Billions Flow Into Bitcoin ETFs: A Look At The Surge In Institutional Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Surge in Institutional Investment

The cryptocurrency market is buzzing with excitement as billions of dollars pour into Bitcoin exchange-traded funds (ETFs). This unprecedented surge in institutional investment marks a significant milestone for Bitcoin's mainstream adoption and signals a growing confidence in its long-term potential. But what's driving this influx of capital, and what does it mean for the future of Bitcoin?

The Rise of Bitcoin ETFs:

Bitcoin ETFs, which allow investors to gain exposure to Bitcoin's price movements without directly owning the cryptocurrency, have become increasingly popular. Their accessibility and regulatory compliance have made them attractive to institutional investors who previously hesitated to invest directly in Bitcoin due to concerns about security, volatility, and regulatory uncertainty. The recent approvals of several Bitcoin ETFs in major markets have further fueled this surge. This regulatory clarity is a key factor, offering a more comfortable and familiar investment vehicle for traditional financial institutions.

Why the Institutional Rush?

Several factors contribute to the billions flowing into Bitcoin ETFs:

-

Diversification: Many institutional investors see Bitcoin as a valuable addition to their portfolios, offering diversification benefits beyond traditional asset classes. Its low correlation with stocks and bonds makes it an attractive hedge against market volatility.

-

Inflation Hedge: With persistent inflationary pressures globally, Bitcoin's limited supply and decentralized nature position it as a potential inflation hedge. This perception is particularly attractive to investors seeking to protect their capital from the erosive effects of inflation.

-

Technological Advancement: The ongoing development and adoption of Bitcoin's underlying blockchain technology continue to attract attention from tech-savvy investors. The potential for further innovation and integration into existing financial systems is driving further investment.

-

Regulatory Developments: As mentioned earlier, regulatory clarity surrounding Bitcoin ETFs has played a crucial role in encouraging institutional participation. The approval of ETFs in major markets like the US has significantly lowered the barriers to entry for large-scale investors.

Impact on the Bitcoin Market:

The influx of institutional investment is having a noticeable impact on the Bitcoin market. We're witnessing increased price stability and reduced volatility, a trend that is likely to continue as more institutional money flows in. This increased liquidity also contributes to a more mature and robust market.

Looking Ahead:

The future of Bitcoin ETFs remains bright. As more jurisdictions approve Bitcoin ETFs and institutional investors continue to seek diversification and inflation hedges, we can expect to see even greater inflows of capital. This could further solidify Bitcoin's position as a mainstream asset class and contribute to its long-term growth.

However, it's crucial to remember that investing in Bitcoin, or any cryptocurrency, carries inherent risks. Volatility remains a significant factor, and investors should conduct thorough research and understand the risks involved before investing.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Surge In Institutional Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

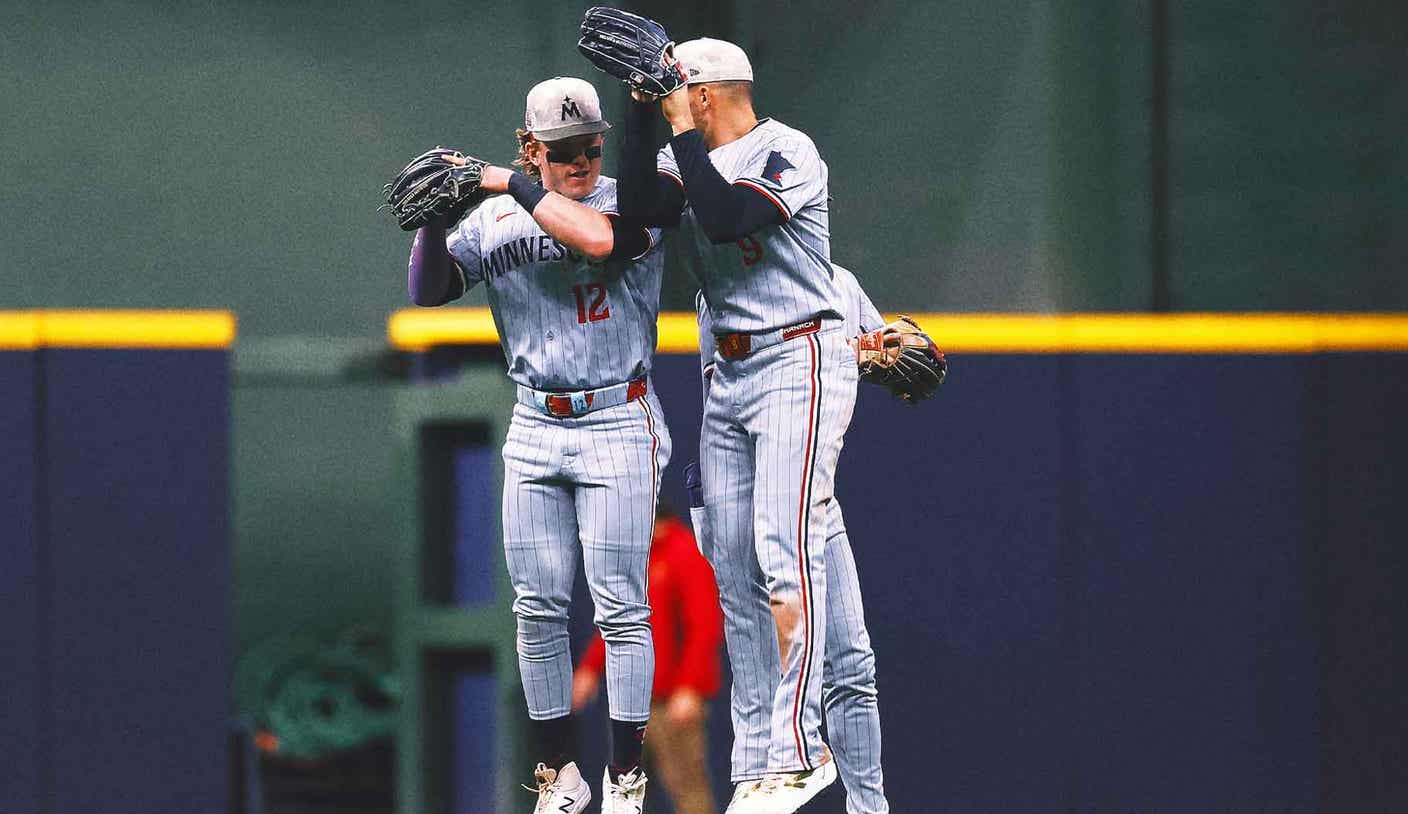

Historic Run Minnesota Twins 13 Game Winning Streak Tops 1991 Record

May 20, 2025

Historic Run Minnesota Twins 13 Game Winning Streak Tops 1991 Record

May 20, 2025 -

Rail Riders Fall To Mud Hens Despite Strong Fight

May 20, 2025

Rail Riders Fall To Mud Hens Despite Strong Fight

May 20, 2025 -

Aspinall Injury Jon Jones Alleges Ufc Deception

May 20, 2025

Aspinall Injury Jon Jones Alleges Ufc Deception

May 20, 2025 -

Marcus Armstrong Crash At Indianapolis Update On His Racing Status

May 20, 2025

Marcus Armstrong Crash At Indianapolis Update On His Racing Status

May 20, 2025 -

Christen Press Recovering After Angel City Collapse Released From Hospital

May 20, 2025

Christen Press Recovering After Angel City Collapse Released From Hospital

May 20, 2025