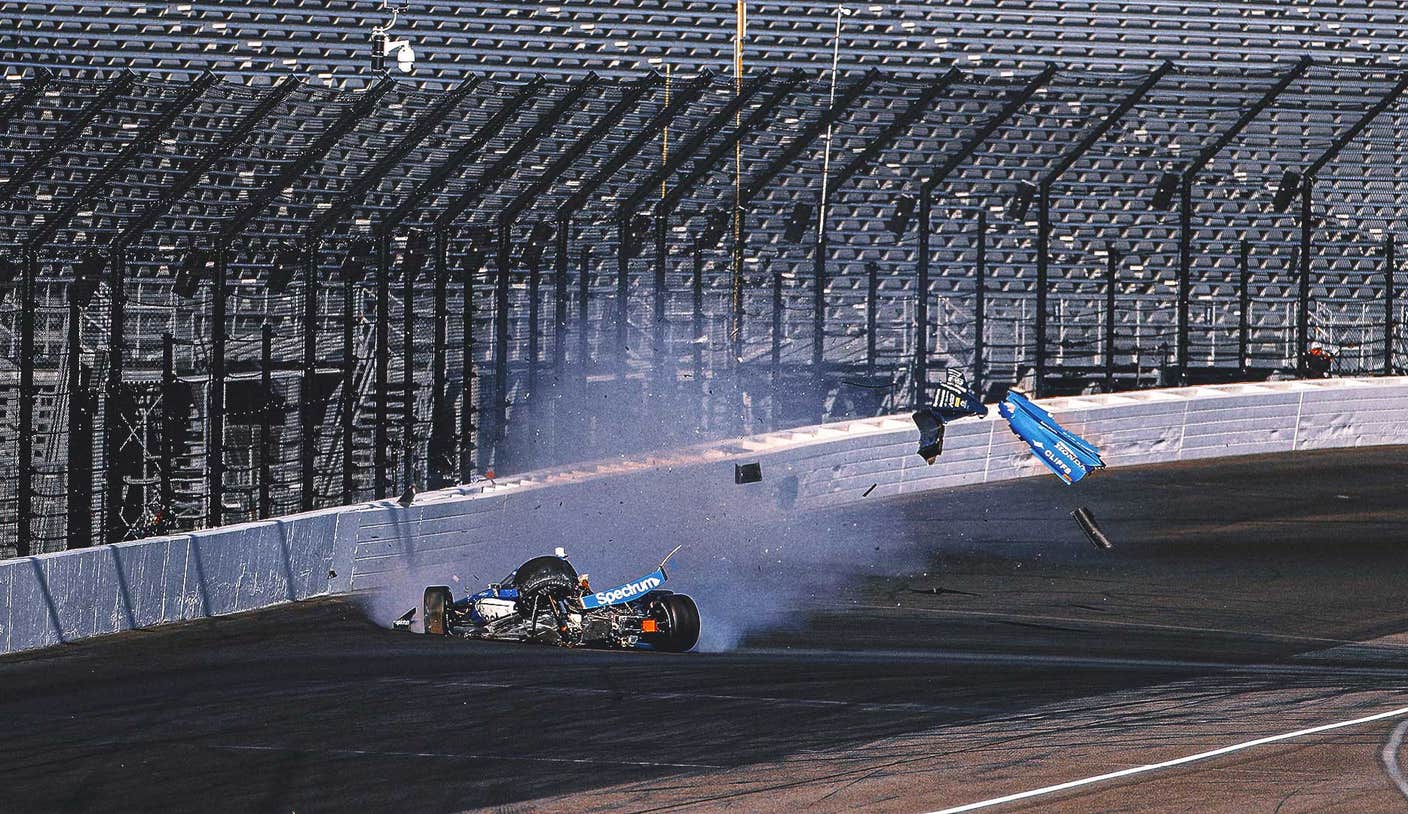

Analysis The High Number Of Indy 500 Qualifying Wrecks

May 20, 2025

Analysis The High Number Of Indy 500 Qualifying Wrecks

May 20, 2025 -

Can These Backup Qbs Lead An Nfl Team To A 2024 Playoff Victory

May 20, 2025

Can These Backup Qbs Lead An Nfl Team To A 2024 Playoff Victory

May 20, 2025