Billions Flow Into Bitcoin ETFs: A Look At The Driving Investment Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow into Bitcoin ETFs: A Look at the Driving Investment Trends

The cryptocurrency market is experiencing a surge of institutional investment, with billions of dollars pouring into Bitcoin exchange-traded funds (ETFs). This unprecedented influx marks a significant shift in the perception of Bitcoin and digital assets, paving the way for mainstream adoption. This article delves into the key factors driving this investment trend and explores what it means for the future of Bitcoin and the broader cryptocurrency landscape.

The Rise of Bitcoin ETFs:

The approval of Bitcoin ETFs by regulatory bodies globally has been a game-changer. These funds offer investors a regulated and convenient way to gain exposure to Bitcoin without the complexities of directly owning and managing the cryptocurrency. This accessibility is a major factor fueling the current investment boom. Previously, investors often faced hurdles like setting up cryptocurrency wallets, navigating volatile exchanges, and understanding the technical aspects of blockchain technology. ETFs simplify this process significantly, attracting a wider range of investors.

What's Driving the Investment?

Several key factors are contributing to the billions flowing into Bitcoin ETFs:

-

Increased Institutional Adoption: Large institutional investors, such as pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin. ETFs provide a comfortable entry point for these institutions, which often prefer regulated investment vehicles.

-

Regulatory Clarity: The gradual clarification of regulatory frameworks surrounding cryptocurrencies, particularly in major markets like the US, has boosted investor confidence. While regulations are still evolving, the increased clarity reduces uncertainty and encourages investment.

-

Inflation Hedge: Bitcoin is often viewed as a potential hedge against inflation. In times of economic uncertainty, investors seek assets that can retain their value or even appreciate in the face of rising inflation. Bitcoin's limited supply and decentralized nature make it an attractive option for some.

-

Technological Advancements: The ongoing development and improvement of Bitcoin's underlying technology, including the Lightning Network for faster and cheaper transactions, continue to enhance its appeal as a store of value and a medium of exchange.

A Look at the Numbers:

While precise figures fluctuate daily, billions of dollars have already poured into Bitcoin ETFs since their approval. This is evident in the significant increases in the assets under management (AUM) for these funds. Data from leading financial news sources can provide a clearer picture of this rapid growth. [Link to reputable financial news source tracking ETF AUM].

The Future of Bitcoin ETFs:

The current investment trend suggests a bright future for Bitcoin ETFs. As more regulatory clarity emerges and institutional adoption continues, we can expect further growth in this sector. This could potentially lead to:

- Increased Bitcoin Price Volatility: Increased investment flows can lead to short-term price fluctuations, creating both opportunities and risks for investors.

- Greater Market Liquidity: The increased trading volume associated with ETFs improves the liquidity of the Bitcoin market.

- Further Mainstream Adoption: The continued success of Bitcoin ETFs could accelerate the mainstream adoption of Bitcoin and other cryptocurrencies.

Conclusion:

The massive influx of billions into Bitcoin ETFs signifies a pivotal moment for the cryptocurrency market. It highlights the growing institutional acceptance and the increasing maturity of the crypto space. While risks remain, the current trend points towards a future where digital assets play a more significant role in the global financial landscape. For investors, staying informed about regulatory developments and market trends is crucial for navigating this dynamic environment. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Bitcoin ETFs: A Look At The Driving Investment Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

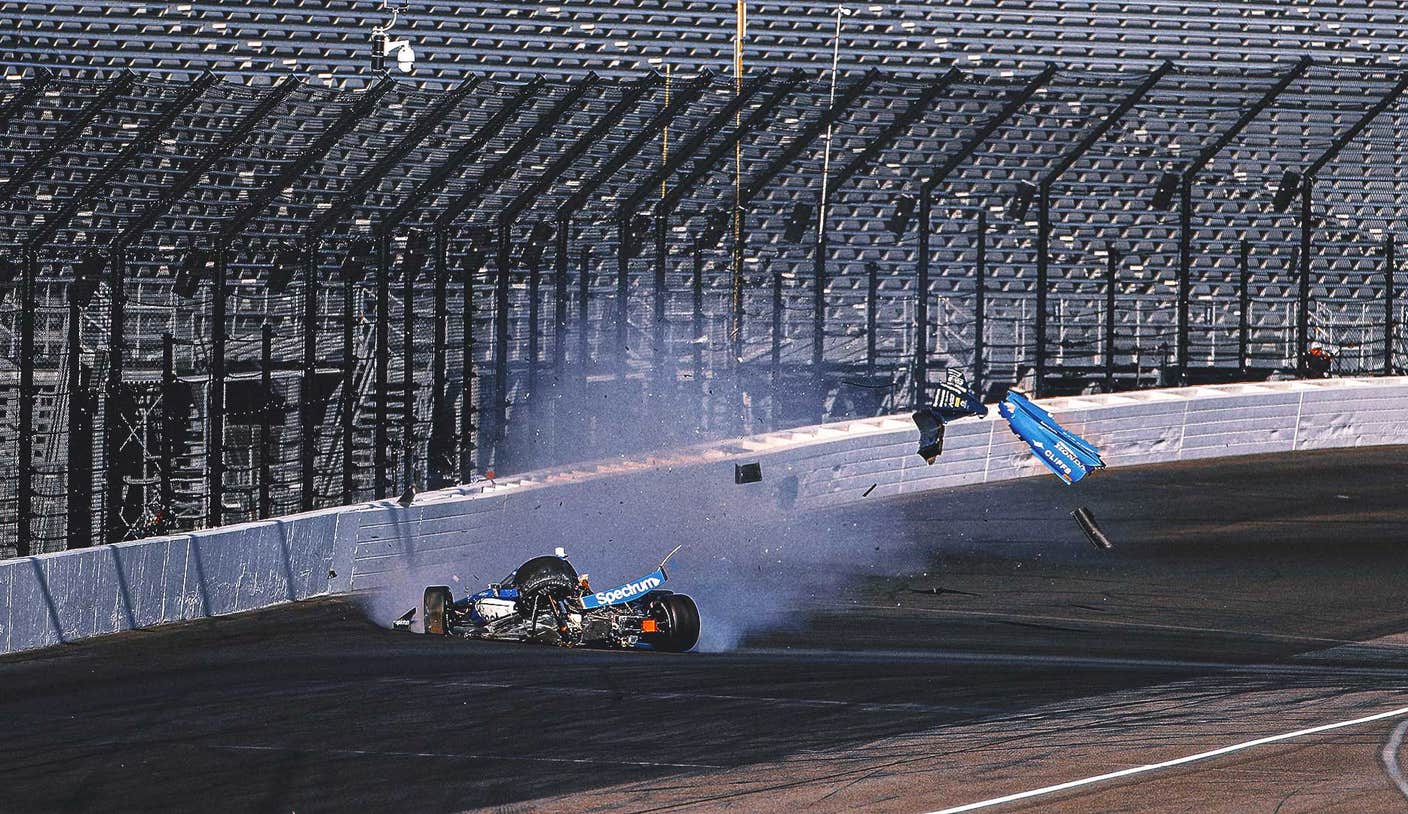

Analysis The High Number Of Crashes During Indy 500 Practice

May 21, 2025

Analysis The High Number Of Crashes During Indy 500 Practice

May 21, 2025 -

Confirmed A New Peaky Blinders Series Is Coming With A Big Twist

May 21, 2025

Confirmed A New Peaky Blinders Series Is Coming With A Big Twist

May 21, 2025 -

The Putin Trump Dynamic Shifts An Analysis Of Reduced Us Leverage

May 21, 2025

The Putin Trump Dynamic Shifts An Analysis Of Reduced Us Leverage

May 21, 2025 -

Job Opportunities At Ubisoft Milan Work On The Next Rayman Game

May 21, 2025

Job Opportunities At Ubisoft Milan Work On The Next Rayman Game

May 21, 2025 -

Japanese Businesses Boost Corporate Value With Nature Conservation Initiatives 13 Sector Strategies

May 21, 2025

Japanese Businesses Boost Corporate Value With Nature Conservation Initiatives 13 Sector Strategies

May 21, 2025