Bitcoin ETF Investment Surges Past $5 Billion: A Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Surges Past $5 Billion: A Market Analysis

The long-awaited arrival of Bitcoin exchange-traded funds (ETFs) has unleashed a wave of investment, pushing assets under management (AUM) past the $5 billion mark. This monumental surge signals a significant shift in the landscape of cryptocurrency investment, offering traditional investors a more accessible entry point into the volatile but potentially lucrative world of Bitcoin.

The approval of the first Bitcoin futures ETF in October 2021 paved the way for this unprecedented growth. However, the recent approvals of spot Bitcoin ETFs, allowing direct investment in Bitcoin, have truly ignited the market. This accessibility, coupled with the growing institutional acceptance of Bitcoin as a legitimate asset class, is driving the phenomenal rise in investment.

What's Fueling This Investment Boom?

Several factors contribute to the explosive growth of Bitcoin ETF investments:

-

Increased Institutional Adoption: Major financial institutions are increasingly incorporating Bitcoin into their investment portfolios, viewing it as a potential hedge against inflation and a diversifier within their asset allocation strategies. This institutional backing lends credibility and stability to the market, attracting a wider range of investors.

-

Regulatory Clarity (in some jurisdictions): While regulatory landscapes vary globally, the approval of Bitcoin ETFs in key markets like the US signifies a step towards greater regulatory clarity and acceptance. This reduced uncertainty encourages more investors to participate. However, it's crucial to note that regulatory changes remain a significant factor influencing the market and individual investors should research regulations in their specific jurisdiction.

-

Ease of Access: ETFs offer a convenient and regulated way to invest in Bitcoin, eliminating the complexities associated with directly buying and securing the cryptocurrency. This ease of access makes Bitcoin investment appealing to a broader range of individuals, including those unfamiliar with the intricacies of cryptocurrency trading.

-

Growing Demand for Digital Assets: The broader trend of growing interest in digital assets and blockchain technology fuels the demand for Bitcoin ETFs. As more investors recognize the potential of this technology, investment in related assets like Bitcoin is likely to continue growing.

Market Analysis and Future Outlook:

The $5 billion AUM milestone is a significant achievement, but it's just the beginning. Analysts predict further growth, particularly if more spot Bitcoin ETFs are approved in major markets. However, market volatility remains a key consideration. Bitcoin's price is notoriously susceptible to fluctuations influenced by various factors, including regulatory changes, macroeconomic conditions, and market sentiment.

Risks and Considerations:

While the potential rewards are significant, investors should be aware of the inherent risks associated with Bitcoin investment. These include:

- Price Volatility: Bitcoin's price can experience dramatic swings in short periods.

- Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies is still evolving, creating potential risks.

- Security Risks: While ETFs mitigate some security risks, investors should still research the fund's security measures.

Conclusion:

The surge in Bitcoin ETF investment past $5 billion signifies a major turning point for the cryptocurrency market. Increased accessibility, institutional adoption, and growing regulatory clarity are driving this growth. However, investors should proceed with caution, understanding the inherent risks associated with Bitcoin's volatility and the evolving regulatory landscape. Further research and due diligence are crucial before making any investment decisions. Consult with a financial advisor before investing in any cryptocurrency-related product.

Keywords: Bitcoin ETF, Bitcoin Exchange-Traded Fund, Cryptocurrency Investment, Bitcoin Investment, ETF AUM, Market Analysis, Bitcoin Price, Regulatory Clarity, Institutional Adoption, Digital Assets, Blockchain Technology, Investment Risks, Cryptocurrency Regulation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Surges Past $5 Billion: A Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

5 B Poured Into Bitcoin Etfs Understanding The Bold Directional Bets

May 20, 2025

5 B Poured Into Bitcoin Etfs Understanding The Bold Directional Bets

May 20, 2025 -

Hrithik Roshan Jr Ntr And Kiara Advanis War 2 Teaser A Powerful First Impression

May 20, 2025

Hrithik Roshan Jr Ntr And Kiara Advanis War 2 Teaser A Powerful First Impression

May 20, 2025 -

Bali Tightens Tourist Rules Aimed At Improving Visitor Conduct And Protecting The Environment

May 20, 2025

Bali Tightens Tourist Rules Aimed At Improving Visitor Conduct And Protecting The Environment

May 20, 2025 -

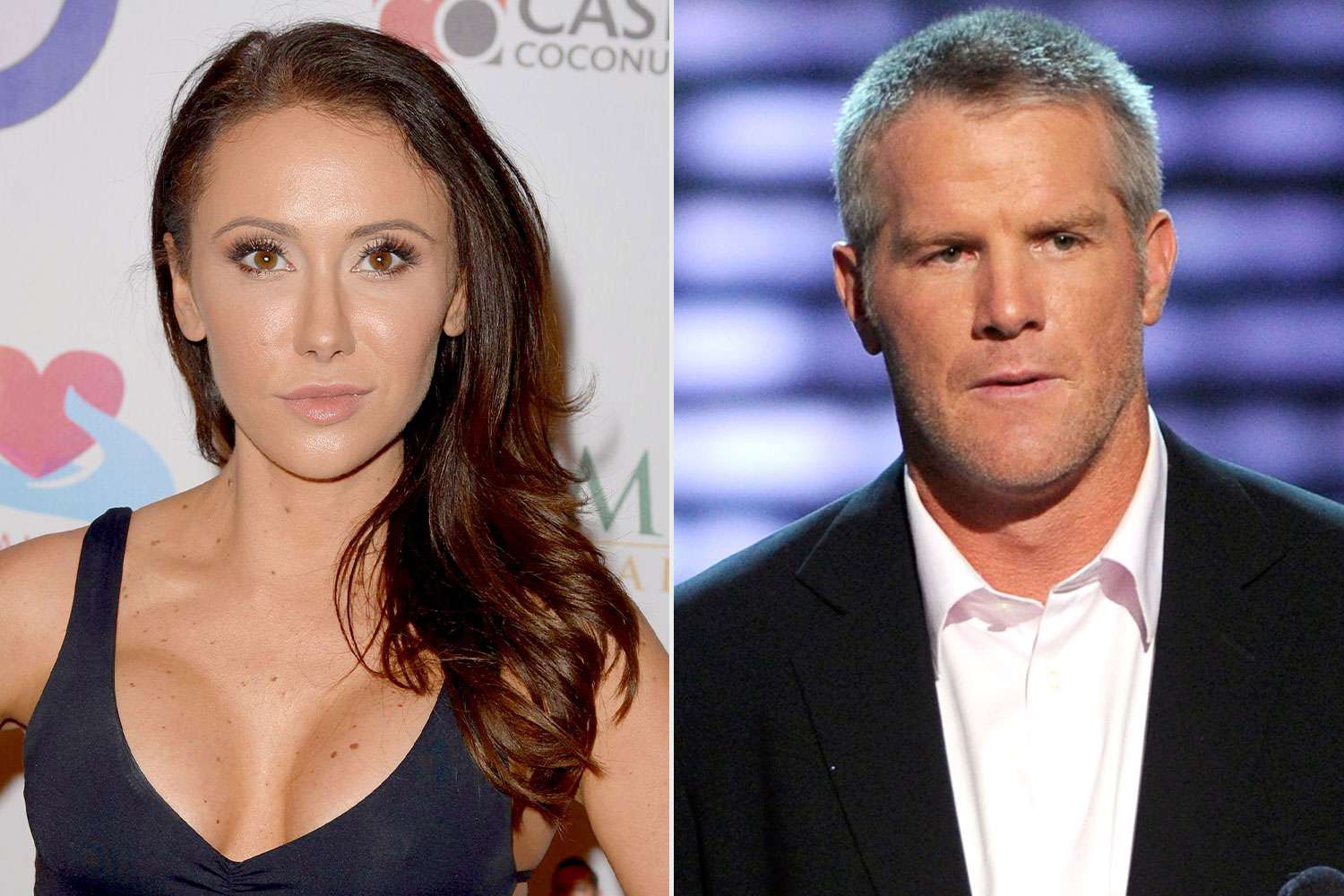

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 20, 2025 -

Jon Rahm Stays Positive Despite Late Pga Championship Collapse

May 20, 2025

Jon Rahm Stays Positive Despite Late Pga Championship Collapse

May 20, 2025