Billions Flood Into Bitcoin ETFs: A Look At The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flood into Bitcoin ETFs: A Look at the Bold Investment Strategies

The cryptocurrency market is buzzing. Billions of dollars are pouring into Bitcoin exchange-traded funds (ETFs), marking a significant shift in how institutional and retail investors are approaching this volatile yet potentially lucrative asset class. This unprecedented influx of capital signifies a growing acceptance of Bitcoin as a legitimate investment vehicle, but also raises questions about the underlying investment strategies fueling this surge.

The Rise of Bitcoin ETFs:

The approval of the first Bitcoin futures ETF in the US in 2021 opened the floodgates. While not directly investing in Bitcoin itself, these ETFs offered a regulated and accessible pathway for investors hesitant about the complexities of directly purchasing and storing cryptocurrency. Now, with the recent approvals of spot Bitcoin ETFs (investing directly in Bitcoin), the market is experiencing a dramatic upswing. This signifies a crucial step towards mainstream adoption, attracting a wider range of investors, from seasoned hedge funds to everyday retail traders.

What's Driving the Investment Spree?

Several factors contribute to this massive investment in Bitcoin ETFs:

- Reduced Risk Perception: ETFs offer a regulated and transparent investment vehicle, mitigating some of the risks associated with directly holding Bitcoin, such as security breaches and regulatory uncertainty. This is a major draw for risk-averse investors.

- Increased Institutional Adoption: Large institutional investors, previously hesitant to embrace crypto, are increasingly allocating a portion of their portfolios to Bitcoin through ETFs, signaling a growing level of confidence in the asset's long-term potential.

- Ease of Access: Unlike direct Bitcoin purchases, which often require navigating complex cryptocurrency exchanges and wallets, ETFs provide a straightforward and familiar investment mechanism accessible through standard brokerage accounts.

- Diversification Opportunities: Many investors see Bitcoin as a potential hedge against inflation and a diversifier within their overall investment portfolios, reducing reliance on traditional assets.

- Technological Advancements: The ongoing development and adoption of blockchain technology underpinning Bitcoin continues to fuel optimism and attract investors interested in long-term technological growth.

Bold Investment Strategies Unveiled:

The surge in Bitcoin ETF investments reflects a variety of sophisticated strategies:

- Dollar-Cost Averaging (DCA): Many investors are employing DCA, a strategy that involves regularly investing a fixed amount of money regardless of price fluctuations. This helps mitigate the risk of investing a large sum at a market peak.

- Index Fund Investing: Investors are utilizing Bitcoin ETFs as a core component of diversified portfolios, mirroring the strategy employed in traditional stock market index funds.

- Hedging Strategies: Some investors are using Bitcoin as a hedge against inflation or geopolitical instability, believing its decentralized nature offers protection against traditional financial market risks.

- Long-Term Holding (HODLing): Many Bitcoin proponents are employing a long-term holding strategy, believing in the asset's future price appreciation despite short-term volatility.

The Future of Bitcoin ETFs:

The future looks bright for Bitcoin ETFs. As regulatory clarity improves and institutional adoption grows, we can expect even more investment to flow into this asset class. However, it's crucial to remember that Bitcoin remains a highly volatile asset, and investors should always conduct thorough research and assess their risk tolerance before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in Bitcoin or Bitcoin ETFs involves significant risk, and you could lose money.

Keywords: Bitcoin ETF, Bitcoin exchange-traded fund, cryptocurrency investment, Bitcoin investment strategies, institutional investors, Bitcoin price, cryptocurrency regulation, blockchain technology, dollar-cost averaging, HODLing, investment diversification, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flood Into Bitcoin ETFs: A Look At The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

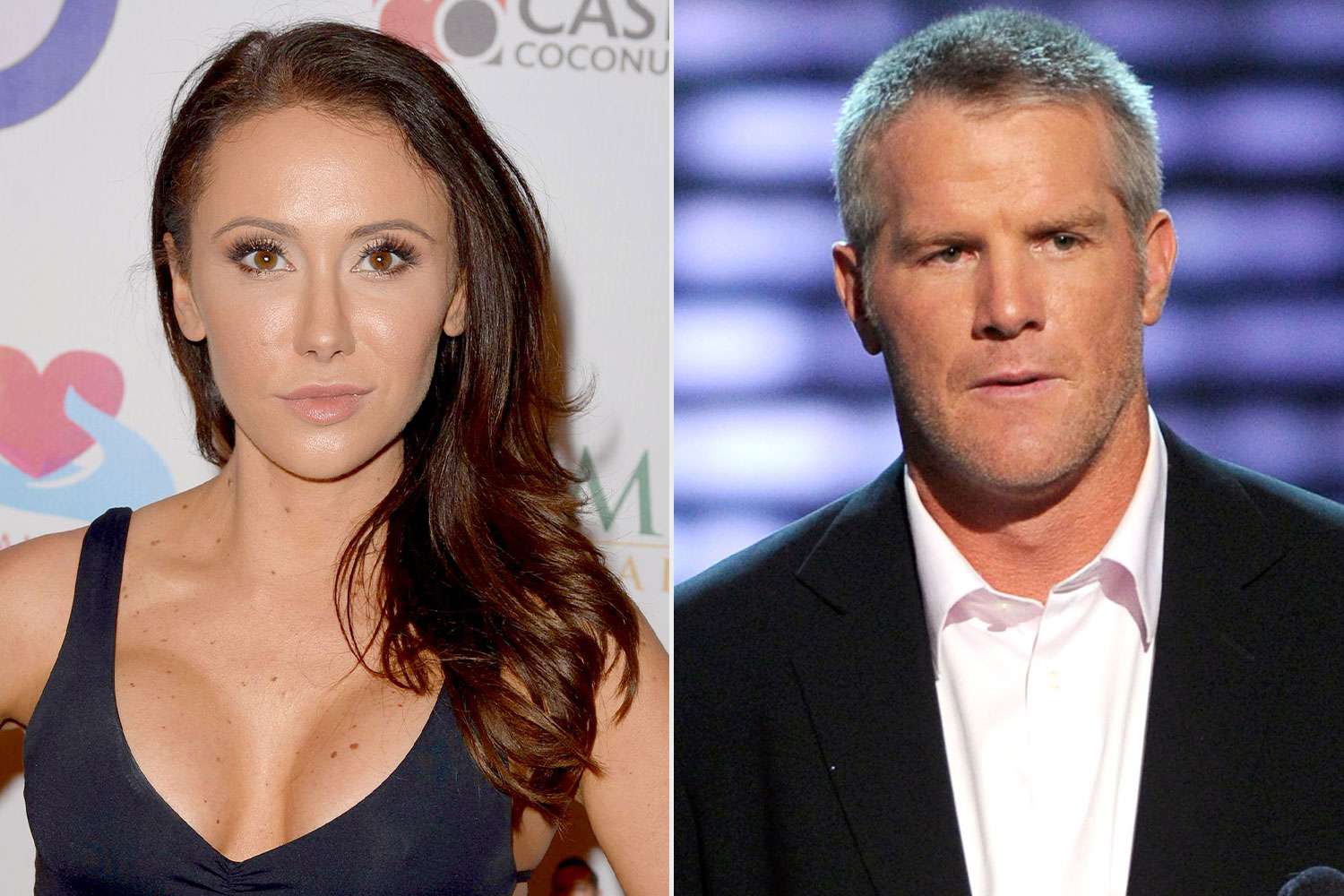

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Betrayal And Lack Of Respect

May 21, 2025

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Betrayal And Lack Of Respect

May 21, 2025 -

160 Japanese Firms Compete In Nature Conservation Boosting Corporate Value Across 13 Industries

May 21, 2025

160 Japanese Firms Compete In Nature Conservation Boosting Corporate Value Across 13 Industries

May 21, 2025 -

Bali Tourism Overhaul New Guidelines To Improve Visitor Conduct

May 21, 2025

Bali Tourism Overhaul New Guidelines To Improve Visitor Conduct

May 21, 2025 -

Severe Weather Alert Heavy Rain And Storms To Hit North Carolina Tonight

May 21, 2025

Severe Weather Alert Heavy Rain And Storms To Hit North Carolina Tonight

May 21, 2025 -

Trae Youngs Recent Remarks Comparing Knicks And Thunder Fan Reactions

May 21, 2025

Trae Youngs Recent Remarks Comparing Knicks And Thunder Fan Reactions

May 21, 2025