Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Surges Past $5 Billion: Analyzing the Market Trend

The long-awaited arrival of Bitcoin ETFs in the US has sparked a frenzy of investment, with assets under management (AUM) recently surpassing the $5 billion mark. This unprecedented surge signals a significant shift in the perception of Bitcoin and digital assets within the traditional financial landscape. This article delves into the reasons behind this meteoric rise, analyzes the current market trends, and explores what the future might hold for Bitcoin ETFs and the broader cryptocurrency market.

The Catalyst: SEC Approval and Institutional Interest

The approval of the first Bitcoin futures ETFs by the Securities and Exchange Commission (SEC) in October 2021 was a watershed moment. While not directly investing in Bitcoin itself, these ETFs provided a regulated pathway for institutional investors – hesitant to navigate the complexities of direct cryptocurrency exchanges – to gain exposure to Bitcoin's price movements. This paved the way for the recent approvals of spot Bitcoin ETFs, further fueling the investment surge.

The increased regulatory clarity and the availability of these comparatively low-risk investment vehicles have attracted a significant influx of capital from institutional investors, including hedge funds, pension funds, and asset management firms. This institutional interest is a crucial driver behind the current $5 billion AUM figure. It signals a growing acceptance of Bitcoin as a legitimate asset class within mainstream finance.

Market Trends and Future Predictions

Several factors are contributing to the sustained growth of Bitcoin ETF investments:

- Increased Regulatory Clarity: The SEC's gradual acceptance of Bitcoin ETFs is boosting investor confidence.

- Institutional Adoption: Major financial players are increasingly incorporating Bitcoin into their portfolios.

- Inflation Hedge: Many investors view Bitcoin as a potential hedge against inflation.

- Technological Advancements: Developments in the Bitcoin network and the broader crypto ecosystem continue to attract interest.

However, challenges remain. The volatility inherent in the cryptocurrency market is a persistent concern. Furthermore, the SEC's ongoing scrutiny of Bitcoin spot ETFs highlights the regulatory uncertainties that could impact future growth.

Experts offer diverse predictions. Some anticipate further growth, driven by increased institutional adoption and broader regulatory acceptance. Others express caution, highlighting the potential for market corrections and the need for careful risk management. The overall sentiment, however, suggests a bullish outlook for Bitcoin ETFs in the medium to long term.

Understanding the Risks and Rewards

Investing in Bitcoin ETFs, while offering regulated access to the Bitcoin market, carries inherent risks. Price volatility remains a significant factor. Investors should carefully consider their risk tolerance and conduct thorough due diligence before investing. Diversification within a broader investment portfolio is crucial to mitigate potential losses.

Looking Ahead: What to Expect

The $5 billion milestone represents a significant victory for Bitcoin's integration into traditional finance. However, the journey is far from over. Future developments in regulation, technological innovation, and broader market sentiment will all play crucial roles in shaping the future trajectory of Bitcoin ETFs and the cryptocurrency market as a whole. Staying informed on these developments is crucial for any investor considering entering this dynamic space. [Link to reputable financial news source for further analysis].

Call to Action (subtle): For those interested in learning more about Bitcoin and investment strategies, further research into reputable financial resources is recommended. Understanding the risks and rewards is paramount before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Surges Past $5 Billion: Analyzing The Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fbi Director Confirms Investigation Into New York Ags Office

May 21, 2025

Fbi Director Confirms Investigation Into New York Ags Office

May 21, 2025 -

Renegades Wr Tyler Vaughns Spectacle Best Ufl Week 8 Highlights

May 21, 2025

Renegades Wr Tyler Vaughns Spectacle Best Ufl Week 8 Highlights

May 21, 2025 -

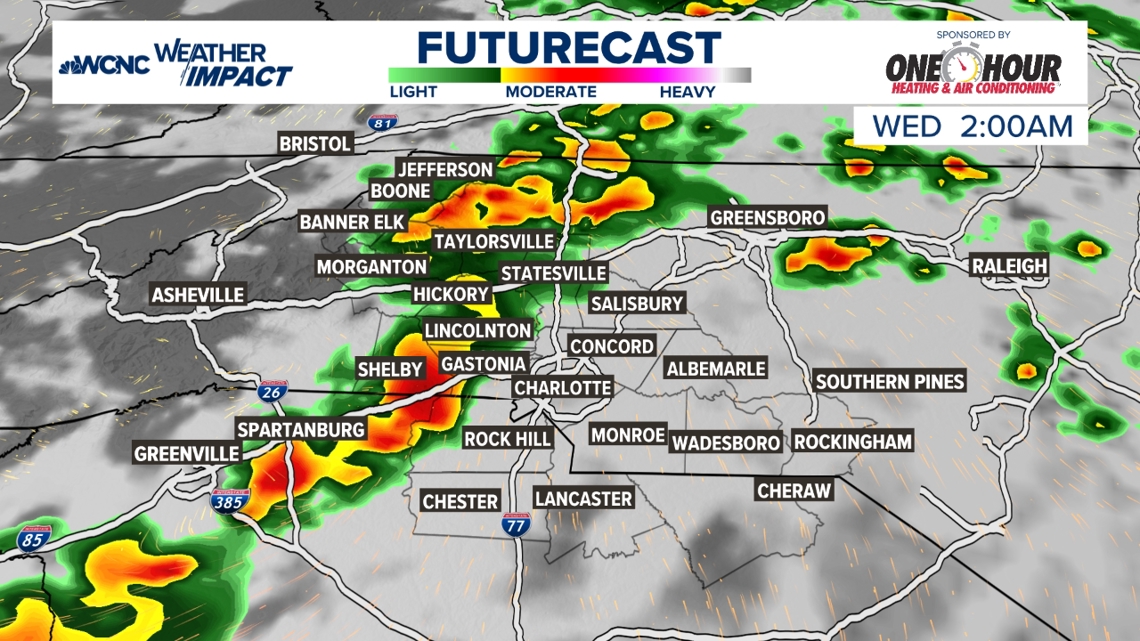

Few Strong Storms Possible Tuesday Night Limited Area Affected

May 21, 2025

Few Strong Storms Possible Tuesday Night Limited Area Affected

May 21, 2025 -

Thunder Silence Critics Dominate Nuggets In Decisive Game 7 Victory

May 21, 2025

Thunder Silence Critics Dominate Nuggets In Decisive Game 7 Victory

May 21, 2025 -

Japanese Businesses Boost Corporate Value With Nature Conservation New 13 Sector Initiative

May 21, 2025

Japanese Businesses Boost Corporate Value With Nature Conservation New 13 Sector Initiative

May 21, 2025